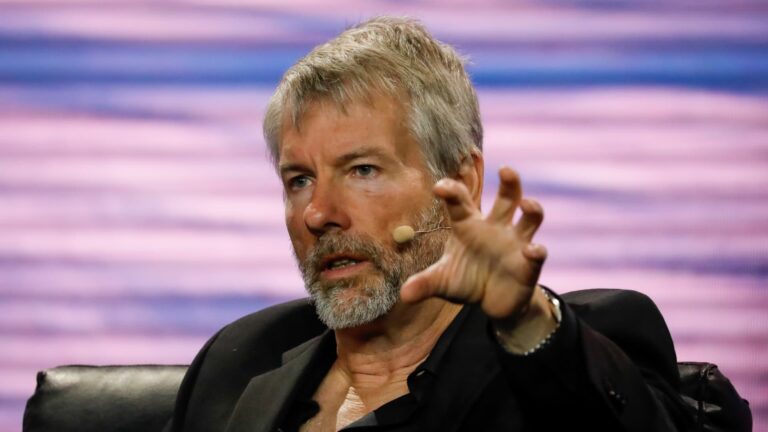

Bitcoin will no doubt rally when financier self-confidence returns, Michael Saylor states. The flagship digital currency, down about 10% in 2025, has actually been combining for numerous weeks as President Trump’s tariffs have actually magnified international financial issues, keeping financiers out of danger possessions. “The marketplace is truly skittish based upon issues about tariffs,” stated the creator and chairman of the aggressive bitcoin acquirer Technique, previously MicroStrategy. “The personality of the U.S. economy, the rate of interest forward chart … the rates of interest have actually drawn in 30, 40, 50 basis points. And we remain in this macro danger off zone. When that turns, I believe Bitcoin will rip forward with a revenge.” He included that “if you’re going to put a billion dollar bet on today, the only thing you would do is put a billion dollar bank on bitcoin as a long term shop of worth, that is clear.” Saylor is laser concentrated on bitcoin however even he sees it as just one tier of numerous that comprise the wider digital economy. Talking to CNBC’s Bob Pisani at the advisor-focused Future Evidence conference in Miami on Monday, Saylor drew up 4 sectors of the crypto community sustained by blockchain innovation. Saylor, notoriously bullish on bitcoin, stated the cryptocurrency sits at the top of a hierarchy of possessions as a digital product; followed by digital currencies, or stablecoins; tokenized stocks and bonds that can distribute 24/7; and lastly, digital tokens. “A digital token will be the most affordable limit,” he stated. “Any person can introduce a token, it will not be a security, it will stop brief in the energy that’s considered lawfully a security.” “The huge unlock is that digital token economy, and for that to take shape in a genuine method, we really require a digital possessions structure backed by Washington, D.C. entered law,” he included. He kept in mind that the U.S. is making development on that front, with the Securities and Exchange Commission carrying out “a fancy set of conferences” to identify what makes up a security. The 60-year-old billionaire likewise revealed self-confidence in the development of the GENIUS Act, the proposed stablecoin focused costs that passed the Senate recently and now heads to your home. “I believe the GENIUS act will be passed [and] the U.S. federal government will permit a U.S. regulated business or bank to release a stablecoin, as long as it’s backed by Treasurys, by currency equivalents, in a U.S. controlled organization,” Saylor stated.

Related Articles

Add A Comment