Crypto financiers rejoiced today after the United States Securities and Exchange Commission dismissed among the crypto market’s most questionable claims– one that led to an over four-year legal fight with Ripple Labs.

In another substantial regulative advancement, Solana-based futures exchange-traded funds (ETFs) have actually debuted in the United States, a relocation that might indicate the approval of area Solana (SOL) ETFs as the “next rational action” for legislators.

SEC’s XRP turnaround a “triumph for the market”: Ripple CEO

The SEC’s termination of its years-long claim versus Ripple Labs, the designer of the XRP Journal blockchain network, is a “triumph for the market,” Ripple CEO Brad Garlinghouse stated at Blockworks’ 2025 Digital Possession Top in New York City.

On March 19, Garlinghouse exposed that the SEC would dismiss its legal action versus Ripple, ending 4 years of lawsuits versus the blockchain designer for a supposed $1.3-billion unregistered securities offering in 2020.

” It seems like a success for the market and the start of a brand-new chapter,” Garlinghouse stated on March 19 at the Top, which Cointelegraph went to.

Ripple’s CEO stated the SEC is dropping its case versus the blockchain designer. Source: Brad Garlinghouse

Continue reading

Solana futures ETF to grow institutional adoption, in spite of restricted inflows

The crypto market is set to debut the very first SOL futures ETF, a substantial advancement that might lead the way for the very first area SOL ETF as the “next rational action” for crypto-based trading items, according to market watchers.

Volatility Shares is introducing 2 SOL futures ETFs, the Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT), on March 20.

Volatility Shares Solana ETF SEC filing. Source: SEC

The launching of the very first SOL futures ETF might bring substantial brand-new institutional adoption for the SOL token, according to Ryan Lee, primary expert at Bitget Research study.

The expert informed Cointelegraph:

” The launch of the very first Solana ETFs in the United States might substantially enhance Solana’s market position by increasing need and liquidity for SOL, possibly narrowing the space with Ethereum’s market cap.”

The Solana ETF will grow institutional adoption by “using a controlled financial investment automobile, drawing in billions in capital and strengthening Solana’s competitiveness versus Ethereum,” stated Lee, including that “Ethereum’s established community stays a powerful barrier.”

Continue reading

Pump.fun introduces own DEX, drops Raydium

Pump.fun has actually released its own decentralized exchange (DEX) called PumpSwap, possibly displacing Raydium as the main trading place for Solana-based memecoins.

Beginning on March 20, memecoins that effectively bootstrap liquidity, or “bond,” on Pump.fun will move straight to PumpSwap, Pump.fun stated in an X post.

Formerly, bonded Pump.fun tokens moved to Raydium, which became Solana’s most popular DEX, mostly thanks to memecoin trading activity.

According to Pump.fun, PumpSwap “functions likewise to Raydium V4 and Uniswap V2” and is developed “to produce the most smooth environment for trading coins.”

” Migrations were a significant point of friction – they slow a coin’s momentum and present needless intricacy for brand-new users,” Pump.fun stated.

” Now, migrations occur immediately and totally free.”

Raydium’s trading volumes rose in 2024, mostly due to memecoins. Source: DefiLlama

Continue reading

Bybit: 89% of taken $1.4 B crypto still traceable post-hack

The lion’s share of the hacked Bybit funds is still traceable after the historical cybertheft, with blockchain private investigators continuing their efforts to freeze and recuperate the funds.

The crypto market was rocked by the biggest hack in history on Feb. 21 when Bybit lost over $1.4 billion in liquid-staked Ether (stETH), Mantle Staked ETH (mETH) and other digital properties.

Blockchain security companies, consisting of Arkham Intelligence, have actually determined North Korea’s Lazarus Group as the most likely offender behind the Bybit make use of as the enemies continue switching the funds in an effort to make them untraceable.

Regardless Of the Lazarus Group’s efforts, over 88% of the taken $1.4 billion stays traceable, according to Ben Zhou, co-founder and CEO of crypto exchange Bybit.

The CEO composed in a March 20 X post:

” Overall hacked funds of USD 1.4 bn around 500k ETH. 88.87% stay traceable, 7.59% have actually gone dark, 3.54% have actually been frozen.”

” 86.29% (440,091 ETH, ~$ 1.23 B) have actually been transformed into 12,836 BTC throughout 9,117 wallets (Typical 1.41 BTC each),” stated the CEO, including that the funds were generally funneled through Bitcoin (BTC) mixers, consisting of Wasbi, CryptoMixer, Railgun and Twister Money.

Source: Ben Zhou

The CEO’s upgrade comes almost a month after the exchange was hacked. It took the Lazarus Group 10 days to move 100% of the taken funds through the decentralized crosschain procedure THORChain, Cointelegraph reported on March 4.

Continue reading

Libra, Melania developer’s “Wolf of Wall Street” memecoin crashes 99%

The developer of the Libra token has actually released another memecoin with a few of the exact same worrying onchain patterns that indicated substantial expert trading activity ahead of the coin’s 99% collapse.

Hayden Davis, co-creator of the Authorities Melania Meme (MELANIA) and Libra tokens, has actually released a brand-new Solana-based memecoin with an over 80% expert supply.

Davis released the Wolf (WOLF) memecoin on March 8, banking on reports of Jordan Belfort, called the Wolf of Wall Street, introducing his own token.

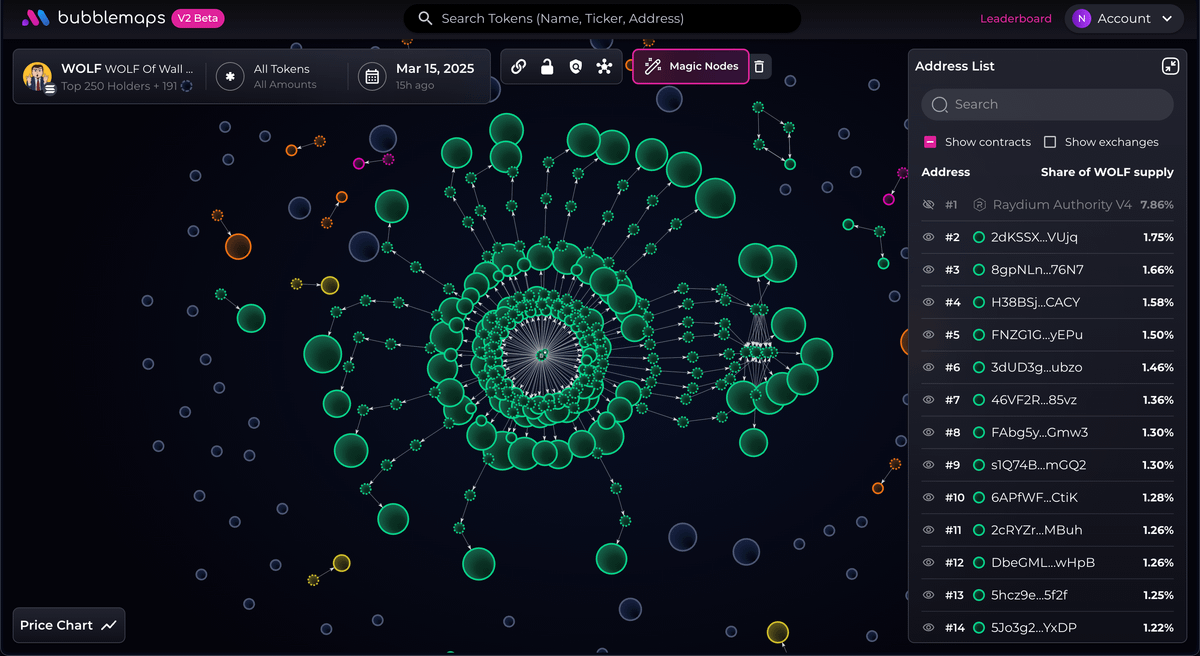

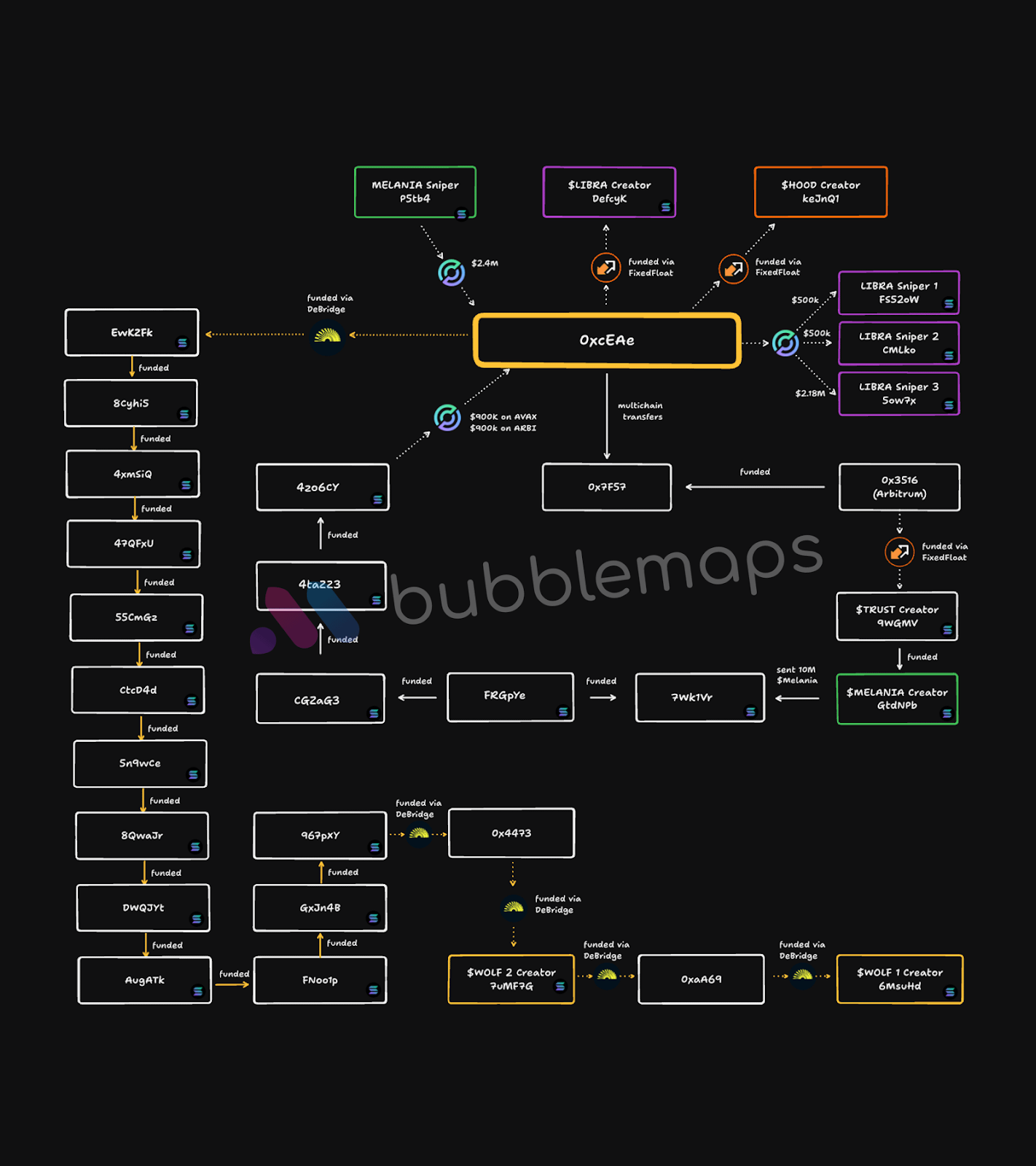

The token reached a peak $42 million market cap. Nevertheless, 82% of WOLF’s supply was bundled under the exact same entity, according to a March 15 X post by Bubblemaps, which composed:

” The bubble map exposed something odd– $WOLF had the exact same pattern as $HOOD, a token released by Hayden Davis. Was he behind this one too?”

Source: Bubblemaps

The blockchain analytics platform exposed transfers throughout 17 various addresses, stemming back to the address “OxcEAe,” owned by Davis.

” He moneyed these wallets months before $LIBRA and $WOLF released, moving cash through 17 addresses and 2 chains,” Bubblemaps included.

Source: Bubblemaps

The Wolf memecoin lost over 99% of its worth within 2 days, from the peak $42.9 million market capitalization on March 8 to simply $570,000 by March 16, Dexscreener information programs.

Continue reading

DeFi market summary

According to Cointelegraph Markets Pro and TradingView information, the majority of the 100 biggest cryptocurrencies by market capitalization ended the week in the green.

Of the leading 100, the BNB Chain-native 4 (KIND) token increased over 110% as the week’s most significant gainer, followed by PancakeSwap’s CAKE (CAKE) token, up over 48% on the weekly chart.

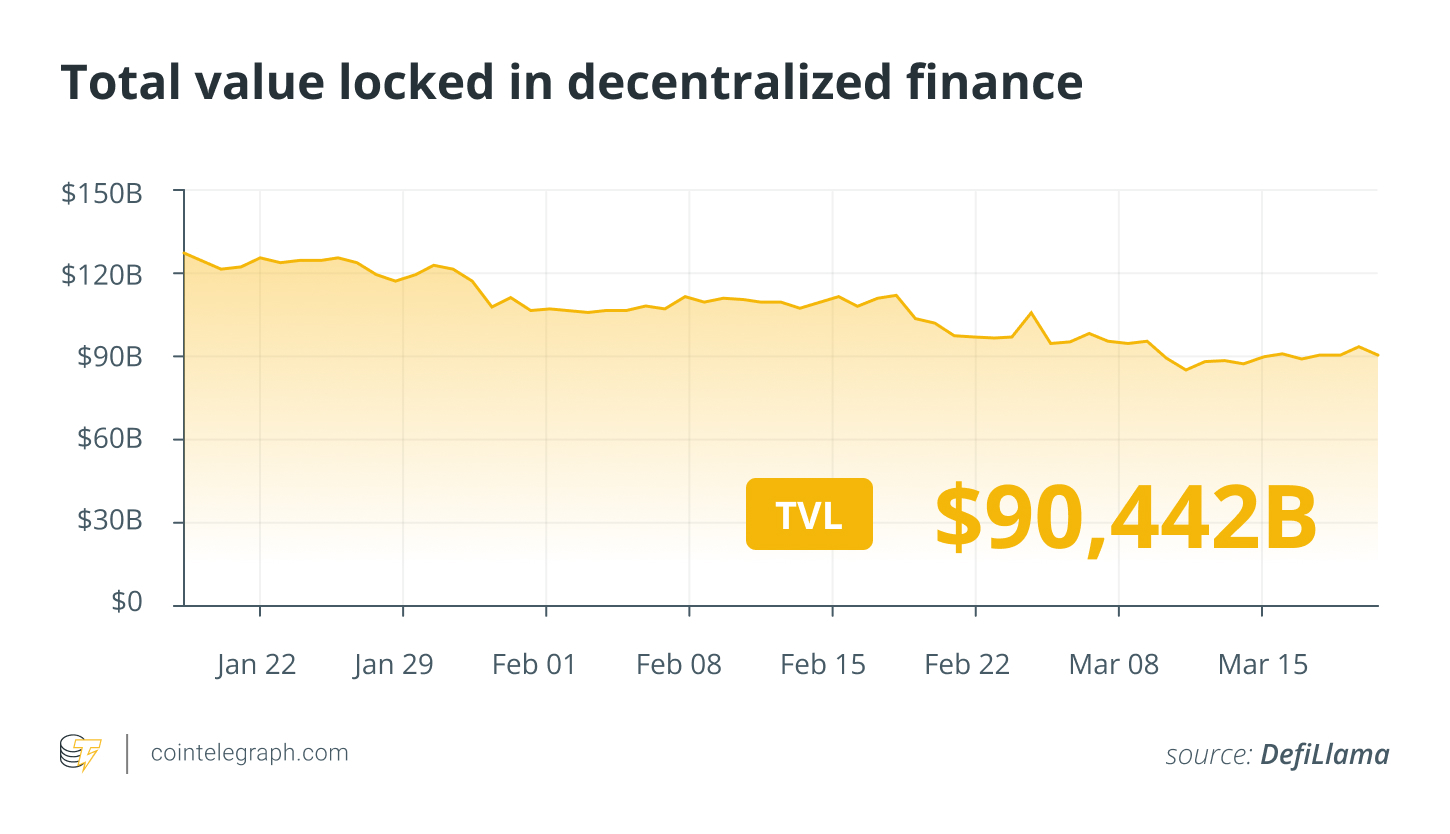

Overall worth secured DeFi. Source: DefiLlama

Thanks for reading our summary of this week’s most impactful DeFi advancements. Join us next Friday for more stories, insights and education concerning this dynamically advancing area.