AMSTERDAM, March 14, 2025 /PRNewswire/ — Hassan Badrawi, CEO of OCI International commented:

“2024 has been a yr of pivotal transformation for OCI International. We have now efficiently executed a sequence of strategic transactions, considerably strengthened our stability sheet, and delivered distinctive returns to our shareholders. These milestones replicate our agility in navigating evolving market situations whereas reinforcing our deep worth creation ethos.

Particularly, within the second half of 2024, we introduced the divestment of OCI Methanol to Methanex and accomplished the divestments of our total Fertiglobe fairness stake to ADNOC, Iowa Fertilizer Firm to Koch Industries, and OCI Clear Ammonia[1] to Woodside Vitality. These transactions will collectively quantity to over $11.6 billion in gross proceeds, which has allowed us to repay roughly $1.8 billion in debt and return $3.3 billion in money distributions to shareholders in This fall 2024. A further money distribution of as much as $1 billion ($4.75 per share) is additional deliberate for Q2 2025, topic to the mandatory approvals. This is able to take OCI’s money returns to shareholders to $6.4 billion over the course of a four-year interval and convey complete returns to shareholders through buybacks, share and money distributions to greater than $21 billion since our unique itemizing in 1999.

Looking forward to 2025, our precedence stays executing key excellent deliverables together with finalizing the OCI Methanol transaction, reaching Challenge Completion for OCI Clear Ammonia, and leveraging the operational excellence and strategic worth of our European Nitrogen property towards a supportive European market backdrop. Latterly, our nitrogen manufacturing facility in Geleen, impartial ammonia import terminal in Rotterdam and main pan-European distribution platform are positioned favorably with respect to latest rationalization within the business and rising ammonia throughput into Europe; OCI is about to learn additional within the medium- to longer-term based mostly on rising regulatory assist and our expectation of normalized fuel pricing.

Past this, with a leaner, extra agile and streamlined group, OCI International is properly positioned to navigate its future supported by monetary energy and strategic optionality.”

Monetary Highlights

FY 2024 Key Highlights

- OCI International OCI reported FY 2024 Whole Operations (Persevering with and Discontinued Operations) income of $4,084 million in comparison with $5,022 million in FY 2023, and FY 2024 Whole Operations adjusted EBITDA of $826 million in comparison with $1,214 million in FY 2023.

- OCI reported FY 2024 Persevering with Operations (European Nitrogen and Company Entities segments) income of $975 million, a rise of three% YoY and an FY 2024 adjusted EBITDA lack of $32 million in comparison with a lack of $126 million within the prior yr.

- FY 2024 adjusted EBITDA for European Nitrogen (OCI’s sole working section inside Persevering with Operations right now) was $55 million in comparison with an adjusted EBITDA lack of $51 million in FY 2023. Earnings benefited from an enchancment in volumes and decrease common pure fuel costs in 2024 in comparison with 2023 regardless of a rise in fuel pricing in H2 2024.

H2 2024 Key Highlights

- OCI reported H2 2024 Whole Operations income of $1,648 million, a lower of 28% in comparison with the identical interval final yr and H2 2024 Whole Operations adjusted EBITDA of $234 million in comparison with $552 million in H2 2023, largely reflecting the deconsolidation of IFCo and Fertiglobe within the interval.

- OCI reported H2 2024 Persevering with Operations income of $466 million, a 13% enhance YoY whereas Persevering with Operations adjusted EBITDA noticed a $39 million loss in H2 2024 in comparison with a $14 million loss in H2 2023. Given latest divestments, OCI’s company price base doesn’t but absolutely replicate the decreased scope and scale of the Persevering with Operations. As such, underlying company prices reported inside Company Entities greater than offset earnings from European Nitrogen within the interval.

- H2 2024 income for European Nitrogen was $466 million whereas adjusted EBITDA was $7 million; this compares to $415 million and $20 million in H2 2023, respectively. However a +40% YoY enhance in own-produced gross sales, European Nitrogen adjusted EBITDA deteriorated YoY on account of decrease nitrate pricing, greater and extra unstable fuel costs, different price inflation and a decreased profit from pure fuel hedge positive factors.

- H2 2024 underlying company prices excluding one-offs inside Company Entities had been $46 million in comparison with $34 million in H2 2023. The YoY enhance primarily displays the cessation of company recharges for divested companies, mixed with a lag in achieved price financial savings relative to the timing of transaction closings in 2024. Company prices additionally embody sure stranded and restructuring prices not thought-about as one-offs. OCI continues to make substantial progress in right-sizing its company price base to higher serve the persevering with construction and scale of the enterprise, with company headcount 70% decrease right now in comparison with its peak in 2023. OCI expects to beat its beforehand guided goal of $30 – $40 million of company prices on a run-rate foundation by the top of 2025.

- Reported internet revenue attributable to shareholders from Whole Operations was $4,969 million in H2 2024 in comparison with a reported internet lack of $230 million in H2 2023, reflecting a $4,938 million achieve from the sale of subsidiaries associated to the sale of IFCo, Fertiglobe and OCI Clear Ammonia in H2 2024. Reported internet revenue attributable to shareholders from Persevering with Operations was $4 million in H2 2024 in comparison with a reported internet lack of $104 million in H2 2023.

- The adjusted internet loss attributable to shareholders from Whole Operations was $53 million in H2 2024 in comparison with an adjusted internet lack of $141 million in H2 2023. For Persevering with Operations, the adjusted internet loss attributable to shareholders was $63 million in H2 2024 in comparison with an adjusted internet lack of $95 million in H2 2023.

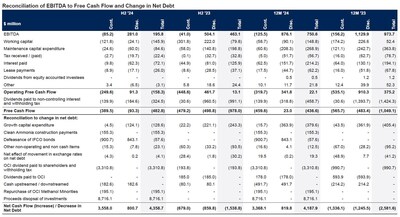

Free Money Circulation and Web Debt Highlights

- Working free money outflow from Persevering with Operations in H2 2024 was $250 million in comparison with a $449 million outflow in H2 2023. The H2 2024 money outflow displays distinctive prices associated to the strategic evaluate and price optimization initiatives, in addition to seasonal working capital actions in OCI’s European Nitrogen enterprise. The seasonal working capital influence has been extra acute this yr as a result of conflation of delayed buying exercise by farmers with greater enter costs for producers on account of quickly rising fuel costs in H2 2024. Longer-term, OCI expects to learn from materially decrease fuel costs as TTF reverts to historic norms, in addition to improved fertilizer pricing supported by the proposed introduction of CBAM in 2026 and the proposed implementation of progressive Russian and Belarusian import tariffs from 1 July 2025.

- Working free money outflow additionally contains upkeep capital expenditures, in addition to tax, money curiosity and lease funds.

- Capital expenditure together with upkeep and development capex for Persevering with Operations was $29 million in H2 2024 in comparison with $80 million in H2 2023.

- Whole challenge spend for OCI Clear Ammonia in H2 2024 amounted to $294 million of which $155 million was spent after the transaction closed on 30 September 2024. Whole challenge spend as of 31 December 2024 was $954 million in comparison with a complete challenge funds of $1.55 billion, together with contingencies. From an accounting perspective, OCI Clear Ammonia expenditures following the 30 September 2024 shut date are recorded as funds towards a legal responsibility. Beforehand, spend has been categorized both as development capital expenditure in Discontinued Operations or as pre-operating prices inside the EBITDA of Discontinued Operations.

- Web money from Persevering with Operations was $1,371 million as of 31 December 2024 in comparison with a internet debt place of $2,194 million as of 30 June 2024, and a internet debt place of $2,001 million on 31 December 2023. The tip-This fall internet money place follows the closing of the Fertiglobe transaction in October 2024 and cost of the beforehand introduced €14.50 extraordinary distribution in November 2024. The reported internet debt/money place for Persevering with Operations for this era in addition to the comparative interval represents a deconsolidation of the stability sheet of Discontinued Operations.

Key Strategic and Enterprise Highlights

2024 has been a defining yr for OCI, as the corporate executed a number of transformative strategic initiatives to unlock shareholder worth and place itself for the long run. Notable milestones in H2 included:

- Efficient 15 October 2024, Mr. Hassan Badrawi was appointed Chief Govt Officer (CEO) of OCI and Mr. Beshoy Guirguis assumed the function of Chief Monetary Officer (CFO) of OCI. Concurrently, Mr. Ahmed El-Hoshy stepped down as CEO of OCI to proceed in his full-time function as CEO of Fertiglobe.

- On 8 September 2024, OCI entered right into a binding fairness buy settlement for the sale of 100% of the fairness pursuits in its world methanol enterprise (“OCI Methanol”) to Methanex Company (“Methanex”) for a purchase order value consideration of $2.05 billion on a cash-free debt-free foundation. The transaction is anticipated to shut in Q2 2025 and positions OCI favorably with reference to ongoing publicity to the methanol business, with future upside optionality.

– Pursuant to the sale announcement, OCI introduced the accelerated repurchase of its 11% and 4% minority stakes in OCI Methanol from Alpha Dhabi Holding PJSC and ADQ respectively for a complete consideration of $335 million, together with the discharge of ultimate dividends due.

– In regards to the dispute over sure shareholder rights between OCI and its three way partnership associate Proman with respect to the Natgasoline asset, after the Delaware Courtroom of Chancery’s ruling in OCI’s favor on 29 January 2025, Proman filed a discover of attraction to the Delaware Supreme Courtroom on 28 February 2025. Proman subsequently irrevocably withdrew its attraction and, because of this, the Courtroom of Chancery’s ruling in OCI’s favor is now ultimate. Following this profitable decision, OCI’s oblique curiosity within the Natgasoline three way partnership might be included as a part of Methanex’s acquisition of OCI Methanol. The transaction has been authorized by the boards of administrators of each OCI and Methanex and stays topic to receipt of sure regulatory approvals and different closing situations. - On 5 August 2024, OCI entered right into a binding fairness buy settlement for the sale of 100% of its fairness curiosity in its Clear Ammonia challenge at present underneath development in Beaumont, Texas (“OCI Clear Ammonia”, “Beaumont New Ammonia” or the “Challenge”) to Woodside Vitality Group Ltd (“Woodside”) for a purchase order value consideration of $2.35 billion on a cash-free debt-free foundation and following a aggressive course of. On 30 September 2024, OCI introduced the profitable closing of the transaction with the receipt of 80% of the money proceeds – or roughly $1,880 million and an extra $20 million adjustment for sure pre-paid bills – and a deferred consideration of 20% – or roughly $470 million – to be acquired at Challenge Completion[2] anticipated in H2 2025. Subsequent to the cut-off date, ultimate proceeds had been adjusted for an extra $2 million of money proceeds based mostly upon precise internet indebtedness and precise transaction bills. OCI continues to be concerned with the development, commissioning, and start-up of the ability by means of Challenge Completion, with a monetary obligation to pay for the remaining capital expenditure and prices to Challenge Completion. Development is properly superior right now with $954 million money spent as of 31 December 2024 (together with each historic capital expenditure and sure pre-operating bills). OCI expects a complete funding price by means of Challenge Completion of roughly $1.55 billion, together with contingencies.

- On 29 August 2024, OCI introduced the profitable completion of the sale of 100% of its fairness pursuits in Iowa Fertilizer Firm LLC (“IFCo”) to Koch Ag & Vitality Options (“KAES”) following a aggressive course of. The transaction additionally included the sale and switch of specified contracts of N-7, the buying and selling entity promoting the product of IFCo, to KAES. The whole consideration acquired was $3.6 billion in money, which included an estimated internet debt and dealing capital settlement. Web proceeds acquired by OCI amounted to roughly $2.6 billion, after adjusting for bond defeasance, mark to market on excellent hedges, and different transaction associated prices.

- On 15 October 2024, OCI introduced the profitable completion of the divestiture of fifty% of the fairness pursuits of Fertiglobe to Abu Dhabi Nationwide Oil Firm P.J.S.C. (“ADNOC”), whereby OCI absolutely exited and monetized its total fairness stake. Consistent with the definitive settlement signed in December 2023 and on account of completion, OCI acquired a internet money consideration of $3,185 million and a $362 million contingent consideration held in escrow upon closing of the deal, post-closing changes of $70 million. Assortment of the contingent consideration relies on the materialization of sure indemnifications agreed as a part of the transaction. Administration’s estimate is that the quantity held in escrow will cowl such indemnifications[3].

The anticipated cumulative crystallization of roughly $11.6 billion of gross proceeds from these 4 transactions has afforded OCI vital flexibility to ship on its capital allocation priorities, together with deleveraging at a gross degree, in addition to returning a significant quantum of capital to shareholders.

All OCI NV financial institution debt has now been repaid, together with the revolving credit score facility and bridge facility utilized throughout the transition interval. The $698 million 2025 Senior Secured Notes had been redeemed at par on 15 October 2024. Whole debt compensation in H2 2024 amounted to $1,817 million. Remaining money proceeds have been invested while OCI at present retains principal gross debt of $685 million, $600 million of which is within the type of its 2033 bonds. OCI’s capital construction might be reviewed on the closing of the OCI Methanol transaction.

- Following the profitable completion of the Fertiglobe and IFCo transactions, OCI paid a rare distribution of €14.50 per share in combination (~$3.3 billion) to shareholders on 14 November 2024 through a capital compensation.

- OCI expects to make a additional extraordinary distribution of as much as $1 billion by means of one other compensation of capital throughout Q2 2025, topic to the mandatory approvals.

Whole, Persevering with and Discontinued Operations Operational Highlights

Additional to the announcement of the anticipated divestiture of OCI’s fairness holdings in OCI Methanol, this section is now labeled as Discontinued Operations. Discontinued Operations for the second half of 2024 additionally contains outcomes for IFCo, Fertiglobe and OCI Clear Ammonia for the interval previous the closing of the respective transactions. The sale of IFCo to KAES accomplished on 29 August 2024, the sale of Fertiglobe to ADNOC accomplished on 15 October 2024 and the sale of OCI Clear Ammonia to Woodside accomplished on 30 September 2024[4].

Expenditures for OCI Clear Ammonia following its shut date are recorded as funds towards a legal responsibility. Previous to the shut date, spend on OCI Clear Ammonia was categorized both as development capital expenditure in Discontinued Operations or as pre-operating prices inside the EBITDA of Discontinued Operations.

Persevering with Operations as introduced on this report displays prices related to the Company Entities and the operational efficiency of the European Nitrogen section.

Whole Operations (Persevering with and Discontinued)

- 12-month rolling recordable incident price to 31 December 2024 was 0.43 incidents per 200,000 working hours[5].

- H2 2024 own-product gross sales from Whole Operations had been 3,593 million tonnes, 31% decrease towards the identical interval final yr:

– Whole own-produced nitrogen product gross sales volumes of two,968 thousand tonnes decreased by 34% in comparison with H2 2023. The fabric discount displays the deconsolidation of Nitrogen US and Fertiglobe submit divestment in H2 2024. - Realized fuel hedge losses from complete operations had been $69 million in H2 2024 in comparison with $73 million in H2 2023.

Persevering with Operations (European Nitrogen and Company Entities)

- European Nitrogen reported H2 2024 revenues of $466 million, 12% greater than the $415 million reported for H2 2023. The development was primarily pushed by greater own-produced gross sales volumes, offsetting weaker nitrate pricing:

– Personal-produced gross sales volumes within the section elevated 40% YoY in H2 2024 to 918 thousand tonnes in comparison with the same-period final yr, reflecting stronger CAN manufacturing, the launch of AdBlue (DEF) gross sales in Q2 2024, and improved asset utilization charges (AURs). Melamine volumes in H2 2024 additionally elevated by 41% YoY in comparison with H2 2023 as market situations improved.

– Promoting costs for CAN had been 10% decrease in H2 2024 in comparison with the identical interval final yr, whereas UAN costs decreased 6% YoY. - Adjusted EBITDA for European Nitrogen was $7 million in H2 2024, a discount from $20 million in H2 2023. However greater own-produced gross sales volumes, profitability was impacted by weaker nitrate pricing, greater and extra unstable fuel costs, different price inflation and a decreased profit from fuel hedge positive factors in H2 2024 in comparison with H2 2023. Regardless of indicators of early spring demand in the direction of the top of the second half, OCI’s skill to go on rising price inflation was negatively impacted by purchaser value sensitivity within the interval, exacerbated by the latest surge in imports of Russian mineral fertilizers into the European Union. As such, OCI welcomed the European Fee’s proposal to impose progressive import tariffs on Russian and Belarusian nitrogen fertilizers from 1 July 2025.

- Inside Company Entities, H2 2024 underlying company prices excluding one-offs had been $46 million in comparison with $34 million in H2 2023. The YoY enhance primarily displays the cessation of company recharges for divested companies, mixed with a lag in achieved price financial savings relative to the timing of transaction closings in 2024. Company prices additionally embody sure stranded and restructuring prices not thought-about as one-offs.

Discontinued Operations (OCI Methanol)

- The Methanol enterprise contains the manufacturing and sale of standard methanol, biomethanol, ammonia (produced at OCI Beaumont) in addition to outcomes from buying and selling actions.

- The Methanol enterprise reported H2 2024 income of $526 million in comparison with $508 million in H2 2023, and adjusted EBITDA of $91 million in H2 2024 in comparison with $39 million in H2 2023. The rise displays greater methanol costs, decreased fuel costs and improved ammonia pricing at OCI Beaumont. H2 2024 realized fuel hedge losses of $39 million had been largely unchanged from the $40 million fuel hedge loss reported in H2 2023. Excluding realized fuel hedge losses, adjusted EBITDA was $130 million in H2 2024 in comparison with $78 million in H2 2023.

- Whole own-produced methanol gross sales volumes of 624 thousand tonnes represented a 15% lower in H2 2024 in comparison with the identical interval final yr. Manufacturing for the half was unfavorably impacted by an unplanned shutdown at Natgasoline from September 2024. Natgasoline resumed manufacturing on the finish of December and operations have been operating at nameplate capability yr to-date in 2025. As of the top of February 2025, Natgasoline has collected $55 million from insurance coverage towards the occasion and expects to obtain an extra cost within the coming weeks.

- OCI’s HyFuels enterprise contributed $18 million to adjusted EBITDA throughout H2 2024 in comparison with $28 million in H2 2023. OCI’s HyFuels enterprise is the world’s largest producer of inexperienced methanol and a frontrunner in inexperienced methanol transportation fuels functions. The medium-term outlook for the HyFuels enterprise is constructive, set to learn from sturdy regulatory tailwinds mandating rising emissions discount throughout highway, marine and aviation sectors. OCI expects each demand and pricing (premiums) to learn from rising uptake of renewable fuels of non-biological origins (RFNBO) throughout these end-markets.

Market Outlook

Nitrogen

The outlook for OCI’s European Nitrogen enterprise is constructive pushed by wholesome provide and demand dynamics, an expectation of normalizing fuel markets, and supported by evolving regulatory measures together with the introduction of the EU Carbon Border Adjustment Mechanism (CBAM) in 2026 and the proposed implementation of progressive tariffs on Russian and Belarusian nitrogen imports from 1 July 2025.

Ammonia

- Northwest Europe ammonia costs elevated to a median $581/t in H2 2024, a 22% enhance in comparison with the typical in H1 2024 pushed by greater European fuel costs, provide points in Trinidad and North Africa, and delays in new capability in america.

- OCI continues to see supportive ammonia markets within the medium-term pushed by:

– Rising close to time period downstream demand and curtailment of European capability: Inside Europe, elevated manufacturing prices are threatening the viability of higher-cost home ammonia manufacturing, resulting in curtailments and elevated reliance on imported service provider ammonia. Since 2023, roughly 2 mtpa of ammonia capability has both been shut down indefinitely or completely mothballed, representing roughly 10% of complete European nameplate capability of 19.5 mtpa earlier than closures. An additional 10% of swing nameplate capability was quickly shut down firstly of 2025. OCI European Nitrogen’s ammonia manufacturing services are competitively positioned to capitalize upon any rationalization of the European business with pure fuel efficiencies of 32 MMBtu per ton of ammonia manufacturing, outperforming the EU common of 37MMBtu per ton. Furthermore, OCI’s uniquely located Rotterdam terminal gives strategic flexibility to import ammonia in periods of elevated pure fuel pricing, serving each proprietary wants in addition to these of third events.

– Introduction of the European Union’s CBAM: With CBAM set to enter its definitive part on 1 January 2026, the introduction of regulated carbon prices for importers is projected to additional assist European ammonia and fertilizer costs.

– Demand for low-carbon ammonia from new industries similar to gasoline for energy era, as a maritime bunker gasoline, and as a provider of fresh hydrogen. OCI views ammonia a extremely strategic element of worth chains throughout Europe and integral to the area’s formidable decarbonization plans.

Nitrates and different Premium Merchandise

- The outlook for nitrate costs in 2025 is constructive, underpinned by a seasonal enhance in fertilizer demand forward of the spring planting season, assist from greater urea costs and enticing European nitrate premiums over urea. H2 2024 urea Egypt costs elevated by 6% sequentially and costs have continued to rise in 2025 to $458/t as on the finish of February. Elementary demand for grains stays sturdy whereas extended disruptions in provide chains and commerce flows current extra upside potential for crop costs, boosting farmer affordability to the advantage of fertilizer markets.

- We count on additional near-term assist for nitrates demand from the European Fee’s latest proposal of progressive import tariffs on Russian and Belarusian nitrogen fertilizers from 1 July 2025. If voted by means of, the influence on European nitrates demand may very well be materials given European producers’ at present constrained skill to go on greater prices attributable to competitors from low fuel price Russian imports.

- The medium- to longer-term nitrates outlook is supported by CBAM regulation and constructive decarbonization tendencies, which dictate a desire for nitrates over urea given greater nitrogen use effectivity, and since CAN is simpler to decarbonize than urea with low carbon ammonia.

- The European Fee has carried out a brand new responsibility construction for melamine imports into the European Union, which got here into impact in February 2025. The earlier fastened responsibility system has been changed with an advert valorem (%) responsibility, with the potential to considerably enhance import prices for Chinese language melamine. This responsibility construction may end in greater value flooring and improved margins for melamine gross sales, benefitting European producers and OCI’s European Nitrogen enterprise.

Methanol

- US methanol costs rose considerably in H2 2024, with spot costs up 12% and contract costs up 19% from H1 2024 attributable to provide constraints (decreased feedstock within the Atlantic basin), plant outages, steady demand and rising Chinese language MTO manufacturing (the latter reaching ~81% utilization charges excluding MTP in the direction of the top of December). Costs in Europe, a internet importer of methanol, additionally rose in H2 2024, rising 6% on common in comparison with H1 2024.

- Methanol fundamentals stay constructive within the medium- to long-term, however world macroeconomic uncertainties, with demand anticipated to outpace restricted new export capability anticipated globally inside the subsequent 5 years. Methanol is a key beneficiary from development in industrial exercise, supporting conventional chemical demand. Two new MTOs are underneath development and are anticipated so as to add vital methanol demand over the following few years. Authorities insurance policies are encouraging new functions for methanol attributable to emissions advantages, driving demand for methanol as a marine and highway gasoline.

Whole Monetary Outcomes at a Look (Persevering with and Discontinued)

Desk 1 – https://tradernews.co/wp-content/uploads/2025/03/Table_1___Financial_Highlights.jpg

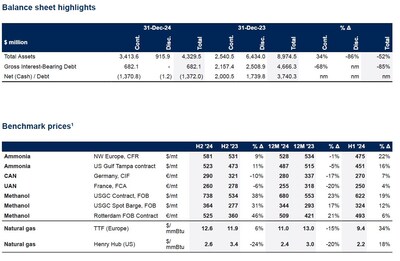

Desk 2 and three – https://tradernews.co/wp-content/uploads/2025/03/Table_2_and_3___BS_Highlights_and_Benchmark_Prices.jpg

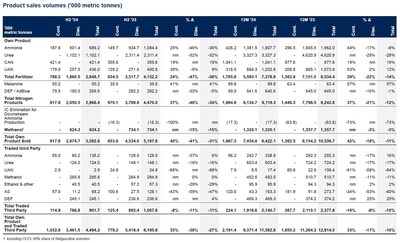

Desk 3 – https://tradernews.co/wp-content/uploads/2025/03/Table_3___Product_Sales_Volumes.jpg

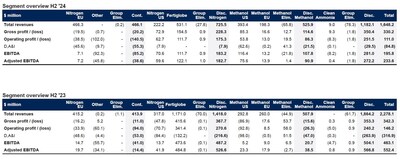

Desk 4 – https://tradernews.co/wp-content/uploads/2025/03/Table_4___Segment_Overview_HY.jpg

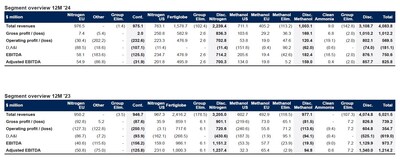

Desk 5 – https://tradernews.co/wp-content/uploads/2025/03/Table_5___Segment_Overview_FY.jpg

Reconciliation to Various Efficiency Measures

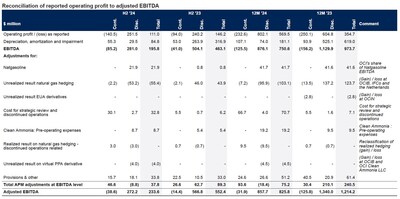

Adjusted EBITDA

Adjusted EBITDA is an Various Efficiency Measure (APM) that intends to provide a transparent reflection of the underlying efficiency of OCI’s operations. The principle APM changes within the second half of 2024 and 2023 relate to:

- Commodity hedge positive factors or losses: OCI doesn’t apply hedge accounting on commodity hedges, subsequently unrealized mark-to-market positive factors and losses are acknowledged within the P&L assertion. Unrealized mark-to-market positive factors or losses are excluded from adjusted EBITDA and adjusted internet revenue.

– A adverse adjustment of $2 million inside Persevering with Operations was made for unrealized mark-to-market positive factors on pure fuel hedge derivatives included inside reported EBITDA in H2 2024. - A $3 million realized pure fuel hedge loss from hedges transferred from IFCo to OCI N.V. was reclassified from Persevering with to Discontinued Operations in H2 2024.

- Different Persevering with Operations changes in H2 2024 embody $30 million in bills and prices associated to ongoing transactions; this compares to $6 million in H2 2023.

Desk 6 – https://tradernews.co/wp-content/uploads/2025/03/Table_6___APM_EBITDA.jpg

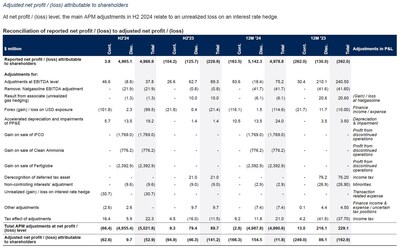

Desk 7 – https://tradernews.co/wp-content/uploads/2025/03/Table_7___APM_Net_Income.jpg

Desk 8 – https://tradernews.co/wp-content/uploads/2025/03/Table_8___FCF.jpg

Notes

This report comprises unaudited second half monetary highlights of OCI International (‘OCI,’ ‘the Group’ or ‘the Firm’), a public restricted legal responsibility firm included underneath Dutch regulation, with its head workplace positioned at Honthorststraat 19, 1071 DC Amsterdam, the Netherlands.

OCI International is registered within the Dutch business register underneath No. 56821166 dated 2 January 2013. The Group is primarily concerned within the manufacturing of nitrogen-based fertilizers and industrial chemical compounds.

Auditor

The monetary highlights and the reported information on this report haven’t been audited by an exterior auditor.

Investor and Analyst Convention Name

On 14 March 2025 at 15:00 CET, OCI will host a convention name for traders and analysts. Buyers can discover the small print of the decision on the Firm’s web site at www.oci-global.com.

Market Abuse Regulation

This press launch comprises inside info as meant in clause 7(1) of the Market Abuse Regulation.

About OCI International

Be taught extra about OCI at www.oci-global.com. You can even comply with OCI on Twitter and LinkedIn.

Contact

OCI International Investor Relations

|

Sarah Rajani, CFA |

www.oci-global.com OCI inventory symbols: OCI / OCI.NA / OCI.AS |

[1] The OCI Clear Ammonia challenge has been renamed to Beaumont New Ammonia by Woodside to replicate change of possession.

[2] Manufacturing of decrease carbon ammonia is conditional on provide of carbon abated hydrogen and ExxonMobil’s CCS facility changing into operational.

[3] The contingent consideration and the indemnifications are offset within the monetary statements pursuant to IAS 32.

[4] OCI continues to be concerned with the development, commissioning, and start-up of the ability by means of Challenge Completion with a monetary obligation to pay for the remaining capital expenditure and prices to Challenge Completion. Following the transaction completion on 30 September 2024, prices associated to OCI Clear Ammonia type a part of Persevering with Operations.

[5] TRIR contains OCI Clear Ammonia, whereas it excludes IFCo operations from September 2024 and Fertiglobe operations from October 2024.

![]() View unique content material to obtain multimedia:https://www.prnewswire.com/news-releases/oci-global-reports-h2-2024-results-302401799.html

View unique content material to obtain multimedia:https://www.prnewswire.com/news-releases/oci-global-reports-h2-2024-results-302401799.html

SOURCE OCI International

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.