Bitcoin (BTC) heads into FOMC week in a mindful state of mind, with multimonth lows still annoyingly close.

-

BTC cost action protects $80,000 assistance as upside liquidity looks ripe for the taking.

-

The Fed is the focal point with a choice due on rate of interest and traders excitedly scanning Chair Jerome Powell for dovish signals.

-

A go back to build-up amongst Bitcoin leading purchasers types premises for self-confidence over market stability moving forward.

-

Historic BTC cost cycle analysis provides an outstanding $126,000 target for the start of June.

-

Those aiming to “be greedy when others are afraid” must focus on $69,000, research study concludes.

Bitcoin trader sees $87,000 liquidity grab

A relatively peaceful weekend saw BTC/USD prevent a long lasting sell-off into the weekly close, rather just dipping to $82,000 before rebounding.

Information from Cointelegraph Markets Pro and TradingView reveals a broad recover of the $80,000 mark sealing itself in current days.

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView

” Not a bad Sunday for Bitcoin,” crypto trader, expert and business owner Michaël van de Poppe summed up in part of his newest market analysis on X.

” We still have Monday to go, however this appears like we’re making a brand-new greater short on Bitcoin before assaulting the highs once again.”

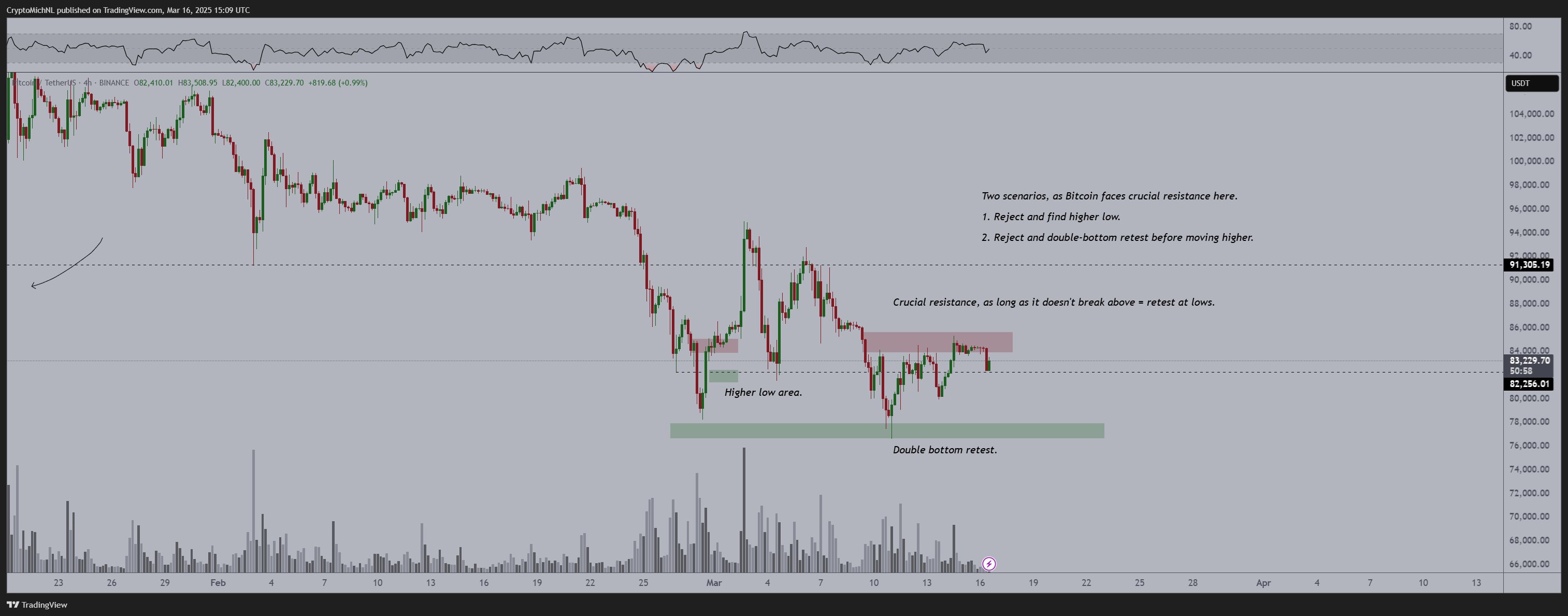

BTC/USDT 4-hour chart. Source: Michaël van de Poppe/X

Other market individuals echoed the belief, consisting of those seeing another retest of multimonth lows to take liquidity and “trap” late shorts.

” I believe Bitcoin will strike 78k very first to get liquidity before a Benefit Breakout,” popular trader Captain Faibik argued in part of his own X material.

” When the breakout happens, Bitcoin is most likely to reach 109k in the coming weeks (Potentially by mid-April).”

BTC/USDT 1-day chart. Source: Captain Faibik/X

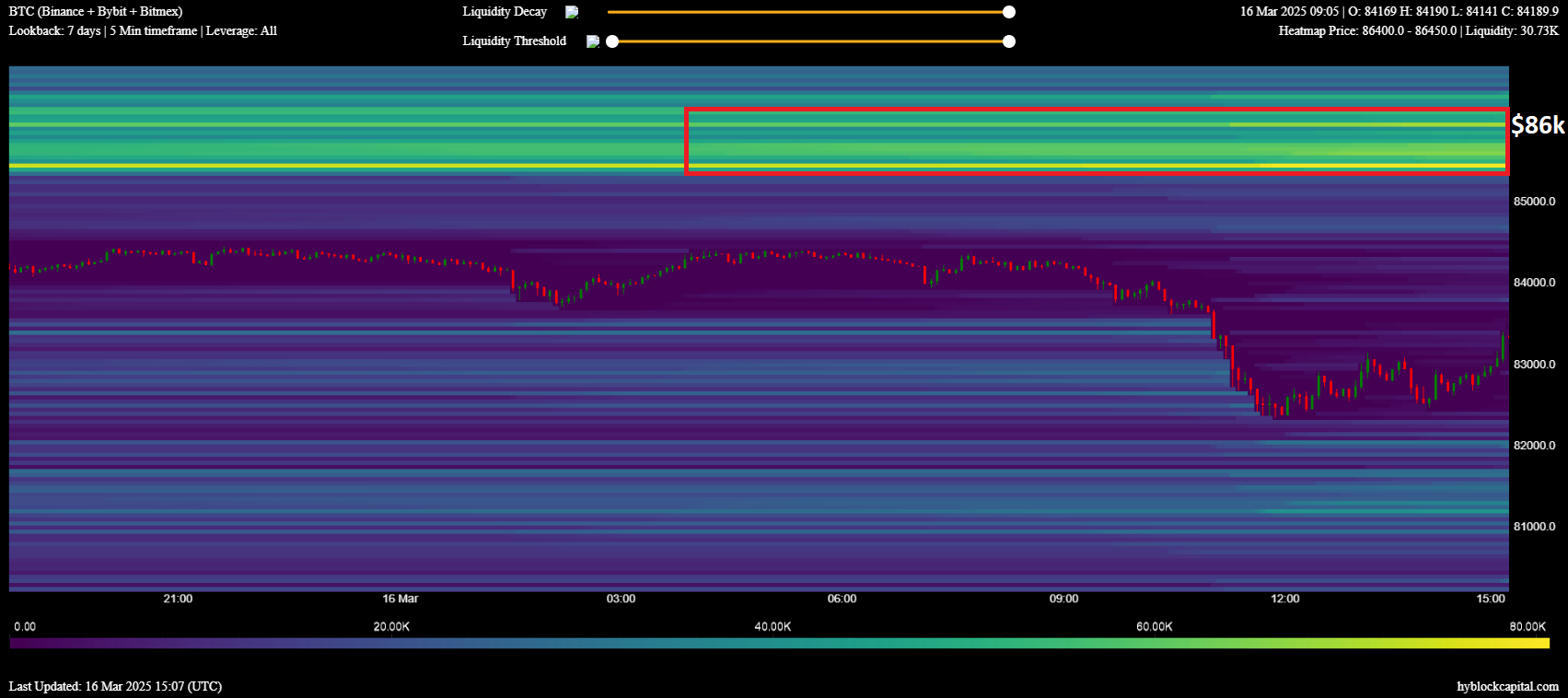

Fellow trader CrypNuevo on the other hand kept in mind that liquidity was manipulated primarily to the benefit, leading to essential targets for bulls to take.

” The location in between $85.4 k & &$ 87.1 k is the primary liquidity zone,” an X thread described.

” A go up targeting this location in the upcoming week appears more than most likely.”

Bitcoin exchange order book liquidity information. Source: CrypNuevo/X

Fed’s Powell in the spotlight as FOMC week gets here

Bitcoin and risk-asset traders have one macroeconomic occasion just on their minds today: the United States Federal Reserve’s rate of interest choice.

Coming at what commentary calls a “essential point in time,” the relocation by the Federal Free Market Committee (FOMC) will have extensive ramifications for market belief.

On the surface area, it appears that couple of surprises will likely come as an outcome of the 2nd conference of 2025– inflation might be cooling, however Fed authorities, consisting of Chair Jerome Powell, preserve a hawkish position on the economy and monetary policy.

Powell has actually consistently specified that he remains in no rush to cut rates, causing nearly consentaneous market bets that existing levels will stay the same after FOMC.

FOMC: Polymarket users anticipate a 99% possibility that the Fed will not make any rate cut modifications on Mar. 20. pic.twitter.com/zaDGBsmAZM

— Cointelegraph (@Cointelegraph) March 17, 2025

The most recent price quotes from CME Group’s FedWatch Tool see a high possibility of cuts coming just in June.

Needs to Powell strike a more unwinded tone throughout his accompanying declaration and interview, the state of mind might quickly turn.

” If Powell even whispers ‘QE’ at the next FOMC, markets will move quickly,” crypto technical expert Kyle Doops argued in part of an X post on the subject.

” However understanding Powell, he’ll keep it as unclear as possible.”

Fed target rate likelihoods. Source: CME Group

Doops described quantitative easing, a byword for liquidity injections and something that traditionally benefits crypto efficiency.

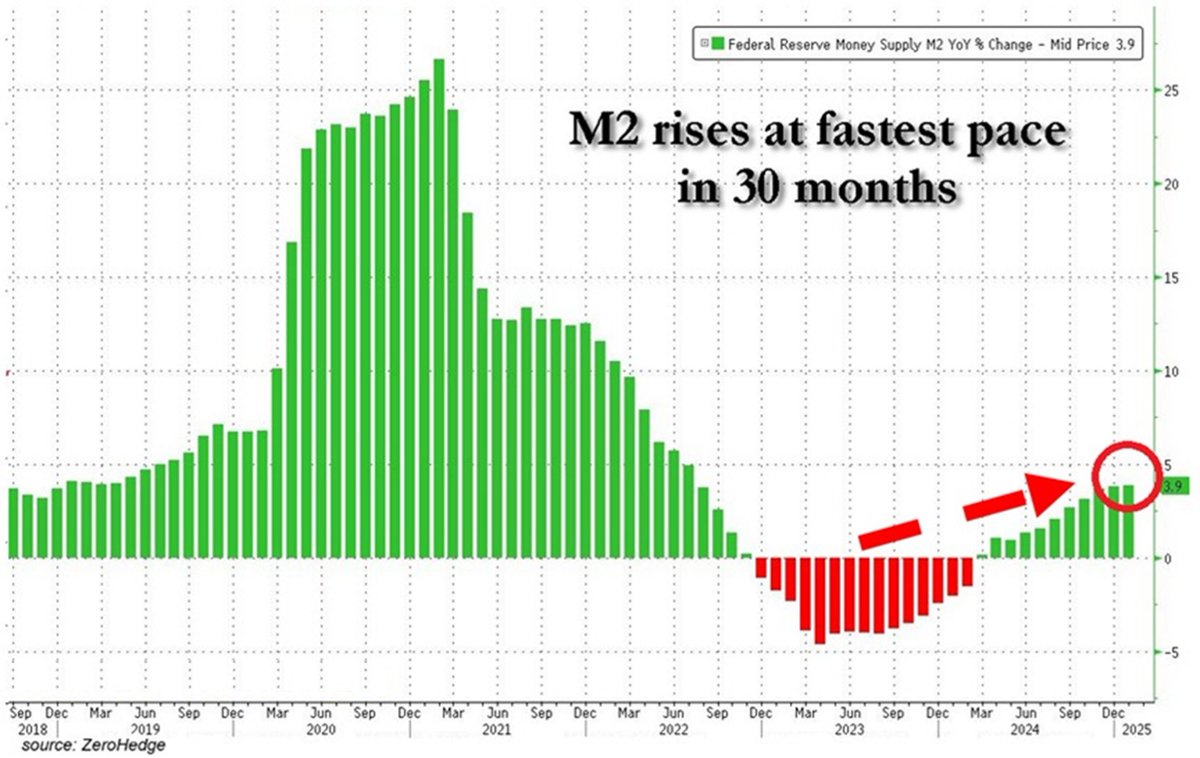

Behind the scenes, United States M2 cash supply is currently increasing– a crucial active ingredient for a crypto market rebound.

” M2 cash supply increased +3.9% year-over-year in January, the fastest speed in 30 months. This is the 11th straight month of cash supply growth,” trading resource The Kobeissi Letter kept in mind at the weekend.

Kobeissi included that around the world liquidity is following a comparable pattern.

” On the other hand, international cash supply has actually increased by ~$ 2.0 trillion over the last 2 months, to its greatest considering that September 2024,” it reported.

” Cash supply is broadening once again.”

United States M2 cash supply chart. Source: The Kobeissi Letter/X

Current purchasers reveal brand-new “hodling habits”

Newer Bitcoin financiers are revealing indications of developing habits as the booming market drawdown continues.

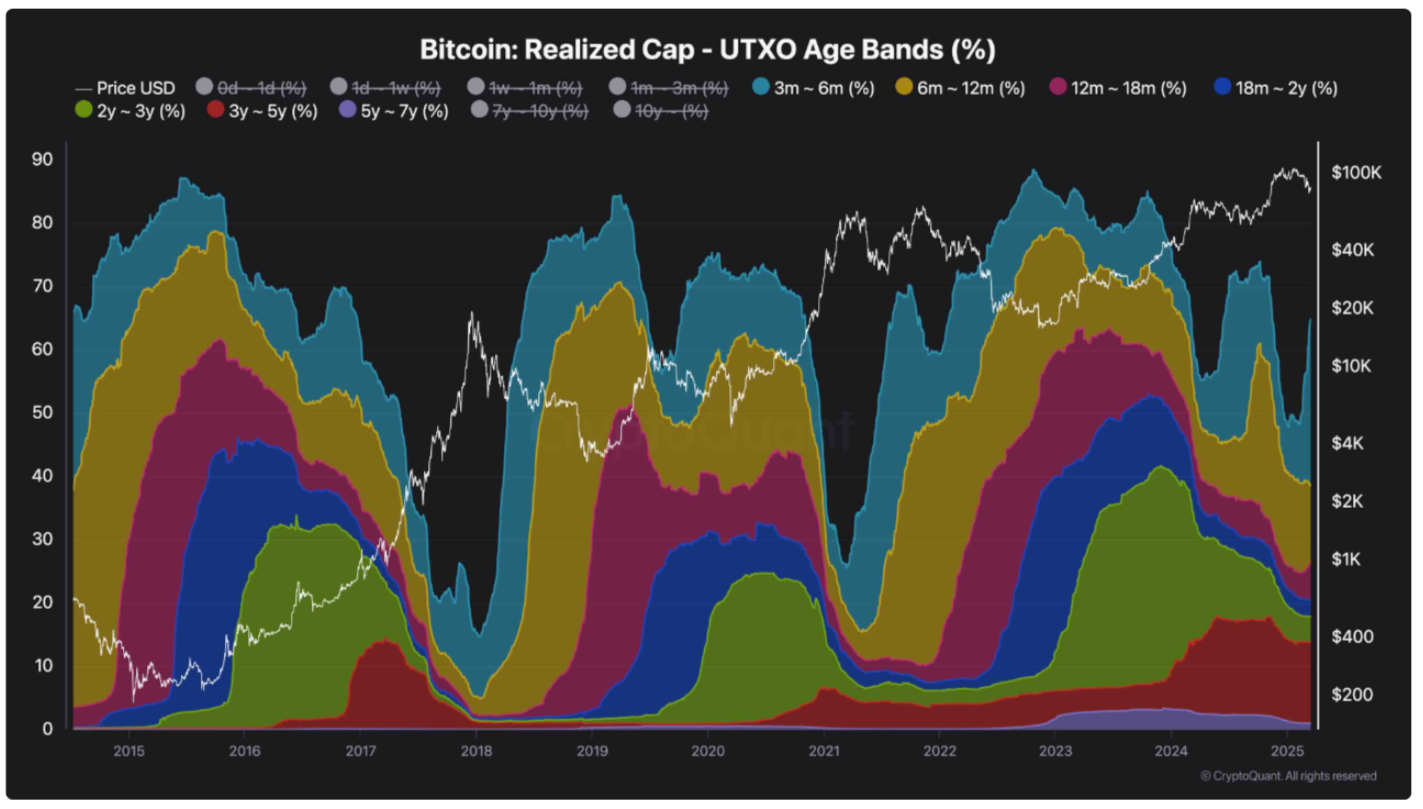

The most recent findings from onchain analytics platform CryptoQuant expose build-up taking control of for the older half of the short-term holder (STH) mate.

STH entities are those who purchased BTC as much as 6 months back. Per CryptoQuant, financiers hodling in between 3 and 6 months are now getting in “build-up” by declining to catch stress offering, in spite of possibly being undersea on their stack.

” According to the most recent information, the portion of coins held for 3 to 6 months has actually been increasing quickly, matching the build-up patterns observed throughout the extended correction in the summer season of 2024,” factor ShayanBTC composed in among its “Quicktake” post on March 16.

” This pattern highlights a hodling habits, where financiers avoid offering their Bitcoin in spite of the existing market correction.”

Bitcoin understood cap by UTXO age (screenshot). Source: CryptoQuant

An accompanying chart reveals Bitcoin’s understood cap split by the age of unspent deal output (UTXOs). This shows the overall worth of coins based upon the cost at which they last moved, with those inactive for in between 3 and 6 months increasing quickly.

” Historically, this kind of durability amongst Bitcoin holders has actually played an important function in forming market bottoms and firing up brand-new uptrends,” the post continues.

” As long-lasting holders continue building up, the offered supply in flow reduces, making Bitcoin more limited. When need ultimately gets, this supply capture typically results in price rises, pressing Bitcoin towards brand-new record highs.”

As Cointelegraph reported, nevertheless, STH purchasers from 2025 have actually displayed noticeably various responses to the BTC cost drop, offering coins with a combined $100 million loss considering that the start of February alone.

$ 126,000 BTC cost by June?

Network financial expert Timothy Peterson’s traditionally precise BTC cost metric, Lowest Rate Forward, just recently offered 95% chances of BTC/USD never ever dropping listed below $69,000 once again.

Now, another estimation sees the capacity for brand-new all-time highs by the start of June.

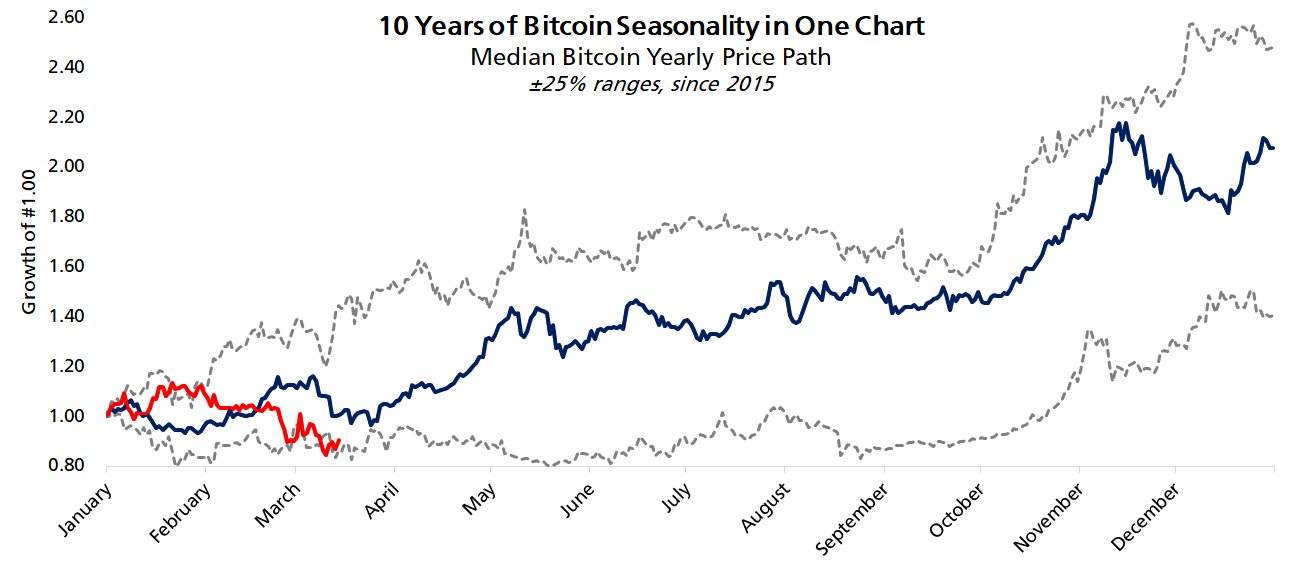

Bitcoin seasonal contrast. Source: Timothy Peterson/X

Comparing BTC cost efficiency considering that 2015 at the weekend, Peterson explained Bitcoin as presently being “near the low end” of what stays a basic variety.

The next 2 months, nevertheless, must be important– April is traditionally among the 2 finest months for the Bitcoin booming market.

” Almost all of Bitcoin’s yearly efficiency happens in 2 months: April and October,” Peterson commented.

” It is totally possible Bitcoin might reach a brand-new all-time high before June.”

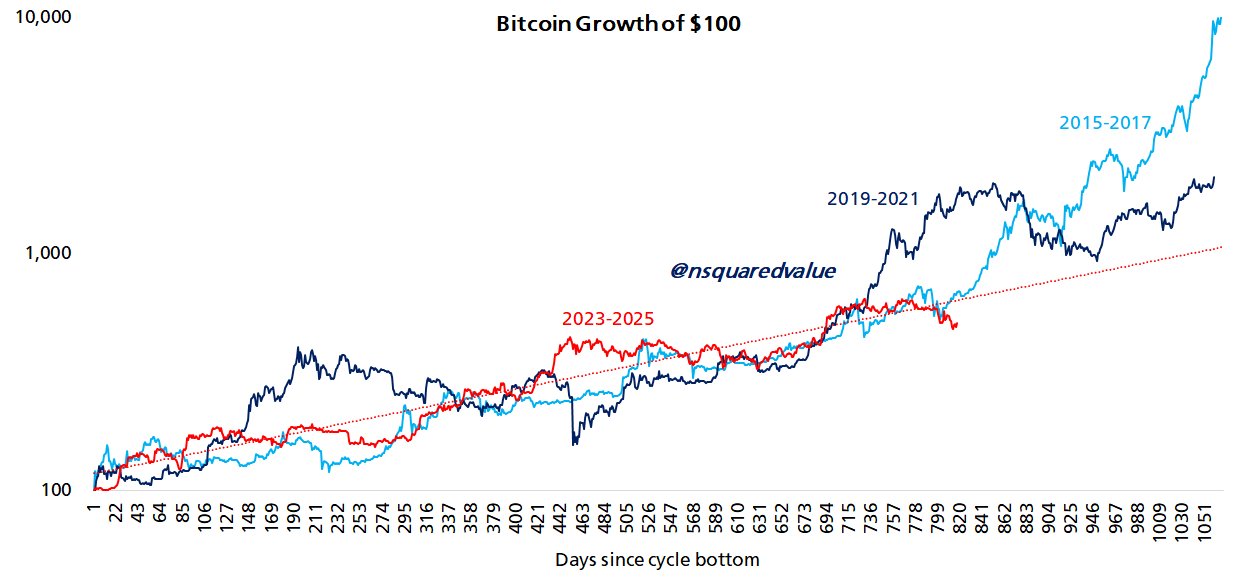

Bitcoin development of $100 contrast. Source: Timothy Peterson/X

Additional analysis produced a BTC cost target of $126,000 as a typical level that Bitcoin might still achieve within the next two-and-a-half months.

$ 70,000 marks a crucial “FUD” watershed

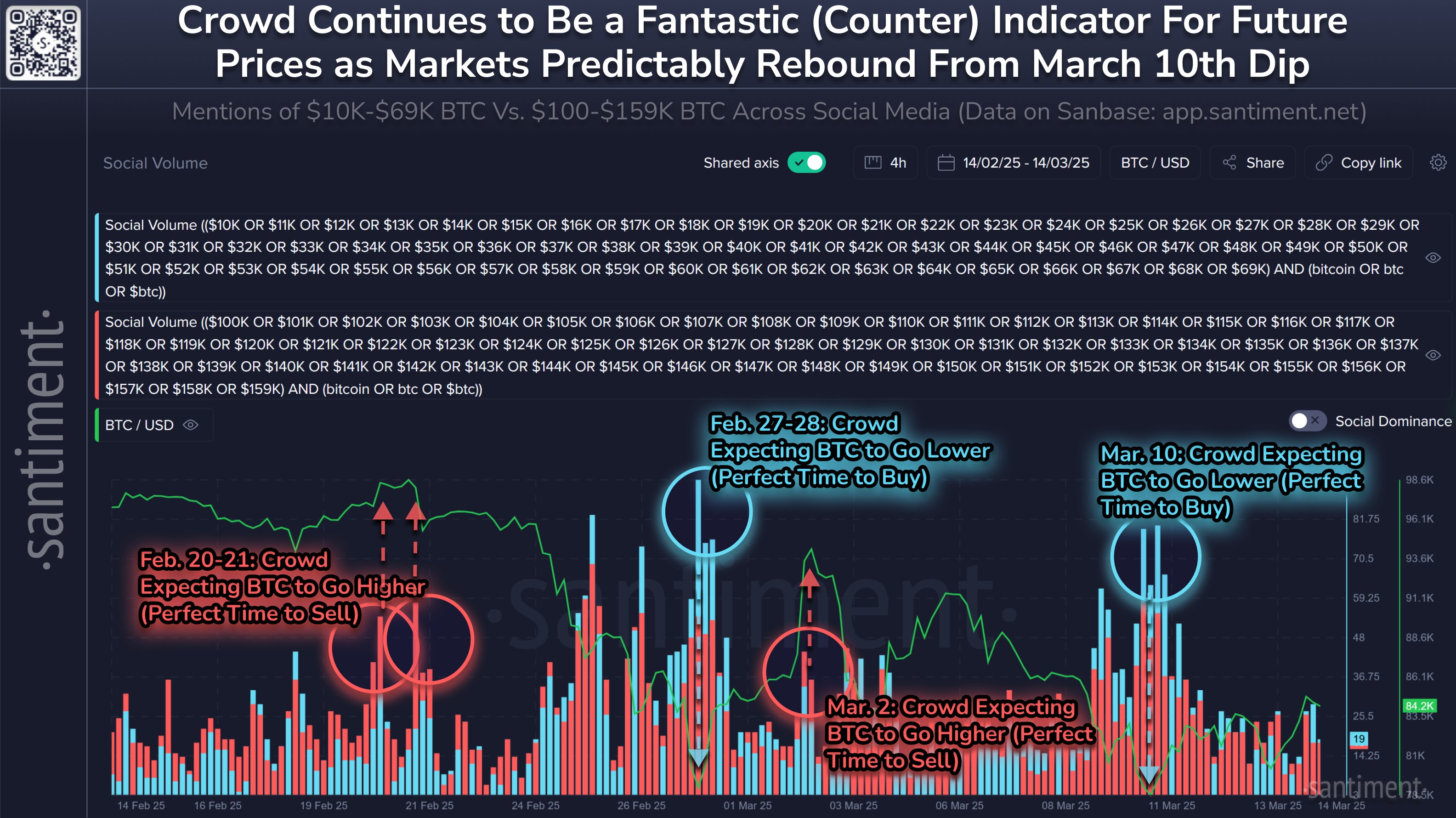

When it concerns BTC cost forecasts, social networks analysis is providing research study company Santiment trigger to take notice of 2 levels in specific.

Related: Bitcoin recovers $80K zone as BNB, HEAP, GT, ATOM mean altcoin season

In its newest examination, Santiment connected $69,000 and $100,000 to extremes in market outlook.

” Over the previous month, we have actually not seen Bitcoin’s market price fall listed below $70K OR increase above $100K,” it summed up on X.

” That implies taking a look at the crowd’s social forecasts of $100K is a terrific gauge for FOMO. Historically, markets move the opposite instructions of the crowd’s expectations.”

Bitcoin social networks information. Source: Santiment/X

Accompanying information taken a look at social networks points out of different BTC cost levels.

” This is why clusters of blue bars (representing $10K-$ 69K $BTC forecasts) so dependably foreshadow a turnaround (or purchase signal), particularly while markets are moving down and the crowd is getting afraid,” Santiment described.

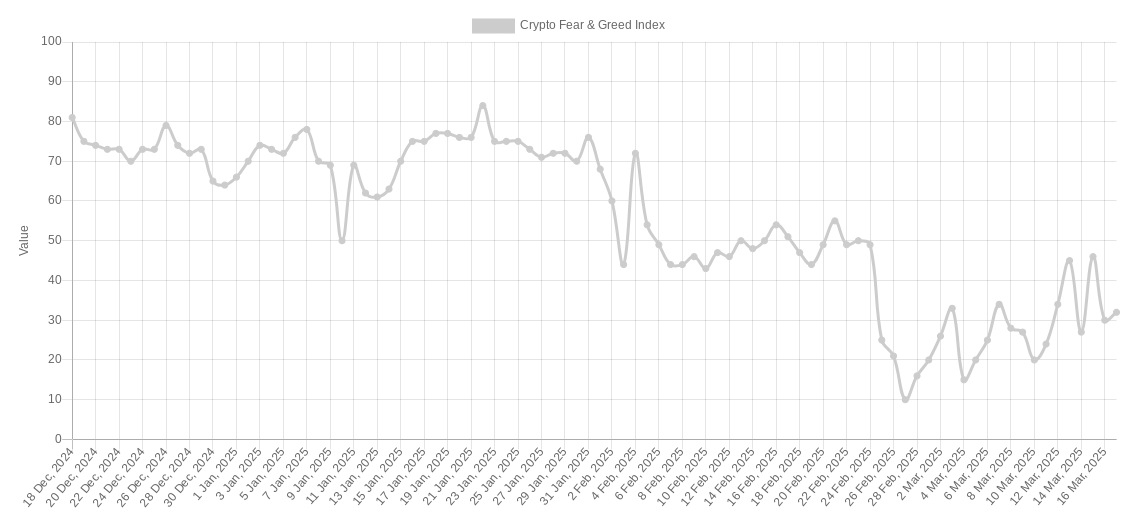

Crypto Worry & & Greed Index (screenshot). Source: Alternative.me

The Crypto Worry & & Greed Index stood at 32/100 on March 17, out of its “severe worry” bracket and at its greatest levels considering that Feb. 24.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.