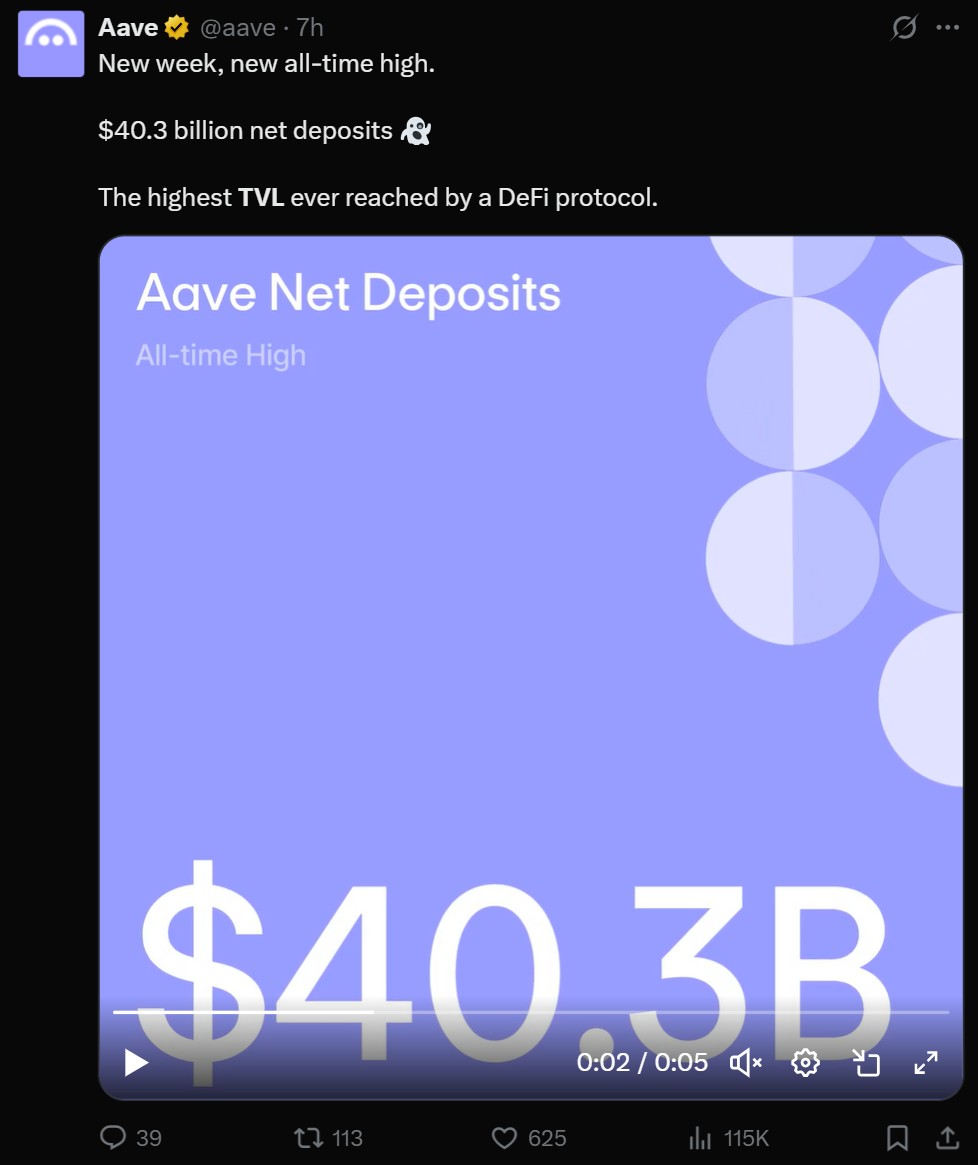

Aave, a decentralized financing (DeFi) procedure, has actually reached a brand-new record of funds onchain, according to information from DefiLlama.

In an X post, Aave stated it topped $40.3 billion in overall worth locked (TVL) on May 12. Onchain information exposes that Aave v3, the current variation of the procedure, has roughly $40 billion in TVL.

Aave is a DeFi loaning procedure that lets users obtain cryptocurrency by transferring other kinds of cryptocurrency as security. On the other hand, lending institutions make yield from customers.

” With these turning points, Aave is showing its supremacy in the Financing Area,” DeFi expert Jonaso stated in a Might 12 X post. TVL represents the overall worth of cryptocurrency transferred into a procedure’s clever agreements.

Related: AAVE skyrockets 13% as buyback proposition passes amongst tokenholders

Breaking all-time highs

In December, Aave attained an all-time high TVL mainly since the cost of Ether (ETH) increased approximately 60% from the previous month. Ether and its staking derivatives comprise almost half of Aave’s TVL, according to information from DefiLlama.

This time around, Aave’s all-time high TVL is likewise driven by inflows of deposits by users.

In Ether-denominated terms, Aave’s TVL increased from around 6 million ETH at the start of 2025 to almost 10 million ETH on Might 12. Determining TVL in ETH represent the effect of varying cryptocurrency costs.

Before United States President Donald Trump dominated in the November election, Ether traded at less than $2,500. It peaked at nearly $4,000 the following month, according to information from Google Financing.

In the previous month, Ether has likewise clocked significant gains, increasing from around $1,500 per Ether one month ago to approximately $2,500 since Might 12, according to information from Google Financing.

The cost of Aave’s native AAVE (AAVE) token has actually increased roughly 25% in the previous 7 days, showing a resilient crypto market and continuous TVL inflows, according to information from CoinMarketCap.

Publication: Adam Back states Bitcoin cost cycle ’10x larger’ however will still decisively break above $100K