News broke on Might 15 that Coinbase was the target of a $20 million extortion effort after cybercriminals hired overseas support representatives to leakage user information for social engineering frauds.

While less than 1% of Coinbase’s active month-to-month users were apparently impacted, the anticipated removal and repayment expenditures vary from $180 million to $400 million, as the exchange vowed to pay back all phishing attack victims.

In spite of the attack on the world’s third-largest cryptocurrency exchange, financier belief stays positive, with the Worry & & Greed Index staying strongly in the “Greed” zone above 69, according to CoinMarketCap information.

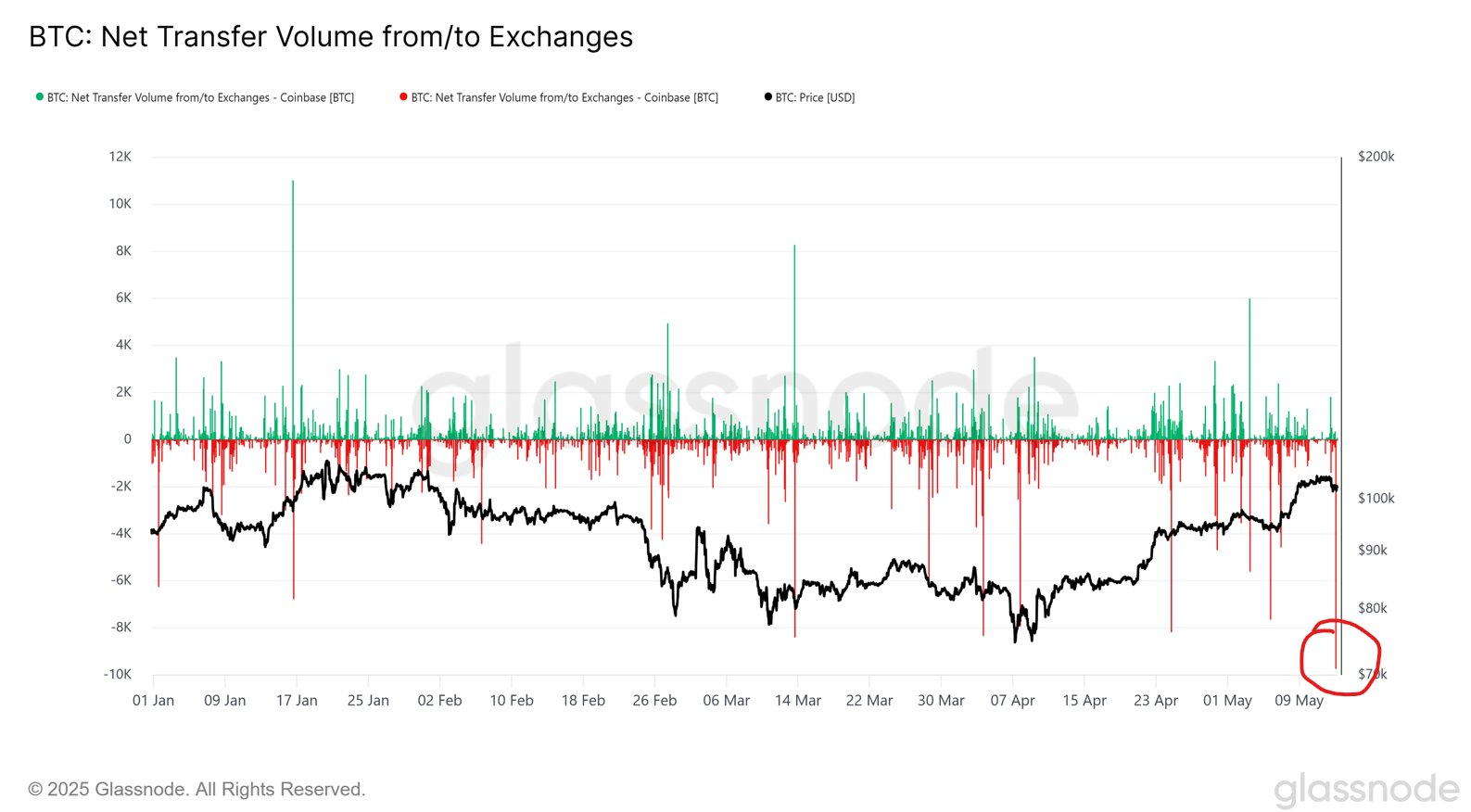

Contributing to financier optimism, Coinbase saw over $1 billion worth of Bitcoin withdrawn on Might 9, marking the greatest net outflow taped in 2025 up until now, activating expert forecasts of a supply-shock driven Bitcoin rally.

Coinbase deals with $400 million expense after expert phishing attack

Coinbase was struck by a $20 million extortion effort after cybercriminals hired overseas support representatives to leakage user information, the business stated on Might 15.

Coinbase stated a group of external stars paid off and collaborated with numerous client assistance professionals to gain access to internal systems and take restricted user account information.

” These experts abused their access to client support group to take the account information for a little subset of consumers,” Coinbase stated, including that no passwords, personal secrets, funds or Coinbase Prime accounts were impacted.

Less than 1% of Coinbase’s month-to-month negotiating users’ information was impacted by the attack, the business stated.

After taking the information, the assaulters tried to obtain $20 million worth of Bitcoin (BTC) from Coinbase in exchange for not divulging the breach. Coinbase declined the need.

Rather, the business used a $20 million benefit for details resulting in the arrest and conviction of those accountable for the plan.

Continue reading

$ 1 billion Bitcoin exits Coinbase in a day as experts alert of supply shock

Institutional need for Bitcoin is growing, as Coinbase, the world’s third-largest cryptocurrency exchange, taped its greatest day-to-day outflows of Bitcoin in 2025 on Might 9.

On Might 9, Coinbase saw 9,739 Bitcoin, worth more than $1 billion, withdrawn from the exchange, the greatest net outflow taped in 2025, according to Bitwise head of European research study André Dragosch.

” Institutional hunger for Bitcoin is speeding up,” Dragosch included a Might 13 X post.

The outflow took place as Bitcoin traded above $103,600 and simply days after the White Home revealed a 90-day decrease in mutual tariffs in between the United States and China, relieving market issues and raising more comprehensive financier belief.

The 90-day suspension of extra tariffs got rid of the danger of “abrupt re-escalation,” which might assist Bitcoin, altcoins and the broader stock exchange rally due to enhanced danger hunger, Nansen’s primary research study expert, Aurelie Barthere, informed Cointelegraph.

Continue reading

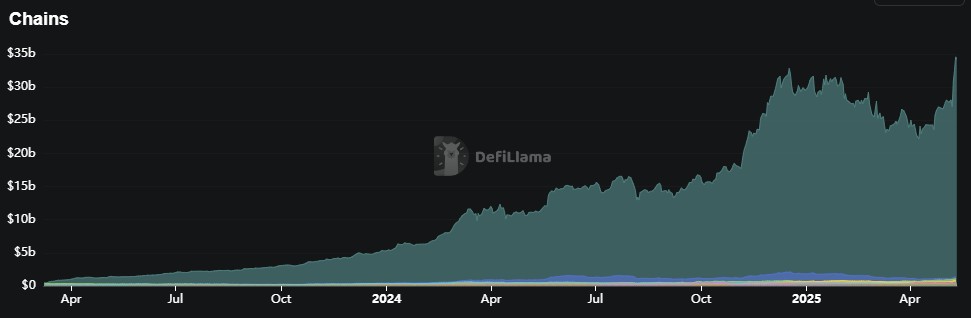

DeFi loan provider Aave reaches $40 billion in worth locked onchain

Aave, a decentralized financing (DeFi) procedure, has actually reached a brand-new record of funds onchain, according to information from DefiLlama.

In an X post, Aave stated it topped $40.3 billion in overall worth locked (TVL) on Might 12. Onchain information exposes that Aave v3, the current variation of the procedure, has about $40 billion in TVL.

Aave is a DeFi loaning procedure that lets users obtain cryptocurrency by transferring other kinds of cryptocurrency as security. On the other hand, lending institutions make yield from customers.

” With these turning points, Aave is showing its supremacy in the Loaning Area,” DeFi expert Jonaso stated in a Might 12 X post. TVL represents the overall worth of cryptocurrency transferred into a procedure’s clever agreements.

Continue reading

SEC hold-ups Solana ETF as choices for Polkadot, XRP loom

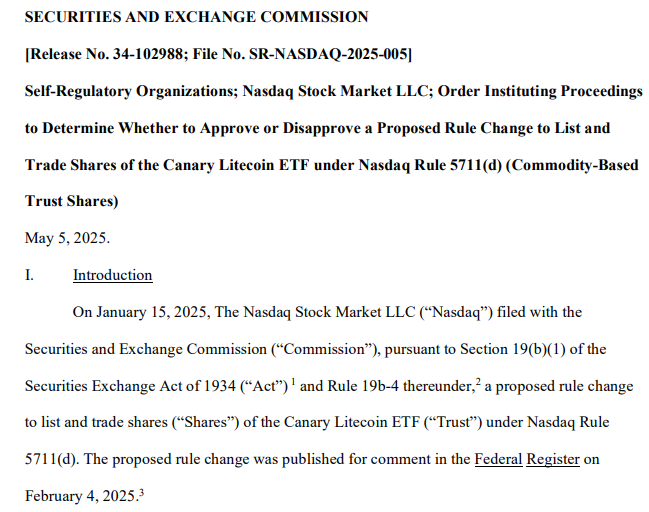

The United States Securities and Exchange Commission (SEC) pressed back its choice on a proposed area Solana exchange-traded fund (ETF), with the cryptocurrency market now aiming to the due dates for the Polkadot and XRP-based ETFs in June.

The SEC postponed its choice on noting Grayscale’s area Solana (SOL) Trust ETF on the New York Stock Exchange (NYSE) to October 2025, according to a Might 13 filing by the securities regulator.

The choice came the week after the SEC postponed its judgment on Canary Capital’s Litecoin (LTC) ETF, Bloomberg Intelligence expert James Seyffart composed in a Might 5 X post.

Area ETFs are essential chauffeurs of liquidity and institutional adoption for digital properties. For Bitcoin, the United States area Bitcoin ETFs represented an approximated 75% of brand-new financial investment after introducing, which assisted BTC regain the $50,000 mark in February 2024, a month after the ETFs debuted for trading.

While a Solana ETF might produce just a portion of the inflows of Bitcoin ETFs, it might increase Solana’s institutional adoption in the long term by providing financiers a “regulated financial investment automobile” that might still draw in billions of dollars in capital, Ryan Lee, primary expert at Bitget Research study, informed Cointelegraph.

Continue reading

Starknet strikes “Phase 1” decentralization, tops ZK-rollups for worth locked

Ethereum layer-2 scaling platform Starknet has actually reached a decentralization turning point set out by Ethereum co-founder Vitalik Buterin and is now the biggest zero-knowledge rollup-based network by overall worth locked.

Starknet stated in a press release shown Cointelegraph that it has actually struck “Phase 1” decentralization, according to a structure Buterin set out in 2022, which indicates the network runs with restricted oversight or “training wheels.”

Starknet included that the structure was the “gold requirement onchain tool for evaluating Ethereum scaling services,” and stated it attained the turning point through modifications such as developing a security council and censorship-avoidance systems.

While the system still enables intervention from a security council, it has actually executed a completely practical credibility evidence system governed by clever agreements.

Starknet is now the only layer-2 ZK-rollup network to have actually reached Phase 1 and has actually grown to be the biggest ZK-rollup blockchain with an overall worth locked of $629 million, simply ahead of ZKsync’s $610 million, according to L2beat.

Starknet is the fifth-largest layer-2 network by worth locked, with the leading 4 all Positive rollup-based, having actually reached Phase 1 decentralization utilizing scams evidence.

Continue reading

DeFi market summary

According to information from Cointelegraph Markets Pro and TradingView, the majority of the 100 biggest cryptocurrencies by market capitalization ended the week in the green.

Solana-based memecoin Dogwifhat (WIF) increased over 43% as the week’s most significant gainer, followed by decentralized exchange Raydium’s (RAY) token, up almost 19% over the previous week.

Thanks for reading our summary of this week’s most impactful DeFi advancements. Join us next Friday for more stories, insights and education concerning this dynamically advancing area.