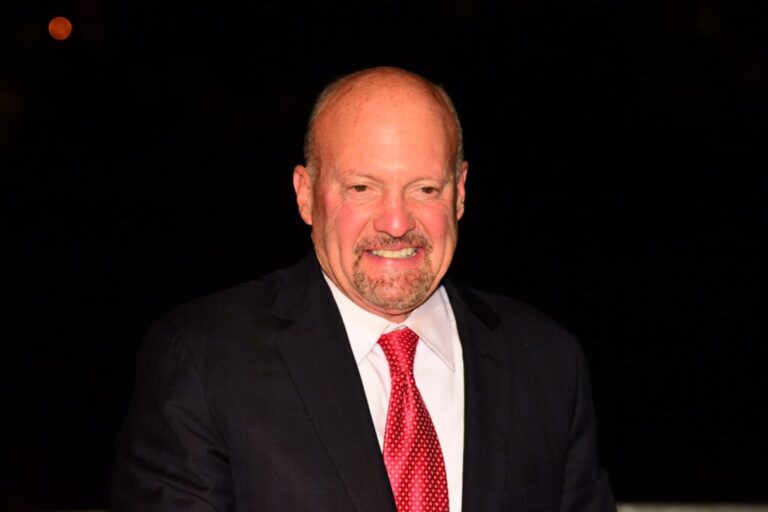

CNBC analyst Jim Cramer has actually voiced issues that the rigid China policy of the Trump administration is negatively impacting tech leviathans Nvidia Corporation NVDA and Apple Inc. AAPL

What Occurred: On Monday, Cramer mentioned that the Trump administration appears to focus on cutting off China over advancing U.S. interests. He specified that the federal government appears to be prejudiced versus these business, especially due to their connections with China, as reported by CNBC.

The Mad Cash host recommended that the White Home thinks Nvidia isn’t doing enough to avoid China from obtaining its items. Apple, which has significant service operations in China, is likewise ‘captured in the crosshairs’ of the trade war.

” Up until Trump ended up being president, our policy was serene co-existence and commerce with China, even if they didn’t play by the guidelines on trade,” specified Cramer.

Jim Cramer states the White Home desires Apple to produce its items in the U.S. or not at all. Nevertheless, he disagrees with that position, arguing it’s ill-advised to limit a business that regularly produces popular and ingenious items.

In spite of the present obstacles, Cramer showed that he simply ‘cut’ positions in Nvidia and Apple for the CNBC Investing Club’s Charitable Trust, revealing hope that the Trump administration may alleviate a few of its harsher policies if conditions get worse.

SEE LIKEWISE: Joe Rogan Paints A Photo Of Trump: In In Between Golf Swings, He’s On The Phone With Other Presidents: ‘We’re Going To Required More Cash!’

Why It Matters: Previously this month, Cramer slammed the Trump administration’s tariff policies as a “manmade catastrophe” causing a stock exchange slump. He had actually likewise alerted that greatly shorted stocks like Nvidia and Apple might deal with more down pressure from brief sellers.

Additionally, Cramer had actually revealed issues about Nvidia’s improvement into a “meme stock” due to U.S. export constraints. This issue was more enhanced when Nvidia’s stock fell almost 5% following reports of Huawei increase AI chip production in China, in spite of a Bernstein expert’s termination of its significance.

Remarkably, Apple and Nvidia, each, revealed $500 billion financial investment, in the U.S. over the next 4 years to enhance domestic production, a relocation which President Donald Trump hailed. While Apple’s financial investment consists of a huge factory in Texas for expert system servers, Nvidia prepares to utilize the financial investment towards making an AI supercomputer in the U.S.

Benzinga Edge Stock Rankings emphasize momentum and development rankings for Apple in the 69th and 45th percentiles, respectively. Curious how other stocks accumulate? Click on this link to reveal development and momentum ratings for leading stocks.

Over the previous month, the shares of Apple lost almost 12.5%, while Nvidia decreased more than 20% throughout the exact same duration.

Image by means of Shutterstock

Disclaimer: This material was partly produced with the aid of AI tools and was examined and released by Benzinga editors.

Market News and Data gave you by Benzinga APIs