Bitcoin (BTC) bulls are attempting to begin the week on a favorable note by pressing the cost above $85,000. Michael Saylor’s Technique has actually utilized the current dip to purchase 3,459 Bitcoin for $285.5 million at a typical cost of $82,618. That increases the overall holding of the company to 531,644 Bitcoin acquired at a typical cost of $67,556.

Nevertheless, not everybody is bullish in the near term. Numerous institutional financiers appear to have actually cut their holdings. CoinShares reported on April 14 that digital possession exchange-traded items (ETPs) saw $795 million in outflows recently. The $7.2 billion in outflows because February have actually reversed almost all year-to-date inflows, now at simply $165 million.

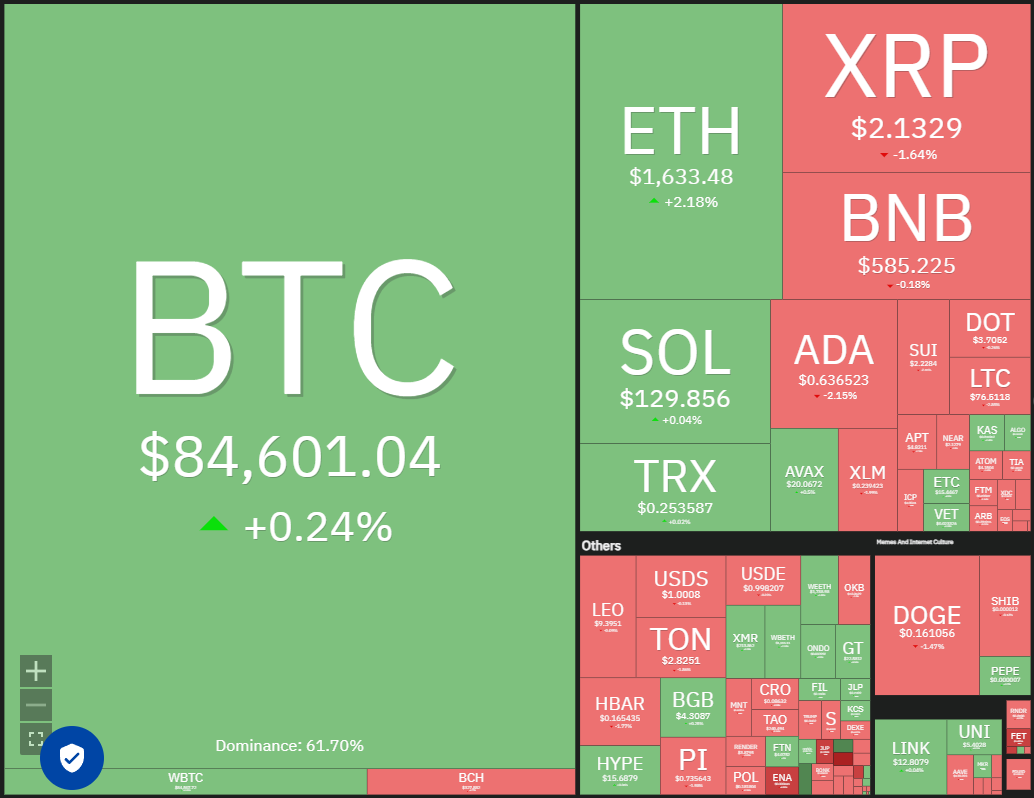

Daily cryptocurrency market efficiency. Source: Coin360

Although Bitcoin appears to have actually bottomed out in the short-term, a roaring booming market rally is not likely to begin in a rush. The tariff headings and the result of the tariff talks in between the United States and other nations might determine the cost action.

Could Bitcoin build on the healing, pulling altcoins greater? Let’s examine the charts to discover.

S&P 500 Index cost analysis

The S&P 500 Index (SPX) saw an extremely unpredictable week, however a favorable indication is that lower levels drew in strong purchasing by the bulls.

SPX day-to-day chart. Source: Cointelegraph/TradingView

After the enormous volatility of the previous couple of days, the index might go into a quieter stage. Sellers are most likely to offer the rallies near 5,500, while the bulls are anticipated to purchase the dips to the 5,119 assistance. That signifies a possible range-bound action in between 5,500 and 5,119 for a long time.

The next trending relocation is anticipated to start after purchasers press the cost above 5,500 or sink listed below 4,950. If the 5,500 level gets gotten, the index might rise to 5,800.

United States Dollar Index cost analysis

The United States Dollar Index (DXY) has actually remained in a freefall because declining from the 20-day rapid moving average (102.81) on April 10.

DXY day-to-day chart. Source: Cointelegraph/TradingView

Purchasers safeguarded the 99.57 level on a closing basis on April 11, however the bears restored their selling on April 14. If the cost closes listed below 99.57, the index might topple to 97.50 and, after that, to 95. The longer the cost stays listed below 99.57, the higher the threat of beginning a brand-new drop.

If purchasers wish to avoid a down relocation, they will need to quickly press the cost back above 99.57. That might begin a healing to 101.

Bitcoin cost analysis

Bitcoin broke above the resistance line on April 12, and the bulls effectively held the retest of the breakout level on April 13.

BTC/USDT day-to-day chart. Source: Cointelegraph/TradingView

The 20-day EMA ($ 82,979) has actually flattened out, and the RSI is near the midpoint, recommending that the selling pressure is lowering. The BTC/USDT set might reach $89,000, which is most likely to function as a stiff resistance. If the cost refuses dramatically from $89,000 and breaks listed below the 20-day EMA, it will suggest a variety development. The set might oscillate in between $89,000 and $73,777 for a couple of days.

If sellers wish to trap the aggressive bulls and maintain control, they will need to rapidly pull the cost back listed below the 20-day EMA. If they do that, the set might come down to $78,500 and consequently to the crucial assistance at $73,777.

Ether cost analysis

Ether (ETH) is dealing with costing the 20-day EMA ($ 1,722), as seen from the long wick on the April 14 candlestick.

ETH/USDT day-to-day chart. Source: Cointelegraph/TradingView

If the cost drops listed below $1,546, the ETH/USDT set might retest the $1,368 assistance. This is an essential level for the bulls to protect due to the fact that a break listed below $1,368 might begin the next leg of the drop towards $1,150.

Alternatively, if purchasers move the cost above the 20-day EMA, it signifies that the bears are losing their grip. There is resistance at the 50-day SMA ($ 1,955), however it is most likely to be crossed. The set might then rise to the strong resistance at $2,111.

XRP cost analysis

XRP (XRP) denied from the 50-day SMA ($ 2.24) on April 13, showing that sellers are active at greater levels.

XRP/USDT day-to-day chart. Source: Cointelegraph/TradingView

The 20-day EMA ($ 2.10) has actually flattened out, and the RSI is near the midpoint, showing a balance in between supply and need. A break listed below $2 will tilt the benefit in favor of the bears. The XRP/USDT set might drop to $1.72 and later on to $1.61.

Purchasers will get the advantage if they press and keep the cost above the 50-day SMA. If they can pull it off, the set might rally to the resistance line. Sellers are anticipated to strongly protect the resistance line due to the fact that a break above it signifies a prospective pattern modification.

BNB cost analysis

BNB (BNB) is dealing with resistance at the drop line, however a small favorable is that the bulls have actually not delivered much ground to the bears.

BNB/USDT day-to-day chart. Source: Cointelegraph/TradingView

That increases the probability of a break above the drop line. If that occurs, the BNB/USDT set might rise to $645. Sellers will attempt to safeguard the $645 level, however it is most likely to be crossed.

This favorable view will be revoked in the near term if the cost refuses dramatically from the drop line and breaks listed below $566. That might keep the set stuck inside the triangle for a while longer.

Solana cost analysis

Sellers are attempting to protect the 50-day SMA ($ 130) in Solana (SOL), however the bulls have actually maintained the pressure.

SOL/USDT day-to-day chart. Source: Cointelegraph/TradingView

If the cost closes above the 50-day SMA, the SOL/USDT set might increase to the $147 to $153 resistance zone. Sellers are anticipated to strongly protect this zone, however if the bulls dominate, the set might rise to $180.

The very first assistance on the disadvantage is the 20-day EMA ($ 123). A bounce off the 20-day EMA will keep the favorable momentum undamaged, while a break listed below it might sink the set to $110 and ultimately to $95.

Related: Solana rallies 20% versus Ethereum, however is $300 SOL cost within reach?

Dogecoin cost analysis

Purchasers are attempting to begin a healing in Dogecoin (DOGE) however are anticipated to deal with stiff resistance from the bears at the moving averages.

DOGE/USDT day-to-day chart. Source: Cointelegraph/TradingView

If the cost refuses from the moving averages, the bears will once again try to sink the DOGE/USDT set listed below $0.14. If they handle to do that, the selling might speed up, and the set might plunge to $0.10.

Contrarily, if purchasers move the cost above the moving averages, the set might rally to $0.20. This is an essential near-term level to keep an eye out for due to the fact that a break above it will finish a double-bottom pattern. The set might then climb up towards the pattern target of $0.26.

Cardano cost analysis

Purchasers are having a hard time to press Cardano (ADA) above the 20-day EMA ($ 0.65), showing that need dries up at greater levels.

ADA/USDT day-to-day chart. Source: Cointelegraph/TradingView

If the cost refuses from the 20-day EMA, the next assistance on the disadvantage is $0.58 and after that $0.50. Purchasers are anticipated to increasingly protect the $0.50 level due to the fact that a break listed below it might sink the ADA/USDT set to $0.40.

On the advantage, purchasers will need to drive and keep the cost above the 50-day SMA ($ 0.71) to signify that the drop might be over. That might move the set to $0.83 and consequently to $1.03.

UNUS SED LEO cost analysis

Purchasers are attempting to press UNUS SED LEO (LEO) above the 20-day EMA ($ 9.39), however the bears are presenting a significant obstacle.

LEO/USD day-to-day chart. Source: Cointelegraph/TradingView

The flattening 20-day EMA and the RSI near the midpoint recommend a balance in between supply and need. That might keep the LEO/USD set stuck in between $9.90 and $8.79 for a couple of days.

The next trending relocation might start on a break above $9.90 or listed below $8.79. If purchasers kick the cost above $9.90, the set will finish a bullish rising triangle pattern. This bullish setup has a target goal of $12.04.

On the disadvantage, a break listed below $8.70 might signify the start of a much deeper correction towards $8.30.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.