Secret takeaways:

-

Bitcoin broke above $105,700 after the United States and China accepted slash tariffs.

-

A verified bull flag breakout on the weekly chart jobs a $150,000.

-

Bitwise’s belief index alerts of possible short-term getting too hot.

Bitcoin (BTC) bulls cheered a significant advancement in the continuous US-China tariff talks, with the cryptocurrency climbing up over the $105,700 mark on Might 12 for the very first time in 4 months, even more validating a bullish extension setup with a $150,000 cost target.

US-China trade truce fuels Bitcoin boom

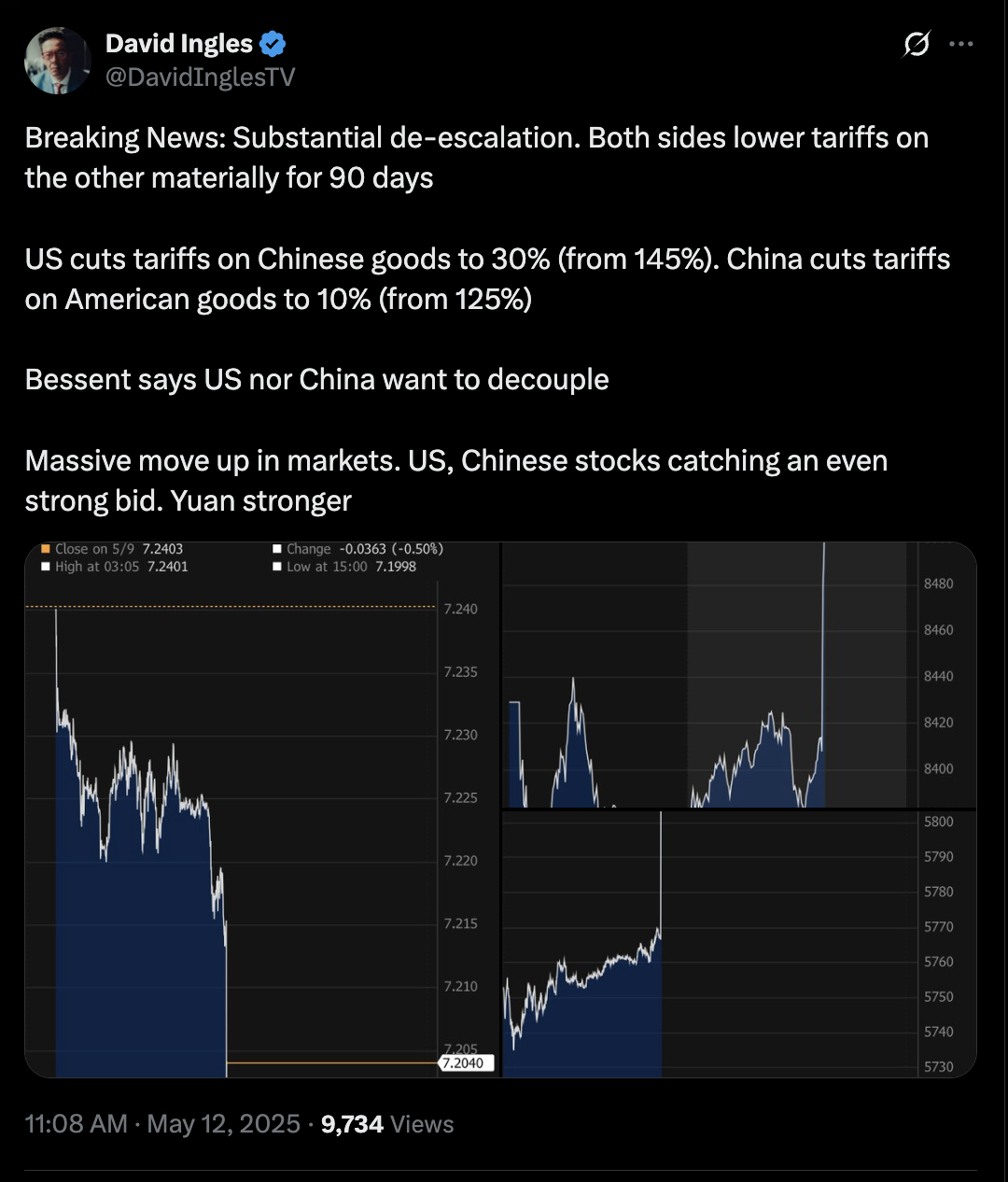

The driver behind Bitcoin’s breakout seems de-escalating trade stress in between the United States and China.

Over the weekend, United States Treasury Secretary Scott Bessent and Chinese Vice President He Lifeng struck a handle Geneva to decrease tariffs that had actually maimed bilateral trade for months.

Under the offer, the United States will reduce tariffs on Chinese products from 145% to 30%, while China will decrease its tasks on United States imports from 125% to 10%.

Related: US-China trade offer might clarify Bitcoin’s usage case: Trader

The arrangement set off a broad-based market rally, with S&P 500 futures increasing 2.8% and the United States dollar getting 0.7%. On the other hand, gold dropped 2.3%, signifying a shift far from safe-haven properties.

Bitcoin, typically viewed as a high-beta threat property, had actually suffered under the weight of the trade war, with increased financier care reducing crypto inflows. The truce now signifies enhanced liquidity and threat hunger, conditions traditionally beneficial for BTC rallies.

Bull flag breakout indicate $150K target

The present Bitcoin rally follows the book breakout of a bull flag pattern on the weekly chart, a bullish extension setup formed when the cost combines downward in a parallel channel after a sharp upward relocation.

In Bitcoin’s case, the flag started forming after BTC peaked at almost $110,000 in January. The combination continued for months till early Might when the cost broke above the flag’s upper trendline with a small volume boost.

This breakout validates bullish extension, with the pattern’s forecasted upside target now sitting near $150,000, determined after including the height of the preliminary flagpole to the breakout point.

Momentum indications, consisting of the relative strength index (RSI), are likewise helpful, with weekly RSI rebounding above 65, showing restored purchasing pressure without getting in overbought area above 70.

BTC might go back to $100,000 very first

Some experts are advising care as Bitcoin’s belief is ending up being blissful.

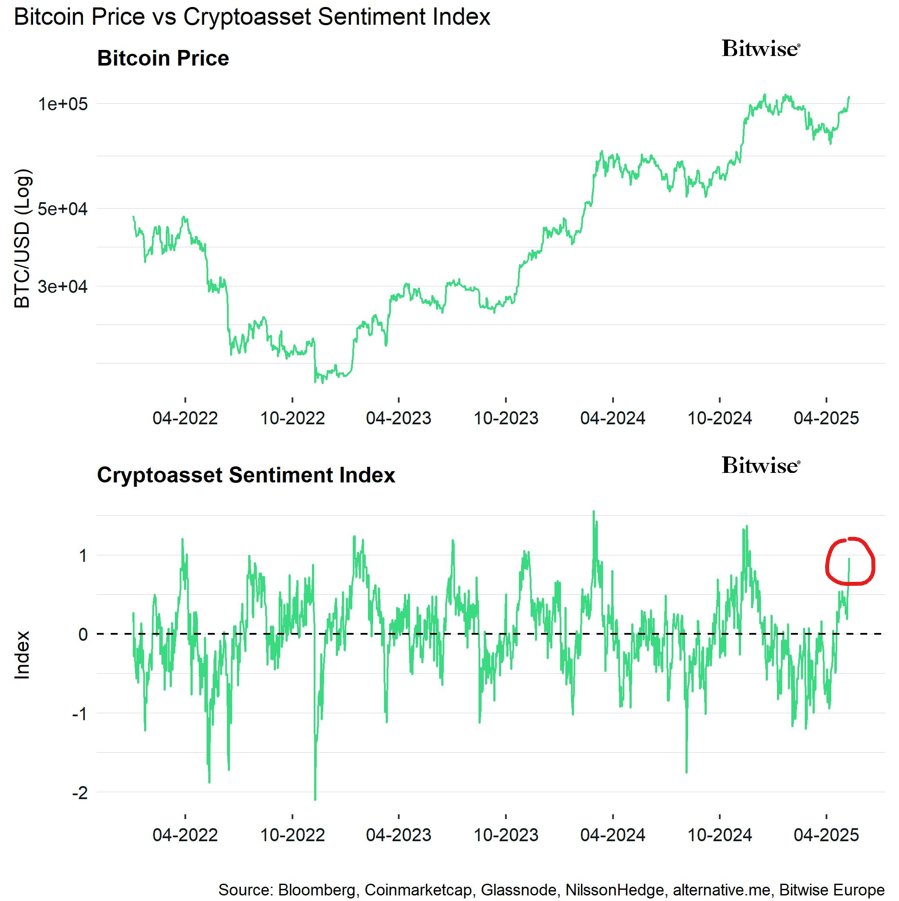

André Dragosch, European Head of Research Study at Bitwise, keeps in mind that the company’s Cryptoasset Belief Index has actually reached its greatest level considering that November 2024, a level that formerly lined up with regional market tops.

The chart reveals that previous peaks in belief, such as those in April 2022, October 2023, and November 2024, were followed by short-term corrections or sideways cost action.

This recommends growing optimism might be extended, raising the threat of a near-term pullback in spite of Bitcoin’s strong long-lasting outlook.

Bitcoin’s cost was backtracking following its climb above $107,000 since Might 12, with its day-to-day RSI disconcerting about overbought conditions.

The next assistance target relaxes $100,000, lining up with its 0.786 Fibonacci retracement line.

A definitive drop listed below the level might have BTC check its rapid moving average (EMA) supports listed below, with the 20-day EMA (the purple wave) at around 97,385 as the preliminary drawback target.

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.