Secret takeaways:

-

A week filled with United States macroeconomic reports might affect Bitcoin traders’ belief.

-

Bitcoin’s rally might stall if there’s a sharp decrease in area purchase volumes.

-

If PCE, the ISM PMI, and tasks information line up with market expectations, BTC might rally.

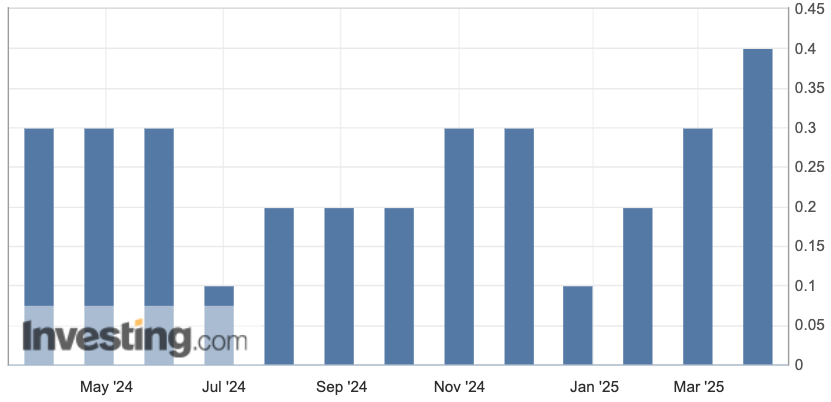

Bitcoin (BTC) cost might deal with a duration of range-bound trading after handling a 10.37% rally over the previous 7 days. Robust area buying need from Method, the area BTC ETFs, and statements from 21Shares and Coinbase contributed in Bitcoin’s rally to $95,700. With the exception of the April 28 statement of a $1.42 billion BTC buy from Method, a peaceful week on the crypto news front might equate to a decrease in area need and lower assistance tests from Bitcoin cost.

Today is likewise event-filled on the macroeconomic information reporting side. On April 29, the Task Openings and Labor Turnover Study (SHOCK) report will be released, and the information might offer insight into how the US-led trade war and tariffs are being absorbed by the labor market.

On Friday, May 2, the tasks report will release, and provided the current tariff-induced volatility, it’s possible that the information might reveal a “genuine huge time out in the economy.”

The Core PCE (Individual Usage Expenses) anticipate will be launched on April 30, and the information will offer a clear view of any considerable shifts in United States inflation.

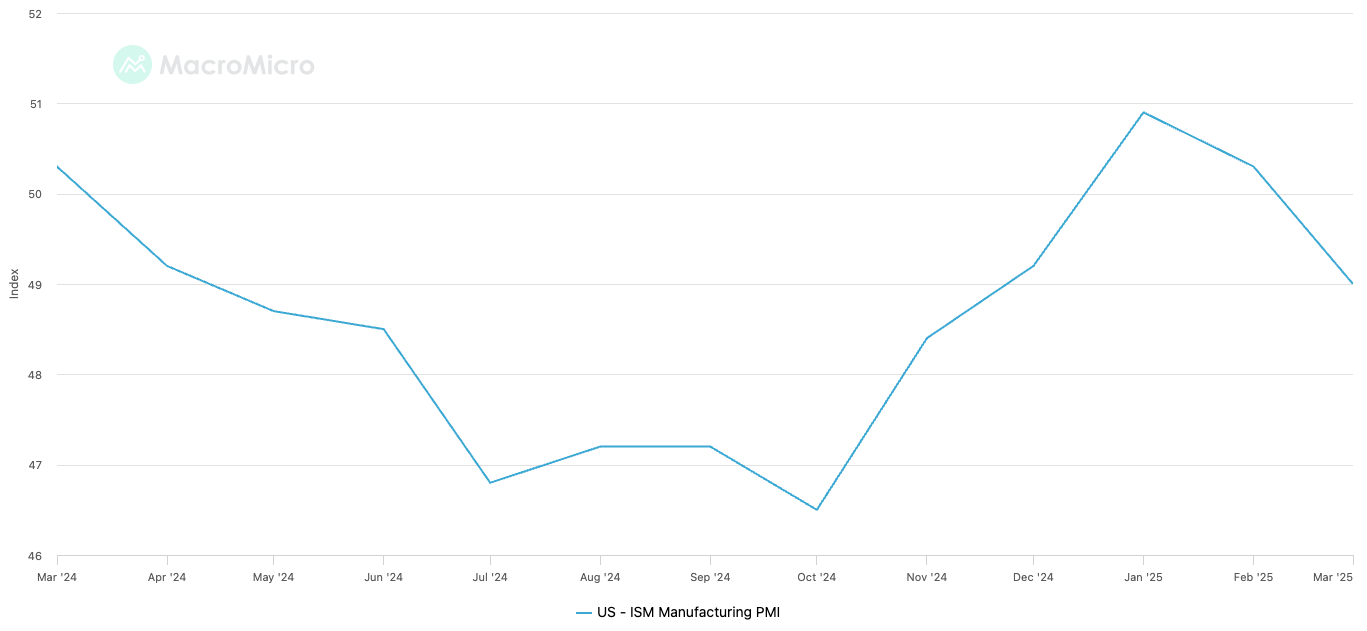

The United States ISM Production PMI information is launched on Might 1. Just recently, the information shows the worry organizations have actually experienced due to the US-led tariff war as they put their company preparation on hold to see how things play out. Markets might respond adversely if the report reveals more wear and tear in the ISM PMI.

Related: Bitcoin cost cools down amidst stressing macroeconomic information– Will $95K hold today?

Depending upon the marketplace context, traders tend to cut or contribute to run the risk of throughout weeks chock-full of macroeconomic information. Offered the disadvantage market volatility seen throughout April, it appears most likely that traders will take the more careful method, enhancing the earlier mentioned view that Bitcoin cost might combine throughout the week.

At the time of composing, Bitcoin cost trades somewhat listed below $95,000, and given that reaching the level on April 25, BTC has actually taken a tight variety in between $93,000 to $95,500.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.