Bitcoin mining company Bitdeer protected $60 million in loans to increase its Bitcoin ASIC producing efforts as worldwide mining competitors heightens amidst record-breaking network hashrates.

According to its yearly report, Bitdeer went into a loan arrangement in April with affiliate company Matrixport, a crypto monetary services business established by Bitdeer’s chairman, Jihan Wu.

The center provides to $200 million, backed by Bitdeer’s Sealminer hardware, with a drifting rates of interest of 9% plus market standards. Since April 21, Bitdeer had actually drawn $43 million from the credit limit.

The most recent financing contributes to a $17 million unsecured loan acquired in January, together with previous capital raises amounting to $572.5 million through convertible notes in 2024. Bitdeer likewise provided over 6 million shares, raising almost $119 million in equity markets this year.

Related: Leading Bitcoin miners produced almost $800M of BTC in Q1 2025

Bitdeer gets 101 MW Alberta power job

In February 2025, Bitdeer got a totally certified 101 megawatt (MW) gas-fired power job near Fox Creek, Alberta, for $21.7 million in money, per the yearly filing.

The website, with possible to scale as much as 1 gigawatt, consists of all needed authorizations for building and construction and a 99 MW grid connection. The power plant is set to be established with an EPC partner and is anticipated to be functional by the 4th quarter of 2026.

In March, the business likewise acquired 40 MW worth of liquid-cooled mining containers from Saiheat.

More just recently, it was reported that Bitdeer is broadening its self-mining operations and purchasing United States-based production. The shift was available in reaction to cooling need for its mining hardware from other miners.

” Our strategy moving forward is to prioritize our own self-mining,” Jeff LaBerge, Bitdeer’s head of capital markets and tactical efforts, supposedly stated.

Furthermore, on Feb. 28, 2025, Bitdeer introduced a $20 million share bought program, efficient through February 2026. To date, it has actually redeemed 1,056,500 Class A shares valued at about $12 million under this program.

Related: American Bitcoin’s aspiration is to control mining– Hut 8 CEO

Bitcoin hashrate rises while miner earnings diminish

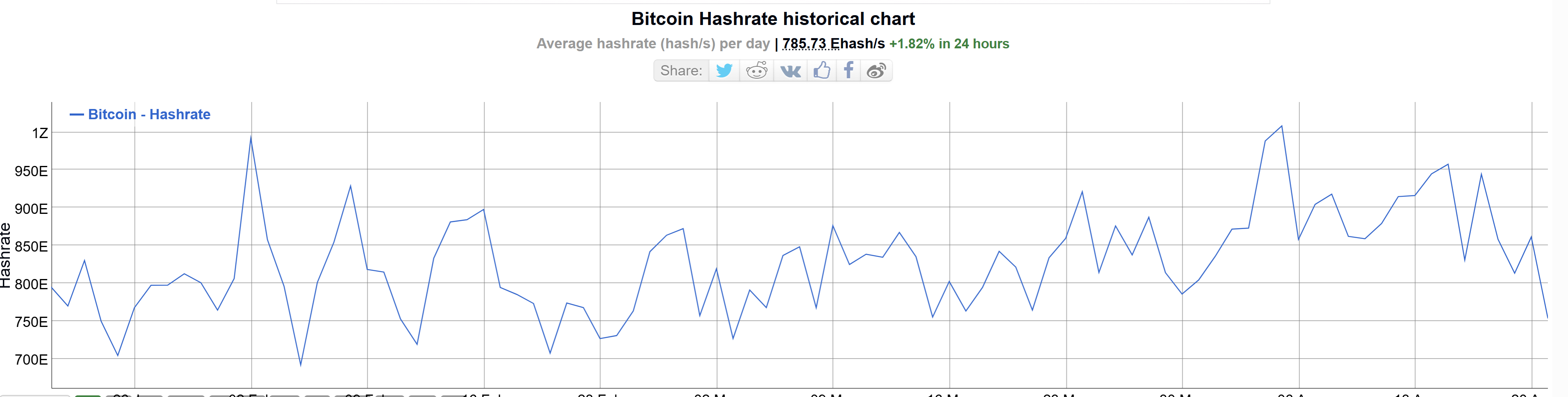

Bitdeer’s growth comes as Bitcoin’s network calculating power struck a record 1 sextillion hashes per second in early April, according to BitInfoCharts.

A greater hashrate suggests that more miners (or more effective devices) are completing to fix Bitcoin blocks. As competitors increases, each private miner’s opportunity of making block benefits reduces, suggesting decreasing success.

More injuring miner profits are low deal charges. Currently, the typical Bitcoin deal cost hovers around $1, below over $16 per transfer in April in 2015, according to YCharts.

The low deal charges and increasing hashrate required public miners to offer over 40% of their BTC production in March– the greatest given that late 2024.

Companies like Hive, Bitfarms and Ionic Digital supposedly offered more than 100% of their regular monthly output.

Publication: Altcoin season to strike in Q2? Mantra’s strategy to win trust: Hodler’s Digest, April 13– 19