Bitcoin (BTC) is entering what previous BitMEX CEO Arthur Hayes calls “up just mode,” as a deepening crisis in the United States bond market possibly drives financiers far from conventional sanctuary possessions and towards alternative shops of worth.

Loss of self-confidence in United States policy improves Bitcoin’s benefit potential customers

On April 11, the benchmark United States 10-year Treasury yield rose above 4.59%– its greatest level in 2 months.

United States 10-year Treasury note yields everyday efficiency chart. Source: TradingView

The $29 trillion United States Treasury market has actually dropped more than 2% today– its steepest decrease considering that September 2019, when a liquidity crunch in the repo market required the Federal Reserve to step in.

United States President Donald Trump’s unforeseeable tariff statements and turnarounds have actually sustained the turmoil. After threatening sweeping levies on international trading partners, Trump strolled back a lot of the procedures within days for specific nations, other than China.

The United States dollar contributed to the pressure, with its strength versus a basket of leading foreign currencies– as tracked by the United States Dollar Index (DXY)– dropping listed below the 100 mark for the very first time considering that 2022.

United States Dollar Index everyday efficiency chart. Source: TradingView

That more notched its worst weekly decrease in over 2 years.

On the other hand, Bitcoin increased by over 4.50% amidst the United States bond market thrashing, reaching around $83,250 on hopes that the weakening macroeconomic conditions will press United States policymakers to act.

” It’s on like donkey kong,” composed Hayes in his April 11 X post, including:

” We will be getting more policy reaction this weekend if this maintains. We will go into UP ONLY mode for $BTC.”

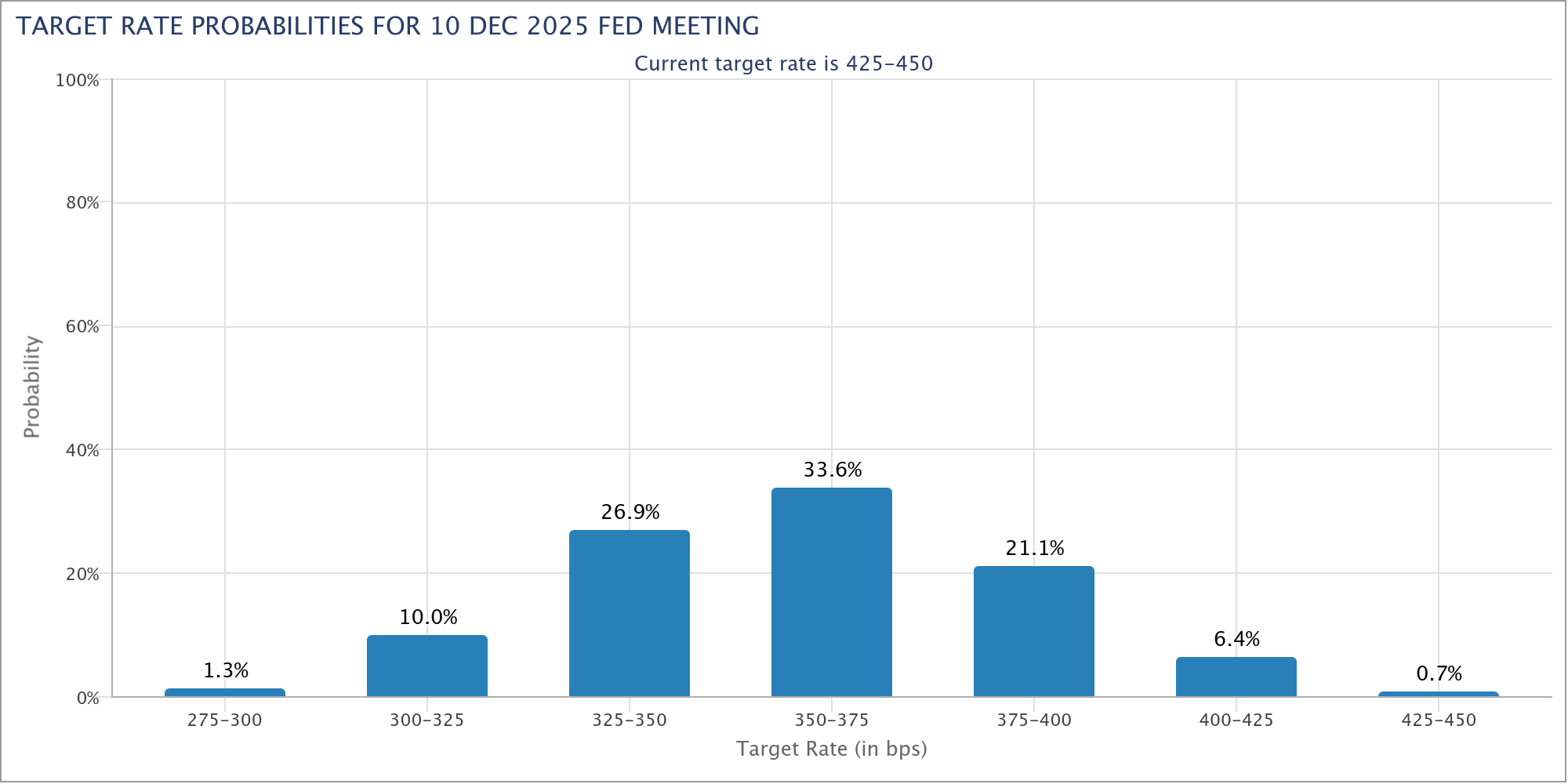

Moreover, bond traders are now pricing in a minimum of 3 rate cuts from the Federal Reserve by the end of the year, with a 4th ending up being significantly most likely. Rate cuts have actually traditionally been bullish for Bitcoin.

Target rate possibilities for December Fed conference. Source: CME

Bitcoin eyes ‘parabolic bull run’ due to weaker dollar

Historically, sharp drops in the United States Dollar Index have actually preceded postponed however effective Bitcoin bull runs, according to crypto expert Venturefounder.

” A falling DXY has actually usually been a strong bullish signal for Bitcoin,” the expert composed on X, indicating a clear bearish divergence on the chart.

DXY vs BTC/USD month-to-month cost chart. Source: TradingView/Venturefounder

He included that if DXY continues to move towards the 90 level, it might reproduce conditions that caused parabolic BTC rallies throughout the lasts of previous booming market– each lasting approximately a year.

Furthermore, Bollinger Bands developer John Bollinger used a bullish outlook for Bitcoin, keeping in mind that the cryptocurrency is forming a familiar bottom at $80,000.

Related: Bitcoiners’ ‘bullish impulse’ on economic downturn might be early: 10x Research study

On the other hand, a developing falling wedge pattern on the BTC cost chart mean a prospective Bitcoin cost rally towards $100,000, as Cointelegraph reported previously.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.