Bitcoin (BTC) recovered the $84,500 level on April 14, and the healing appears partly sustained by the statement of partial import tariff relief by United States President Donald Trump. Nevertheless, traders’ optimism faded on April 13 when it emerged that the relaxation was short-lived which tariffs on the electronic devices supply chain might be reviewed.

Unpredictability surrounding the continuous trade stress in between the United States and China affected Bitcoin markets, triggering traders to lose a few of their restored self-confidence. This discusses why Bitcoin’s cost stopped working to break above $86,000 and why BTC derivatives revealed minimal short-term capacity, possibly setting the tone for the next couple of days.

Bitcoin 2-month futures annualized premium. Source: Laevitas.ch

The premium on Bitcoin month-to-month futures agreements peaked at 6.5% on April 11 however has actually because dropped to 5%, which is near a neutral to bearish limit. Sellers usually need a 5% to 10% annualized premium for longer settlement durations, so anything listed below this variety suggests minimized interest from leveraged purchasers.

Bitcoin belief dims as stock exchange ties damage bullish momentum

Traders’ quick enjoyment can be connected to President Trump’s April 13 statement that tariffs on imported semiconductors would be examined throughout the week. This recommends that exemptions for mobile phones and computer systems are tentative, according to Yahoo Financing. Trump supposedly stated: “We wish to make our chips and semiconductors and other things in our nation.”

Bitcoin traders experienced psychological swings throughout this duration of changing expectations. The efficiency of wider markets, especially big innovation business reliant on worldwide trade, appears to have actually affected Bitcoin belief. The strong intraday connection in between Bitcoin and stock exchange has actually moistened bullish interest, exposing concerns about whether this impact is restricted to BTC futures.

S&P 500 futures (left) vs. Bitcoin/USD (right). Source: TradingView/ Cointelegraph

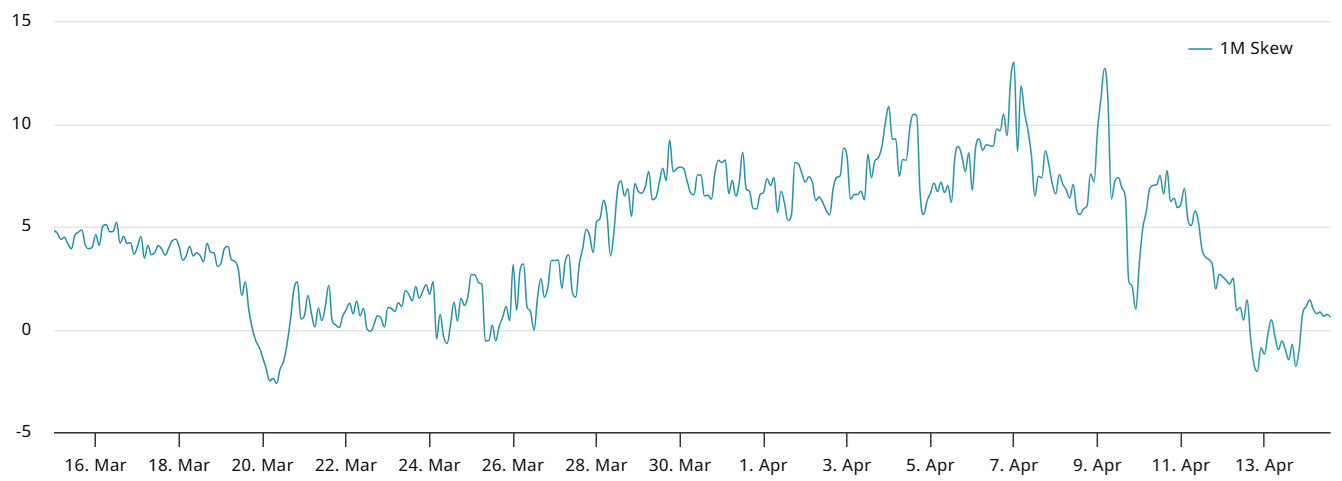

To identify whether Bitcoin traders’ belief is simply matching patterns in the S&P 500, it is handy to analyze the BTC alternatives markets. If expert traders expect a substantial cost drop, the 25% delta alter sign will increase above 6%, as put (sell) alternatives end up being more pricey than call (buy) alternatives.

Bitcoin 30-day alternatives 25% delta alter (put-call) at Deribit. Source: Laevitas.ch

On April 13, the Bitcoin alternatives delta alter briefly dipped listed below 0%, indicating moderate optimism. Nevertheless, this momentum did not hang on April 14, enhancing information from Bitcoin futures that reveal no considerable bullish belief in spite of costs recuperating from the $74,440 lows.

Weak point Bitcoin ETF inflows likewise behind traders’ minimal optimism

Another method to assess market belief is by evaluating stablecoin need in China. Strong retail interest in cryptocurrencies normally presses stablecoins to trade at a premium of 2% or more above the main United States dollar rate. On the other hand, a premium listed below 0.5% frequently suggests worry as traders move far from crypto markets.

Related: Crypto markets ‘fairly organized’ in spite of Trump tariff mayhem: NYDIG

USDT Tether (USDT/CNY) vs. United States dollar/CNY. Source: OKX

In Between April 6 and April 11, Tether (USDT) in China traded at a 1.2% premium, showing moderate interest. Nevertheless, this pattern reversed, with the premium now at simply 0.5%, recommending that the earlier enjoyment has actually dissipated. Thus, traders stay careful and reveal little self-confidence in Bitcoin exceeding $90,000 in the near term.

The statement of Method’s $286 million Bitcoin acquisition at $82,618 stopped working to increase belief, as financiers presume that the current short-lived decoupling from stock exchange patterns was mostly driven by this purchase. Likewise, Bitcoin area exchange-traded funds (ETFs) saw $277 million in outflows in between April 9 and April 11, even more compromising any prospective enhancement in trader self-confidence.

This short article is for basic info functions and is not planned to be and ought to not be taken as legal or financial investment guidance. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.