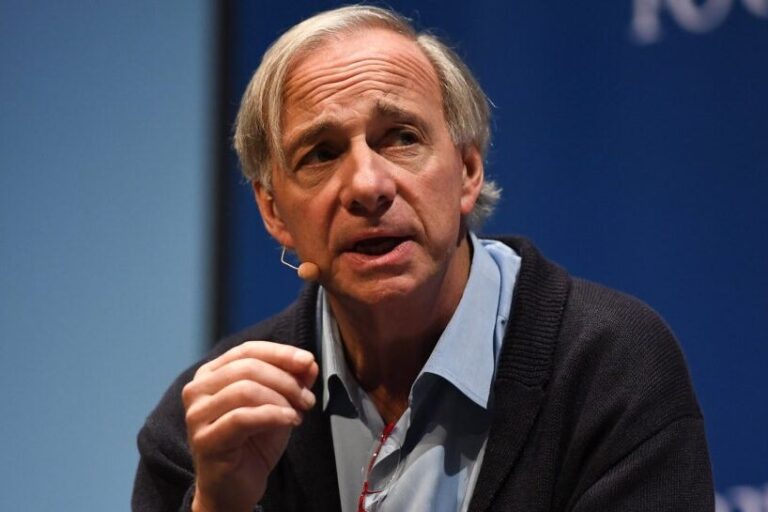

In a Sunday interview, Ray Dalio, the creator of Bridgewater Associates, revealed his apprehension about a possible recession that might go beyond an economic crisis if the existing financial policies are not handled efficiently.

What Taken Place: Dalio shared his issues on Sunday on NBC’s Meet Journalism. He cautioned that the U.S. is on the edge of an economic crisis and a serious financial slump might be on the horizon if the scenario is not managed effectively.

Dalio, who had formerly precisely anticipated the 2008 monetary crisis, accentuated the collapse of the financial order and substantial modifications in the domestic and international order. He drew parallels in between the existing times and the 1930s, describing the disruptive mix of tariffs, extreme financial obligation, and an increasing power challenging the existing power.

” I believe that today we are at a decision-making point and really near to an economic crisis,” Dalio informed NBC. “And I’m anxious about something even worse than an economic crisis, if this isn’t dealt with well.”

He particularly highlighted the unsustainable development of U.S. financial obligation, the decrease in U.S. production, and the nation’s increasing reliance on other countries for necessary products. Dalio gotten in touch with Congress members to dedicate to decreasing the deficit spending to 3% of the GDP, warning of a supply-demand issue for financial obligation if this is not accomplished.

Likewise Check Out: Ray Dalio’s Timeless Stock exchange Recommendations: ‘Do Not Attempt to Time the marketplace Yourself Since You’ll Most likely Lose’

” If they do not, we’re going to have a supply-demand issue for financial obligation at the exact same time as we have these other issues, and the outcomes of that will be even worse than a typical economic downturn,” he included.

In Dalio’s worst-case circumstance, the world economy might deal with interruption, possible military dispute might occur, and internal dispute might result in a discrepancy from the recognized democratic standards.

Why It Matters: Dalio’s forecasts are substantial offered his performance history of precisely anticipating the 2008 monetary crisis. His issues about the existing financial policies and the capacity for a serious financial slump emphasize the value of efficient management and policy reform.

The contrast to the 1930s works as a plain suggestion of the possible effects of financial mismanagement and might act as a wake-up call for policymakers.

The particular concerns Dalio mentions, such as the unsustainable development of U.S. financial obligation and the decrease in U.S. production, are important locations that require to be dealt with to avoid a possible crisis.

Read Next

Ray Dalio Applauds Trump’s Tariff Turnaround, Prompts US-China Offer And Deficit Decrease: Choice To Go Back A ‘Better Method’ To Deal With Issues

This material was partly produced with the assistance of AI tools and was evaluated and released by Benzinga editors.

Market News and Data gave you by Benzinga APIs