Crypto markets prevented the fallout brought on by United States President Donald Trump’s newest salvo versus Federal Reserve Chair Jerome Powell, which saw the United States stock exchange downturn and the dollar continue to deteriorate over unpredictability.

Stock exchange throughout the United States ended April 21 at a loss, with the S&P 500 dropping 2.4%, the tech-heavy Nasdaq slipping 2.5%, and the Dow Jones losing 2.5%, or almost 1,000 points, according to Google Financing.

The S&P 500 has actually now decreased by more than 12% considering that the start of the year, and the Nasdaq is down practically 18% in the United States tech stock exodus.

The stock slide follows intensifying stress in between Donald Trump and Jerome Powell and growing issue over the effect of trade tariffs.

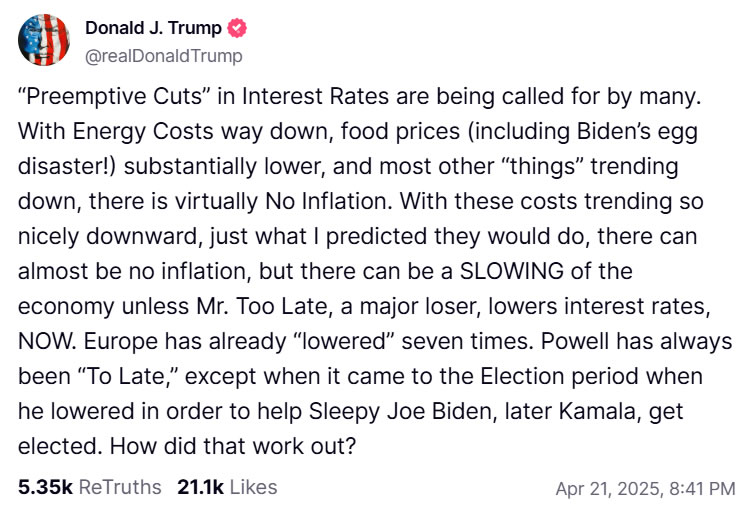

“‘ Preemptive Cuts’ in Rates Of Interest are being required by lots of,” Trump composed on his social networks platform Reality Social on April 21.

” With Energy Expenses method down, food costs […] significantly lower, and many other ‘things’ trending down, there is practically No Inflation,” he included.

Trump has actually restated his require reducing rates of interest, which Powell, who has actually been identified as “Mr. Too Late” and a “significant loser” by the POTUS, has actually kept high at 4.5%.

Recently, Powell took a swipe at Trump’s trade tariffs, stating they might cause a harmful financial mix of increasing costs and slowing development, or “stagflation.”

Trump reacted with a call to fire the reserve bank chair, specifying at the time that his “termination can not come quickly enough.”

The Fed is anticipated to keep its wait-and-see policy technique at its May 7 conference, with rates of interest markets anticipating simply a 13% opportunity of a rate cut, according to CME Fed Watch.

United States dollar decline continues

The United States Dollar Index (DXY)– a step of the strength of the greenback versus a basket of leading currencies– has likewise slipped more than 10% up until now this year. Today it was up to a three-year low listed below 98 on April 21, according to TradingView.

” Everybody wants and needs a weaker dollar to service their dollar financial obligations,” commented Genuine Vision creator and CEO Raoul Friend on April 22. “This is the purest type of worldwide liquidity and is the biggest chauffeur of worldwide M2 [money supply] presently,” he included.

Related: United States dollar goes ‘no-bid’– 5 things to understand in Bitcoin today

On the other hand, crypto markets have actually hung on to weekend gains with overall capitalization staying at $2.83 trillion at the time of composing.

Bitcoin (BTC) is keeping digital possession markets buoyed, striking a four-week high of $88,500 on April 22.

” Amidst among the most unstable durations for worldwide markets in years, Bitcoin is revealing excellent strength,” commented Bitfinex experts in a current market upgrade.

Publication: Altcoin season to strike in Q2? Mantra’s strategy to win trust: Hodler’s Digest