Xapo Bank, an international cryptocurrency-friendly bank headquartered in Gibraltar, is banking on crypto loaning revival by releasing Bitcoin-backed United States dollar loans.

Certifying Xapo Bank customers can now access Bitcoin (BTC) loans of approximately $1 million, the company stated in a statement shown Cointelegraph on March 18.

The brand-new loaning item is developed for long-lasting Bitcoin hodlers who wish to gain access to money while keeping their BTC, Xapo Bank CEO Seamus Rocca informed Cointelegraph.

” Unlike standard properties, Bitcoin is a perfect type of security– it is borderless, extremely liquid, offered 24/7, and quickly divisible, making it distinctively fit for loaning,” Rocca stated.

No security re-usage

A crucial difference of Xapo’s Bitcoin loan item is that the bank does not rehypothecate the loan security by users, implying that its loaning system does not include the re-usage of BTC properties by customers.

Rather, the Bitcoin security is kept in Xapo’s BTC vault utilizing institutional multiparty calculation (MPC) custody.

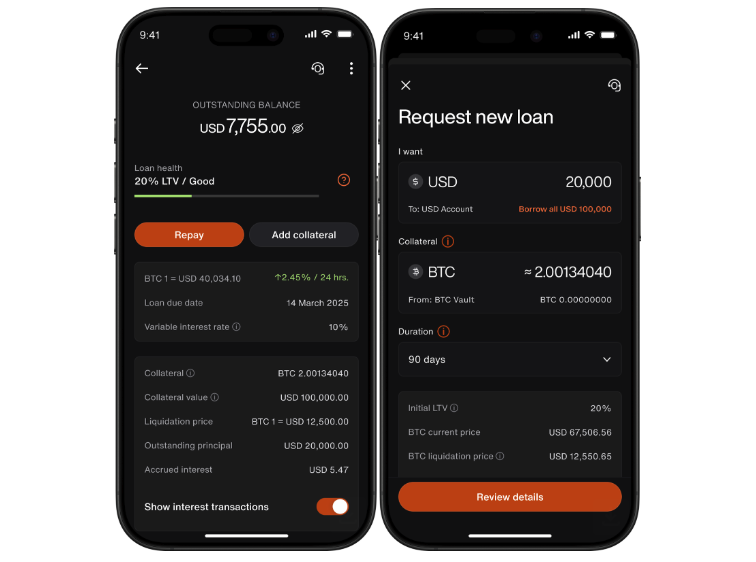

Working of a crypto loaning platform.

Qualified Xapo customers can pick payment schedules of 30, 90, 180 or 365 days, without any charges for early payment, the company stated.

Who is qualified?

Xapo’s brand-new Bitcoin loaning offering will be offered to pre-approved members based upon numerous requirements.

The crucial requirements for eligibility are the quantity of Bitcoin holdings and the duration of holdings, as Xapo particularly targets long-lasting BTC holders with a long-lasting financial investment technique.

According to the bank, the offering will be offered to international financiers in areas like Europe and Asia, omitting homeowners of the United States.

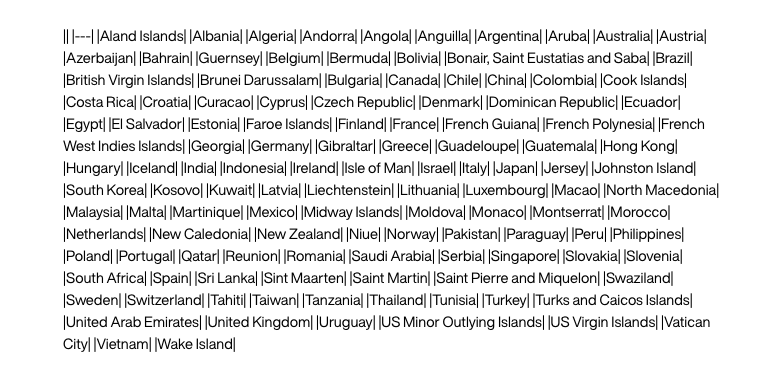

The list of jurisdictions supported by Xapo Bank. Source: Xapo Bank

Xapo Bank is managed by the Gibraltar Financial Providers Commission under the Financial Solutions Act 2019. In 2024, the bank effectively passported its banking license in the UK, approving its Xapo Bank App complete access to the nation.

While Xapo’s loaning is used throughout the European Union, crypto loaning is not covered by regional guidelines like the marketplaces in Crypto-Assets structure.

A revival following many collapses

Xapo Bank’s brand-new BTC loan launch comes a couple of years after the crypto loaning market suffered a significant crisis in 2022.

The crisis came in the middle of the historical Terra crash and a subsequent bearishness that set off the collapses of significant loaning service providers like Celsius and BlockFi.

” The collapse of Celsius, BlockFi, and other central loan providers substantially deteriorated rely on the crypto loaning area,” Xapo Bank CEO informed Cointelegraph.

An example of the Bitcoin loaning procedure on the Xapo Bank App. Source: Xapo Bank

” Customers today work out higher care, focusing on platforms with a tested performance history in Bitcoin custody and those that use protected, transparent options– specifically ones that do not participate in rehypothecation,” Rocca stated, including:

” At the very same time, need for Bitcoin-backed loans is on the increase, especially amongst high-net-worth people and institutional financiers who look for liquidity without offering their Bitcoin holdings.”

In addition to getting rid of possession rehypothecation and MPC security, Xapo provides threat management tools and proactive defense to avoid automated liquidations.

Related: Bitwise makes very first institutional DeFi allotment

” In case of a Bitcoin rate drop, clients get immediate alerts, permitting them to either leading up their security or make partial payments to preserve their loan status,” Rocca kept in mind.

Xapo is not the only company that has actually been working to present loaning items in 2025. In early March, Bitcoin designer Blockstream protected a multibillion-dollar financial investment to release 3 brand-new institutional funds, with 2 of them using BTC loaning.

Publication: ETH might bottom at $1.6 K, SEC hold-ups numerous crypto ETFs, and more: Hodler’s Digest, March 9– 15