Bitcoin purchasers who bought around when it struck a $109,000 all-time peak in January are now panic-selling as the cryptocurrency decreases, states onchain analytics firm Glassnode, which isn’t eliminating that Bitcoin might move to $70,000.

Glassnode stated in a March 11 markets report that a current sell-off by leading purchasers has actually driven “extreme loss awareness and a moderate capitulation occasion.”

Short-term holders ran away as Bitcoin dropped from peak

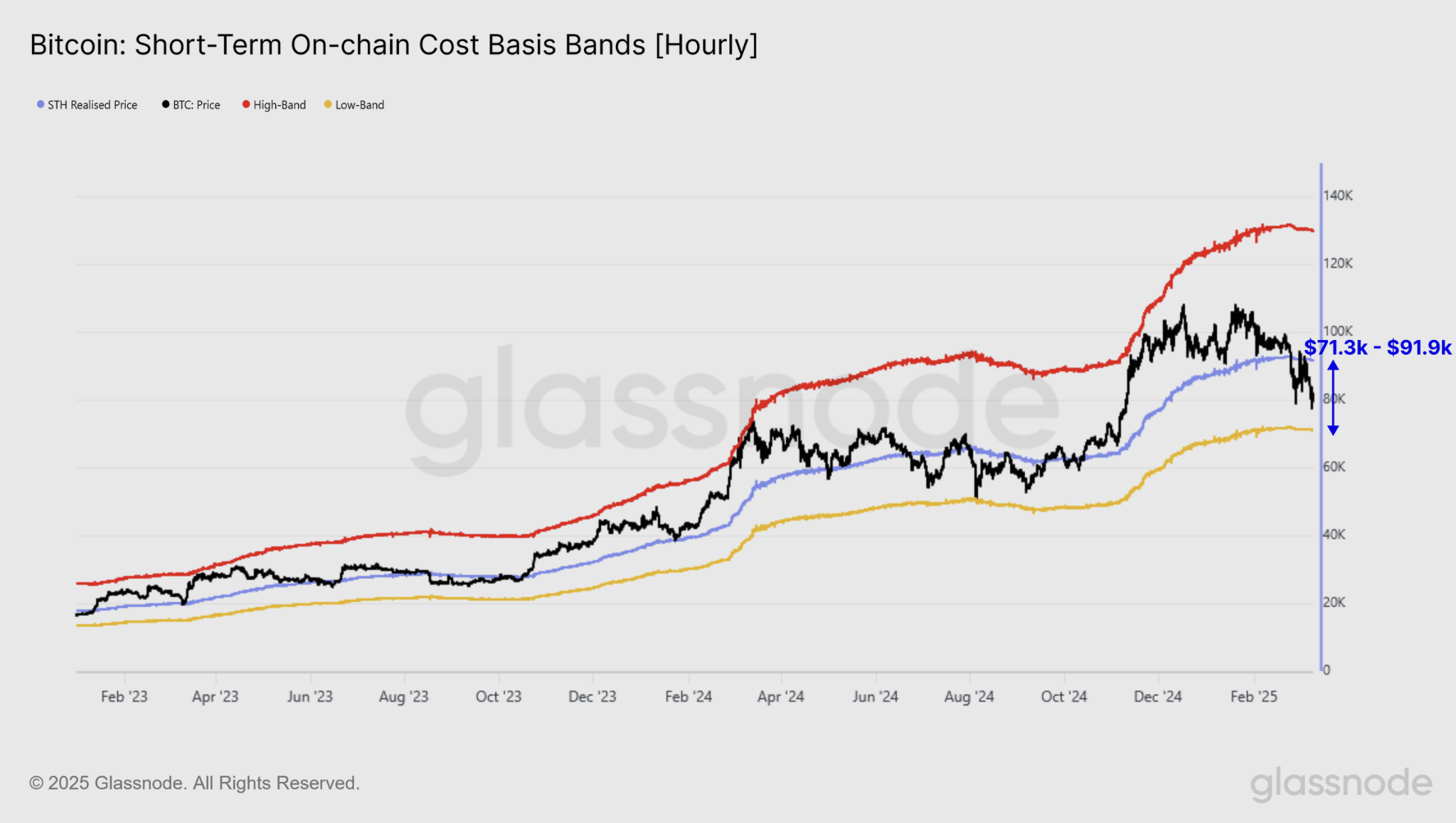

The rise in purchasers paying greater costs for Bitcoin (BTC) in current months is shown in the short-term holder understood cost– the typical purchase cost for those holding Bitcoin for less than 155 days.

In October, the short-term understood cost was $62,000. At the time of publication, it’s $91,362– up about 47% in 5 months, according to Bitbo information.

On The Other Hand, Bitcoin is trading at $81,930 at the time of publication, according to CoinMarketCap. This leaves the typical short-term holder with a latent loss of approximately 10.6%.

Bitcoin is down 5.90% over the previous 7 days. Source: CoinMarketCap

Glassnode stated that short-term holders’ understood cost reveals it appears that “market momentum and capital circulations have actually turned unfavorable, indicating a decrease in need strength.”

” Financier unpredictability is impacting belief and self-confidence,” it included.

Glassnode stated that short-term holders are “deeply undersea” in between $71,300 and $91,900 and cautions that Bitcoin might bottom out as low as $70,000 if offering continues.

” The possibility of forming a momentary flooring in this zone is significant, a minimum of in the near term,” Glassnode stated.

Bitcoin short-term holders are “deeply undersea” in between $71,300 and $91,900. Source: Glassnode

Marketing research company 10x Research study identified it a “book correction” in a March 10 note, including that with Bitcoin’s dip listed below $80,000, “roughly 70% of all offering originated from financiers who purchased within the last 3 months.”

Related: Bitcoin slides another 3%– Is BTC cost headed for $69K next?

On the very same day, BitMEX co-founder Arthur Hayes stated that Bitcoin might retest the $78,000 cost level and, if that stops working, might head to $75,000 next.

Glassnode discussed that a comparable sell-off Bitcoin pattern was seen in August when Bitcoin fell from $68,000 to around $49,000 in the middle of worries of an economic crisis, bad work information in the United States, and slow development amongst leading tech stocks.

Nevertheless, Bitcoin has actually surged 7.5% over the previous 24 hr as the United States market steaded on March 11 after plunging a day previously after United States President Donald Trump declined to eliminate that an economic crisis was on the cards.

Publication: The Sandbox’s Sebastien Borget winces at the word ‘influencer’: X Hall of Flame

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.