Minnesota state Senator Jeremy Miller has actually presented the Minnesota Bitcoin Act, which he prepared after totally altering his position on Bitcoin.

” As I do more research study on cryptocurrency and speak with increasingly more constituents, I have actually gone from being extremely doubtful to getting more information about it, to thinking in Bitcoin and other cryptocurrencies,” Miller stated in a March 18 declaration.

Miller stated the costs intends to “promote success” for Minnesotans by permitting the Minnesota State Board of Financial investment to invest state properties in Bitcoin (BTC) and other cryptocurrencies, simply as it purchases conventional properties.

Numerous other US states have actually presented comparable Bitcoin-buying costs, with 23 states having actually presented legislation to develop a Bitcoin reserve, according to Bitcoin Laws.

An overall of 39 various costs connected to state financial investments in Bitcoin have actually been presented throughout 23 US states. Source: Bitcoin Laws

Under Miller’s costs, Minnesota state staff members would have the ability to include Bitcoin and other cryptocurrencies to their pension.

It would likewise provide locals the alternative to pay state taxes and charges with Bitcoin. Colorado and Utah currently accept crypto for tax payments, while Louisiana enables it for state services.

Financial investment gains from Bitcoin and other cryptocurrencies would likewise be exempt from state earnings taxes. In the United States, as much as $10,000 paid to the state can be subtracted from federal taxes under the state and regional tax reduction, however any quantity beyond that goes through both state and federal tax commitments.

Related: SEC might axe proposed Biden-era crypto custody guideline, states acting chief

The increasing variety of US states proposing Bitcoin reserve costs follows Senator Cynthia Lummis’ July Strategic Bitcoin Reserve Act, which directs the federal government to purchase 200,000 Bitcoin yearly over 5 years, amounting to 1 million Bitcoin.

Nevertheless, on March 12, Lummis proposed a recently reestablished BITCOIN Act, permitting the federal government to possibly hold more than 1 million Bitcoin as part of its recently developed reserve.

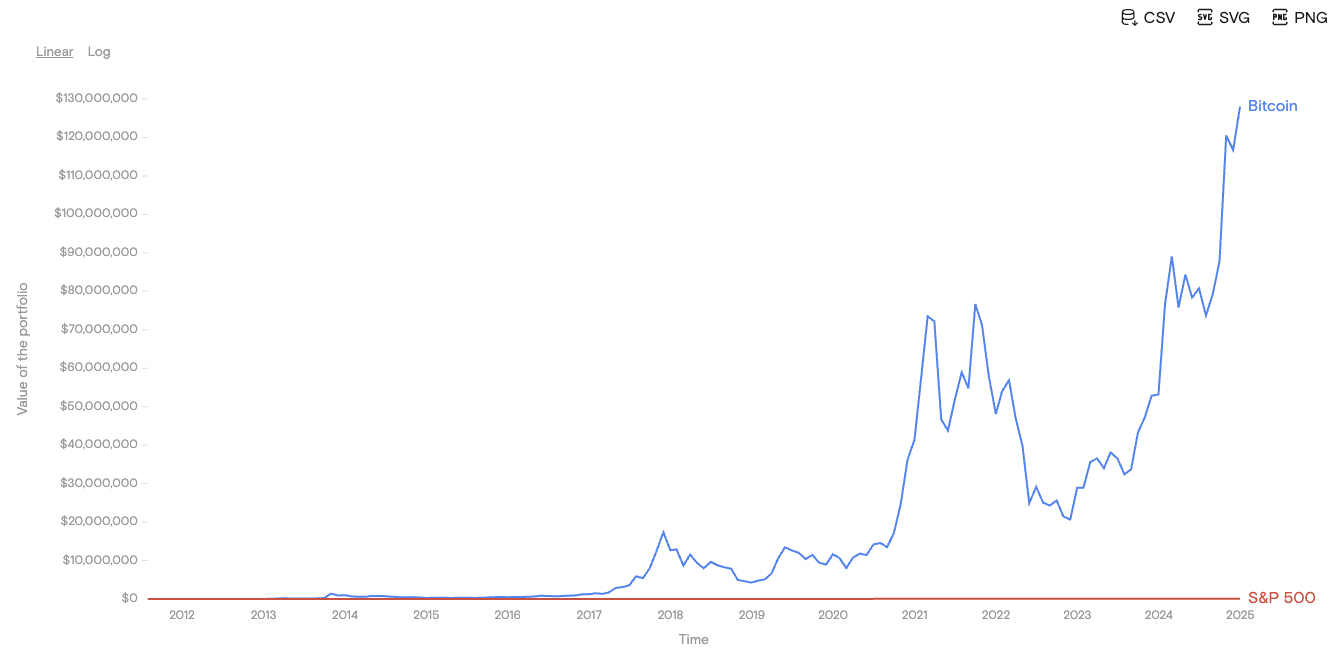

Bitcoin has actually revealed considerable gains compared to conventional properties in the last few years. From August 2011 to January 2025, Bitcoin published a compound yearly development rate of 102.36%, compared to the S&P 500’s 14.83%, according to Curvo information.

Bitcoin’s substance yearly development rate is substantially greater than the S&P 500s. Source: Curvo

Publication: Crypto fans are consumed with durability and biohacking: Here’s why