Bottom line:

-

Solana held the $140 assistance level for a week, a very first in more than 2 months, highlighting traders’ growing self-confidence.

-

SOL futures open interest struck $5.75 billion on April 30, revealing strong institutional interest.

-

With increasing DEX volumes and a $9.5 billion TVL, SOL might rally to $200 before a possible area ETF approval on Oct. 10.

Solana’s native token, SOL (SOL), fell 4% in between April 29 and April 30 after stopping working to sustain the $150 level. Regardless of this short-term decrease, traders appear more positive as the $140 assistance stayed undamaged for an entire week, a result that had not occurred in over 2 months.

As need for leveraged SOL positions reached near record highs on April 30, traders are now reassessing the possibilities of a SOL rally above $200.

SOL futures open interest reached 40.5 million SOL on April 30, marking a 5% boost from the previous month and nearing its all-time high. In dollar terms, this represents $5.75 billion in futures positions, ranking 3rd in the cryptocurrency market and over 50% greater than the need for XRP derivatives. This strong adoption of SOL derivatives indicate growing institutional interest.

Information reveals increased need for bearish leveraged SOL positions

Traders typically think that increased need for SOL futures signals increasing optimism. Nevertheless, given that longs (purchasers) and shorts (sellers) are constantly matched, an increase in open interest does not always show a bullish outlook. To much better comprehend take advantage of need in SOL futures, one can take a look at the financing rate for continuous agreements.

Presently, the financing rate on SOL continuous futures is unfavorable, which reveals more need for bearish positions. The last duration of moderate optimism ended on April 25 after an unsuccessful effort to break above $156. The absence of bullish leveraged positions might be partially due to the 43% cost gain SOL saw in the 3 weeks from April 8 to April 29.

A $200 target for SOL might appear enthusiastic, however the token was trading near $195 in mid-February, even after decentralized application volumes had actually come by 80% from their January peak. While Solana has actually dealt with criticism for its heavy dependence on memecoins, there is more to the network than simply speculation on brand-new tokens.

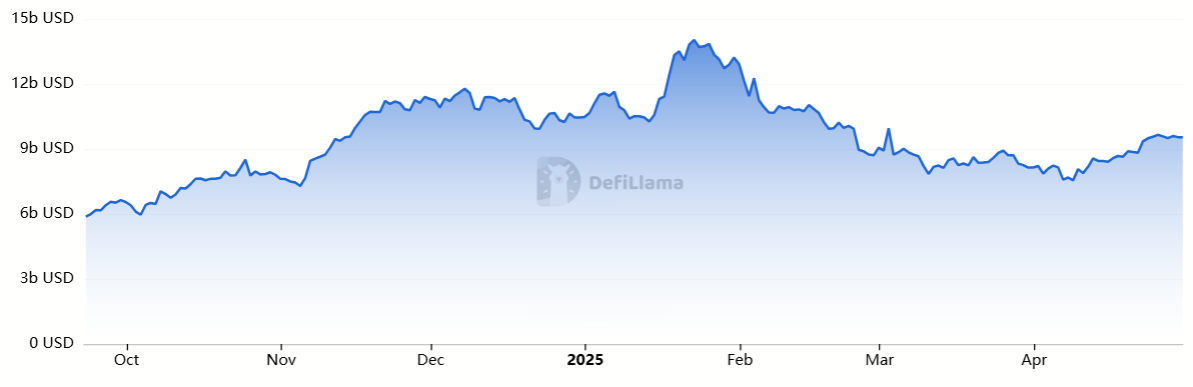

Solana ranks 2nd in overall worth locked (TVL), with $9.5 billion in deposits, consisting of liquid staking, collateralized loans, automated yield platforms, and artificial derivatives. A number of Solana decentralized applications are amongst the leading cost earners, with Meteora gathering $19.1 million in 7 days, followed by Pump-fun with $18.6 million and Juto with $14.6 million.

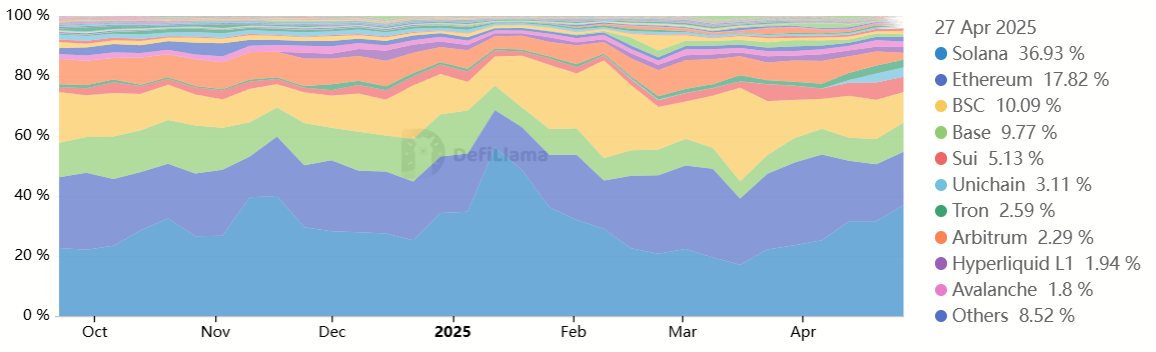

Solana network controls volumes on decentralized exchanges

Because April 14, Ethereum’s typical base layer deal cost has actually been $0.65 or less, yet Solana’s decentralized exchanges have actually seen almost 90% greater trading volumes. Even when consisting of the whole Ethereum layer-2 community, Solana led the previous week with $21.6 billion in decentralized exchange activity.

Favorable highlights from the Solana network consist of an 87% weekly boost in Raydium’s volumes and a 58% increase in Meteora activity. So, even if need for bullish leveraged positions remains flat, SOL’s cost might ultimately show the enhanced onchain metrics.

Related: More than 70 United States crypto ETFs wait for SEC choice this year

From a trading viewpoint, SOL might likewise take advantage of the possible approval of an area Solana ETF in the United States. Experts think the last due date for the United States Securities and Exchange Commission’s choice is Oct. 10, with a 90% possibility of approval. Still, SOL may rally above $200 before this occasion, as the network is well-positioned to draw in brand-new retail financiers.

This post is for basic details functions and is not meant to be and ought to not be taken as legal or financial investment guidance. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.