Bottom line:

-

Bitcoin looks for combination after quick gains as stocks and the United States dollar rise on US-China trade offer news.

-

Close-by order book liquidity kinds prospective targets for traders, which now consist of $102,000.

-

A traditional moving typical retest recommends that a brand-new all-time high must result.

Bitcoin (BTC) stayed with $104,000 at the Might 12 Wall Street open as markets moved on US-China trade offer news.

Bitcoin surfs US-China trade offer responses

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD combining after striking its greatest levels given that late January.

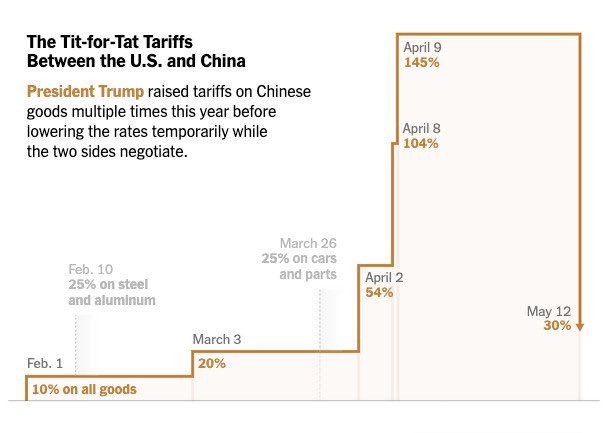

The United States and China accepted slash mutual trade tariffs on the day, triggering the S&P 500 and Nasdaq Composite Index to get around 3%.

United States dollar strength likewise benefited as an outcome, with the United States dollar index (DXY) striking one-month highs.

” The last time United States tariffs on China were this high, the S&P 500 was ~ 200 points lower, 4 Fed rate cuts were anticipated in 2025, and Wall Street was requiring an economic downturn,” trading resource The Kobeissi Letter composed in part of continuous analysis on X.

” Belief is whatever.”

Bitcoin therefore embraced the happy medium in between significant properties on the day as gold dropped precipitously to $3,208 per ounce, nearing month-to-date lows.

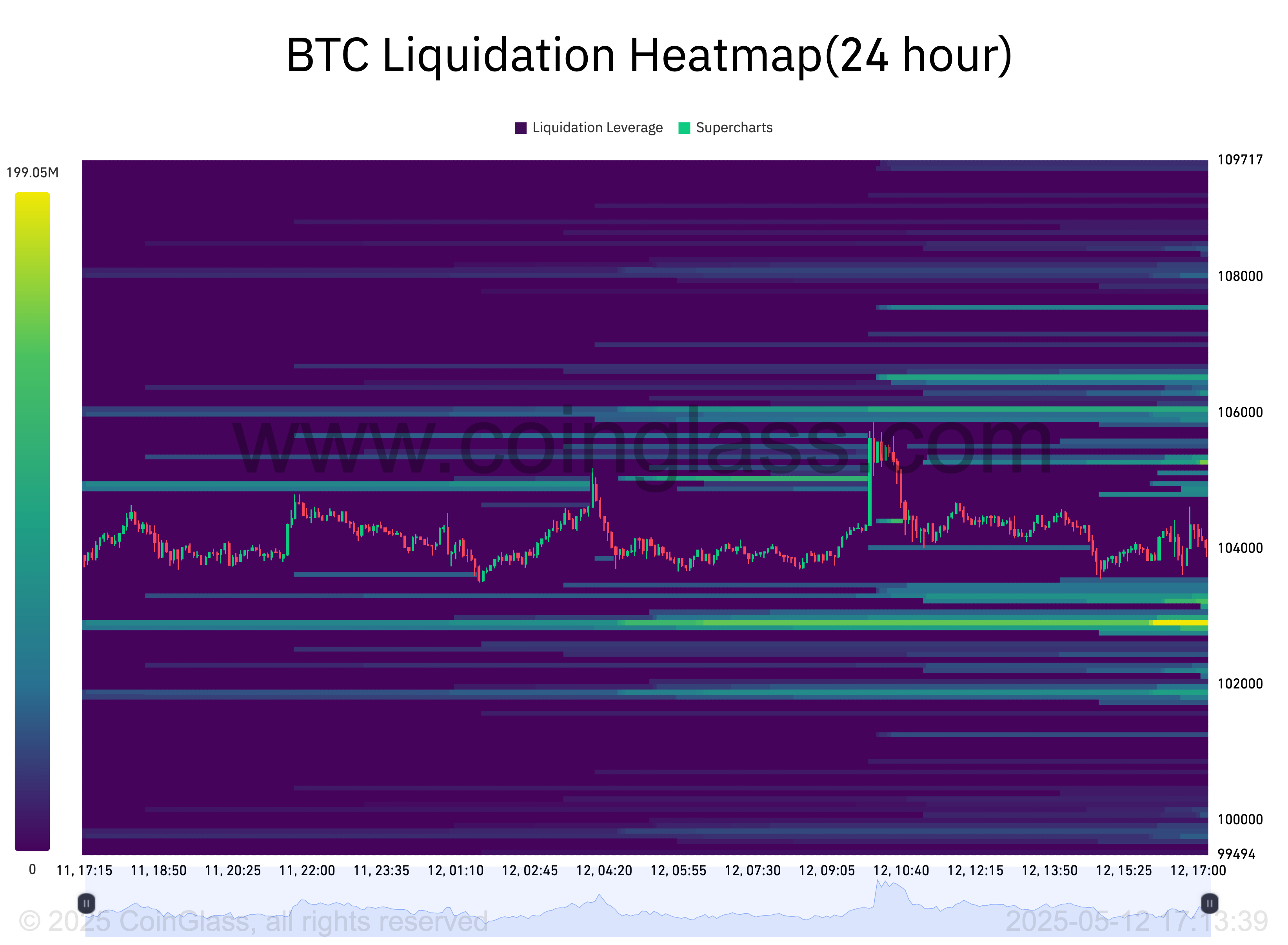

” BTC Swept most neighboring liquidity above after slicing around the $103K-$ 105K location for a couple of days,” popular trader Daan Crypto Trades informed X fans together with a chart of exchange order book liquidity from keeping track of resource CoinGlass.

” Listed below watch on the ~$ 102K area as that’s a quite thick location in regards to liquidation clusters. Might be a great level for some action. Depending upon the response there you can reassess.”

CoinGlass information revealed increasing quotes around the $103,000 mark after the Wall Street open.

New BTC cost record “in the making”

Continuing, fellow trader CrypNuevo was amongst those doubling down on a longer-term bull thesis for BTC cost action.

Related: Is Bitcoin ready to go parabolic? BTC cost targets consist of $160K next

BTC/USD, he kept in mind, had actually carried out an effective retest of the 50-week rapid moving average (EMA).

Presently at $80,300, the 50-week EMA has actually operated as a springboard for brand-new all-time highs recently.

” We got the 1W50EMA retest and, as a result, the next upper hand,” CrypNuevo discussed in an X thread on Might 11.

” Every previous time that we saw this structure, we made a brand-new high so the pattern indicates a brand-new ATH in the making.”

Previously, Cointelegraph reported on a timeless booming market breakout signal on weekly timeframes in the kind of a cross on the moving typical convergence/divergence (MACD) sign.

This short article does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.