Secret takeaways:

-

BONK rate is up 73% considering that April 22, striking a five-month high of $0.00002167.

-

BONK’s open interest rose 290% to $43.2 million.

Bonk (BONK), the second-largest Solana-based memecoin by market capitalization, is on track to continue the healing it started on April 22. BONK has actually climbed up roughly 73% from its April 22 low of around $0.00001247, bringing its rate approximately an intraday high of $0.00002167 on April 28.

Information from Cointelegraph Markets Pro and TradingView reveals BONK trading at $0.00001923, up 3% over the 24 hr and 60% over the last 7 days.

BONK’s trading volume has actually leapt 98% over the last 24 hr to $478 million, and its market capitalization likewise leapt, briefly touching $1.7 billion on April 28, before backtracking to the existing level of $1.5 billion.

Let’s take a look at the elements that have actually sustained BONK’s rate momentum over the recently.

Memecoins recuperate throughout the board

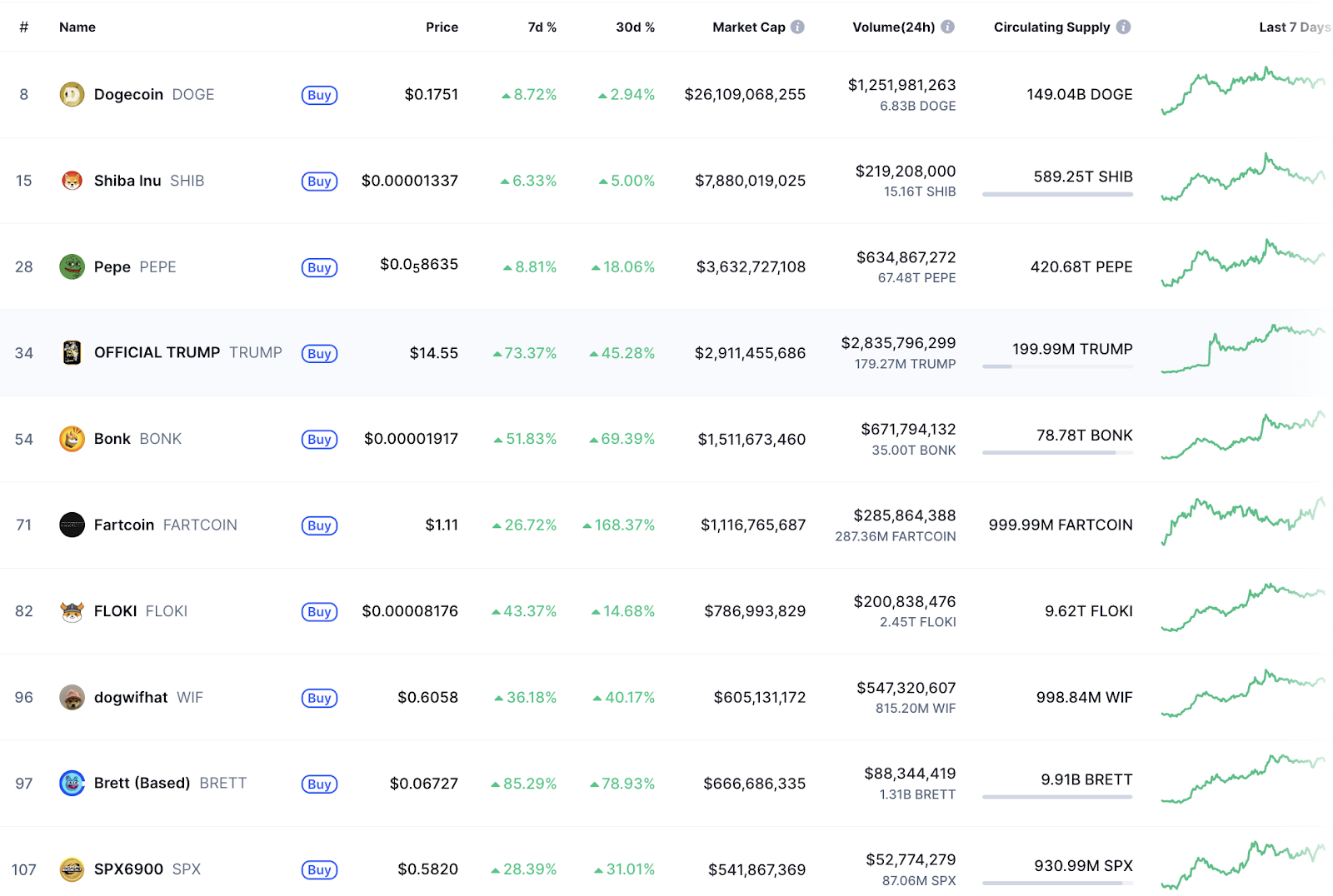

BONK’s rally over the last 7 days mirrors the bullish rate motions throughout the wider crypto market, consisting of the memecoin sector. The majority of memecoins have actually published double-digit gains over the recently. DOGE and Shiba Inu (SHIB), the leading memecoins, have actually leapt 3% and 5% over the last 7 days.

Authorities Trump (TRUMP), the memecoin connected with United States President Donald Trump, has actually taped 73% weekly gains, while Base’s Brett (BRETT) has actually rallied 83% over the very same duration.

This prevalent rally has actually pressed the overall memecoin market price to $55.51 billion, a 17.5% leap in the previous week, according to CoinMarketCap information.

Over $7.96 billion in memecoin trading volume was taped in the previous 7 days alone, representing an 85% weekly modification. The renewal is driven by financiers when again accepting risk-on possessions like memecoins.

Increasing open interest backs BONK’s rally

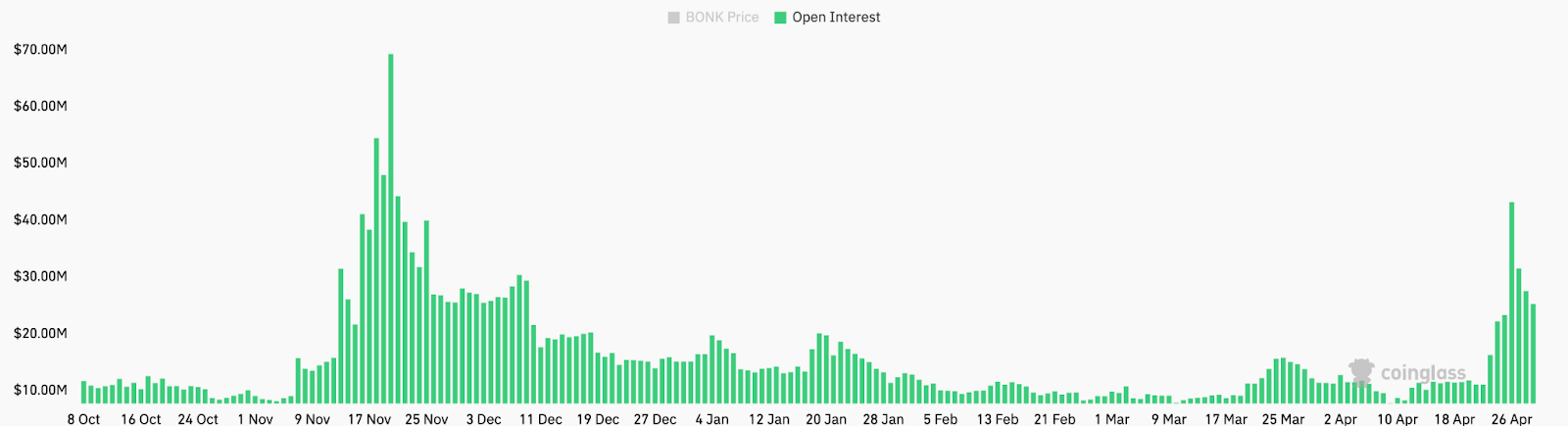

The rise in the rate of Bonk over the last 7 days follows a considerable dive in its open interest (OI).

BONK’s overall OI on all exchanges increased 290% from $11 million on April 22 to $43.2 million on April 26. Although this metric has actually considering that dropped to $28 million at the time of composing, it stays substantially greater than the OI seen considering that December 2024.

Increasing open interest shows growing trader involvement in BONK futures, showing increased speculative activity.

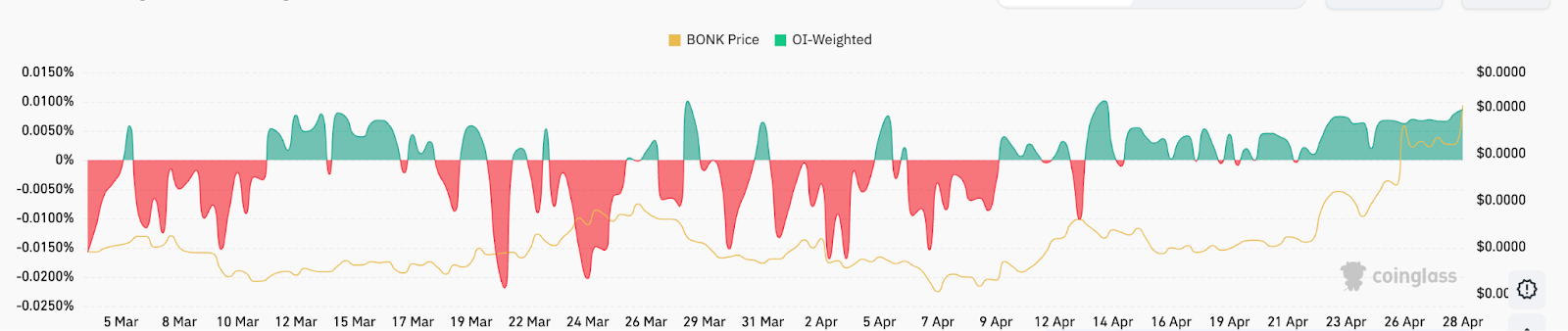

Information from CoinGlass reveals increasing need for leveraged long positions in BONK over the last couple of days, as suggested by the OI-weighted futures financing rate.

Increasing financing rates typically recommend that futures traders are bullish, anticipating future rate boosts, which might suggest an extension of the uptrend.

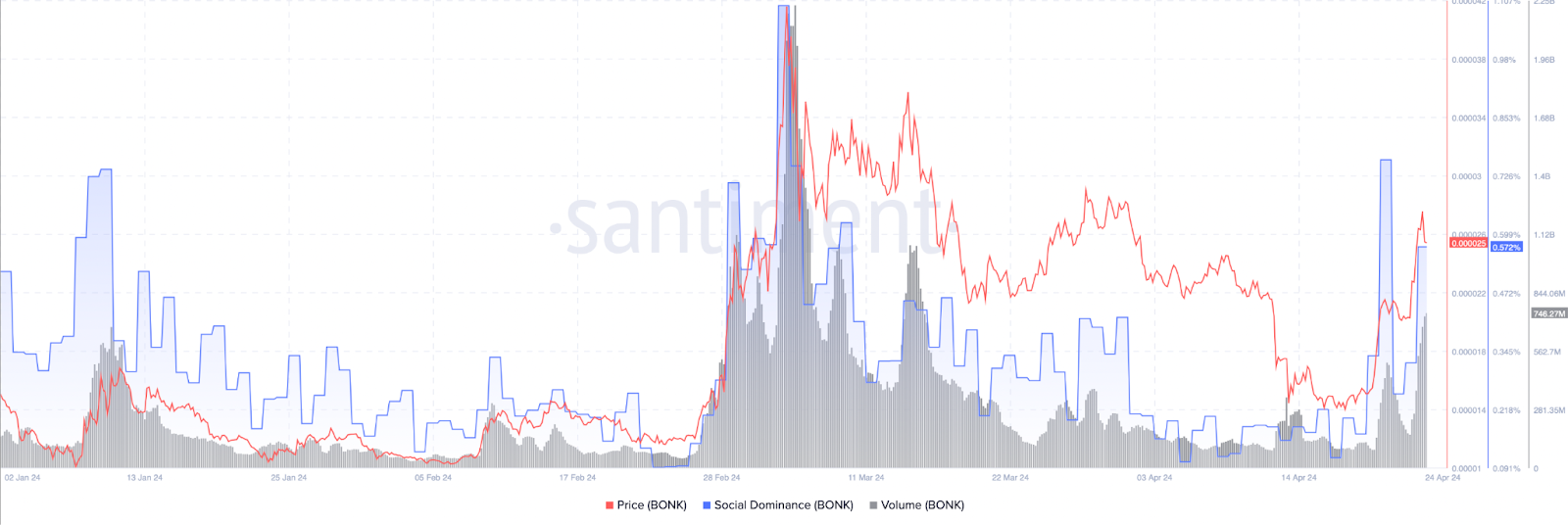

BONK’s social supremacy stays high, recommending high social activity. Santiment information reveals BONK’s social supremacy surging from 0.091% to 0.572% in between April 20 and April 26, driven by BONK’s community buzz.

This rise in chatter on social networks platforms shows increasing retail and institutional interest, magnifying FOMO and driving need.

BONK breaks out of a multimonth sag

On April 13, BONK rate broke out of a coming down parallel channel, firing up strength that saw it turn the 50-day and 100-day rapid moving averages (EMAs) to support.

The bulls will likely continue the rebound towards the considerable resistance level at $0.00002410 (200-day SMA) in the short-term. An everyday candlestick close above this level, accompanied by high volume, might see BONK increase towards the Jan. 19 variety high near $0.000040. This would represent a 104% boost from the existing rate.

The sharp increase in the relative strength index and its position at 71 in the overbought area strengthens the purchasers’ supremacy in the market.

Nevertheless, the overbought conditions might help with profit-taking, occasioning a minor correction before BONK continues its uptrend.

“$ BONK’s coming down trendline got cleared,” stated popular expert World of Charts in an April 28 post on X, “anticipating 2x in the coming days.”

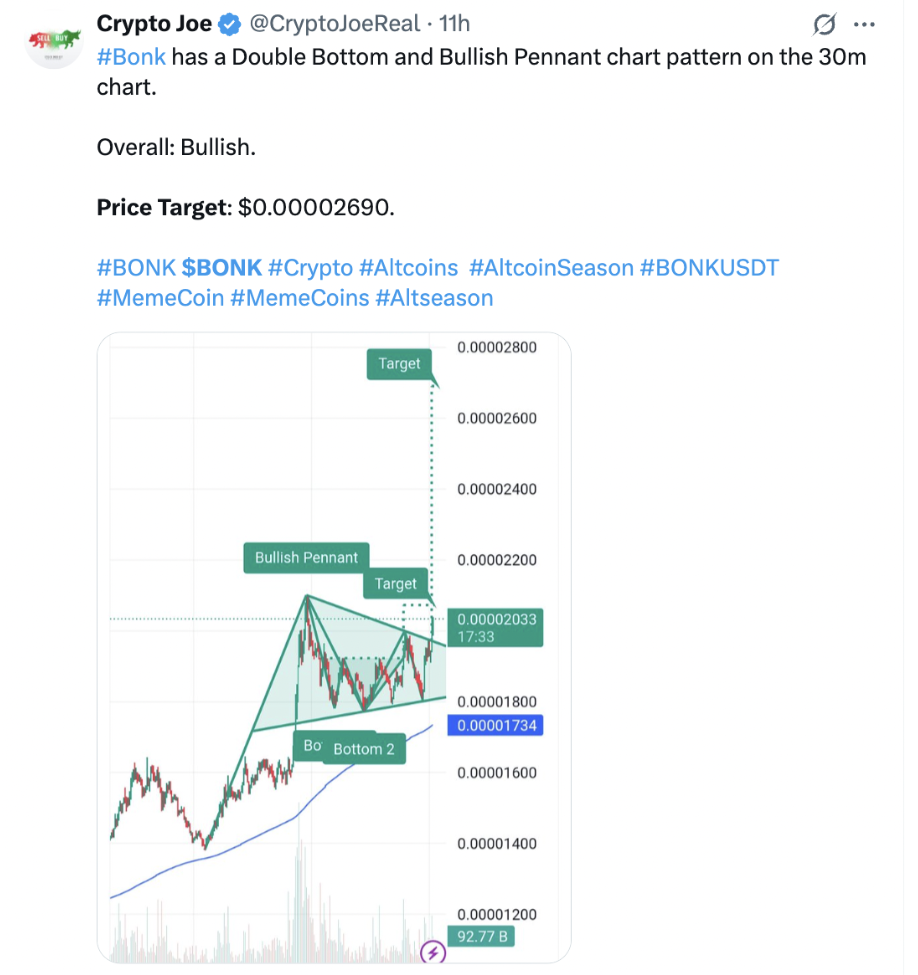

On The Other Hand, Crypto Joe found BONK breaking out of a bullish pennant in the 30-minute timeframe targeting $0.00002690.

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.