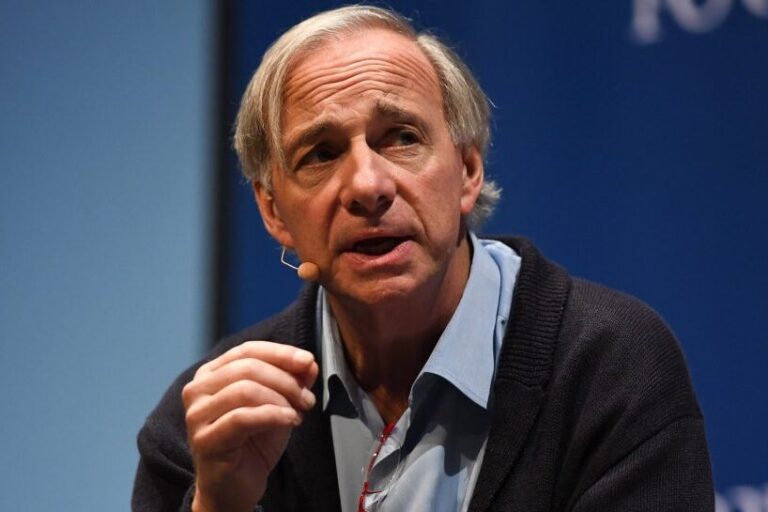

Ray Dalio, creator of Bridgewater Associates, has actually raised alarms about the United States’ nationwide financial obligation, anticipating an impending crisis.

What Taken Place: According to a report by Fortune, Dalio revealed his issues throughout his speech at the CONVERGE LIVE occasion in Singapore on Thursday.

Dalio highlighted a serious imbalance in between supply and need, keeping in mind that the debt-to-GDP ratio has actually reached 122%, exceeding the country’s financial output. He cautioned that the U.S. may quickly deal with troubles offering its financial obligation, as foreign financiers like China and Japan are drawing back.

The Congressional Budget Plan Workplace (CBO) tasks that the financial obligation ratio might intensify to 166% by 2054.

” We have an extremely serious supply and need issue. Some individuals believe we’ll manage it due to the fact that we have actually managed it up until now. I do not believe they comprehend the mechanics of financial obligation,” he stated, according to the report.

Dalio stressed that the U.S. will ultimately require to offer financial obligation that international markets might not have an interest in acquiring, a circumstance he referred to as “vital value.”

Dalio recommended that the existing federal deficit spending of 7.2% of GDP is unsustainable, promoting for a decrease to around 3%.

He meant prospective procedures such as financial obligation restructuring and political pressure on foreign federal governments to acquire U.S. financial obligation.

Joao Gomes, a financing teacher at Wharton Company School, echoed Dalio’s issues, keeping in mind the decreasing interest from standard financial obligation purchasers. He cautioned that if financiers require greater rate of interest, it might cause considerable financial interruptions.

Why It Matters: Dalio’s cautions are not brand-new, however they are significantly immediate.

In February, he warned that the U.S. deals with an “financial cardiac arrest” if financial cuts are not made, comparing the $36 trillion nationwide financial obligation to plaque in the monetary system’s arteries.

He stressed the requirement for financial obligation, prompting the federal government to minimize deficits to 3% of GDP within 3 years, or run the risk of financial instability.

His organized method to comprehending international financial cycles highlights financial obligation as a vital element, comparing it to the circulatory system of monetary markets.

The seriousness of Dalio’s message is highlighted by the capacity for “stunning advancements” if the U.S. does not resolve its financial obligation problems quickly.

Read Next:

Disclaimer: This material was partly produced with the assistance of AI tools and was examined and released by Benzinga editors.

Image courtesy: Shutterstock

Market News and Data gave you by Benzinga APIs