Secret takeaways:

The altcoin market cap, omitting Ether (ETH), has actually included $126 billion in Q2, triggering interest from experts who have actually been awaiting an altseason. Crypto expert Javon Marks kept in mind a breakout that might measure up to the explosive 2017 bull run.

In a current post on X, Marks highlighted a chart comparing the TOTAL3 index (overall market cap of altcoins omitting Bitcoin (BTC) and Ethereum) versus the United States cash supply, recommending that altcoins might be on the brink of a considerable rally.

An increase in TOTAL3 versus the United States cash supply recommends that altcoins are acquiring worth relative to the overall liquidity in the United States economy, showing increased financier interest and capital inflow into altcoins.

Marks highlighted that altcoins have actually just recently bounced off a vital retest level following a breakout, and stated,

” Altcoins have actually bounced off of the breakout retest versus the United States cash supply and can provide among their most effective runs given that 2017!”

Also, confidential crypto trader Moustache shared an analysis on X, highlighting a weekly inverted head-and-shoulders pattern in the TOTAL3 chart. Comparing 2021 and 2025, the chart mirrors the 2021 altcoin season when leading altcoins rose 174% versus Bitcoin’s 20% throughout the last leg. The pattern, a bullish turnaround sign, recommends a rally, with the expert forecasting “much greater levels” for altcoins.

” Altseason” triggers combined belief amongst experts

While some experts are on the altcoin rally bandwagon, others are approaching with care. Technical expert Crypto Scient discussed that the current increase in altcoin market cap is yet to show a greater timespan (HTF) bullish pattern shift. The expert kept in mind that the TOTAL2 pattern stayed bearish after striking resistance at the $1.25 trillion level, and stated,

” Considering That both BTC and overall are near the resistance zone and TOTAL2 still has some space, I am inclined to think that we are dispersing.”

Likewise, Crypto analyst DonaXBT argued that a considerable breakdown in Bitcoin’s supremacy trendline is important for altcoins to experience a significant relocation. The accompanying chart exposes that Bitcoin supremacy is above 60%, with the weekly uptrend still undamaged.

According to the expert, a decrease listed below the 60% level, followed by a retest of the assistance zone in between 56% and 58%, might act as the preliminary driver for a full-fledged altcoin season to emerge.

Related: Warren Buffett exits crypto-friendly Nubank holdings, netting $250M earnings

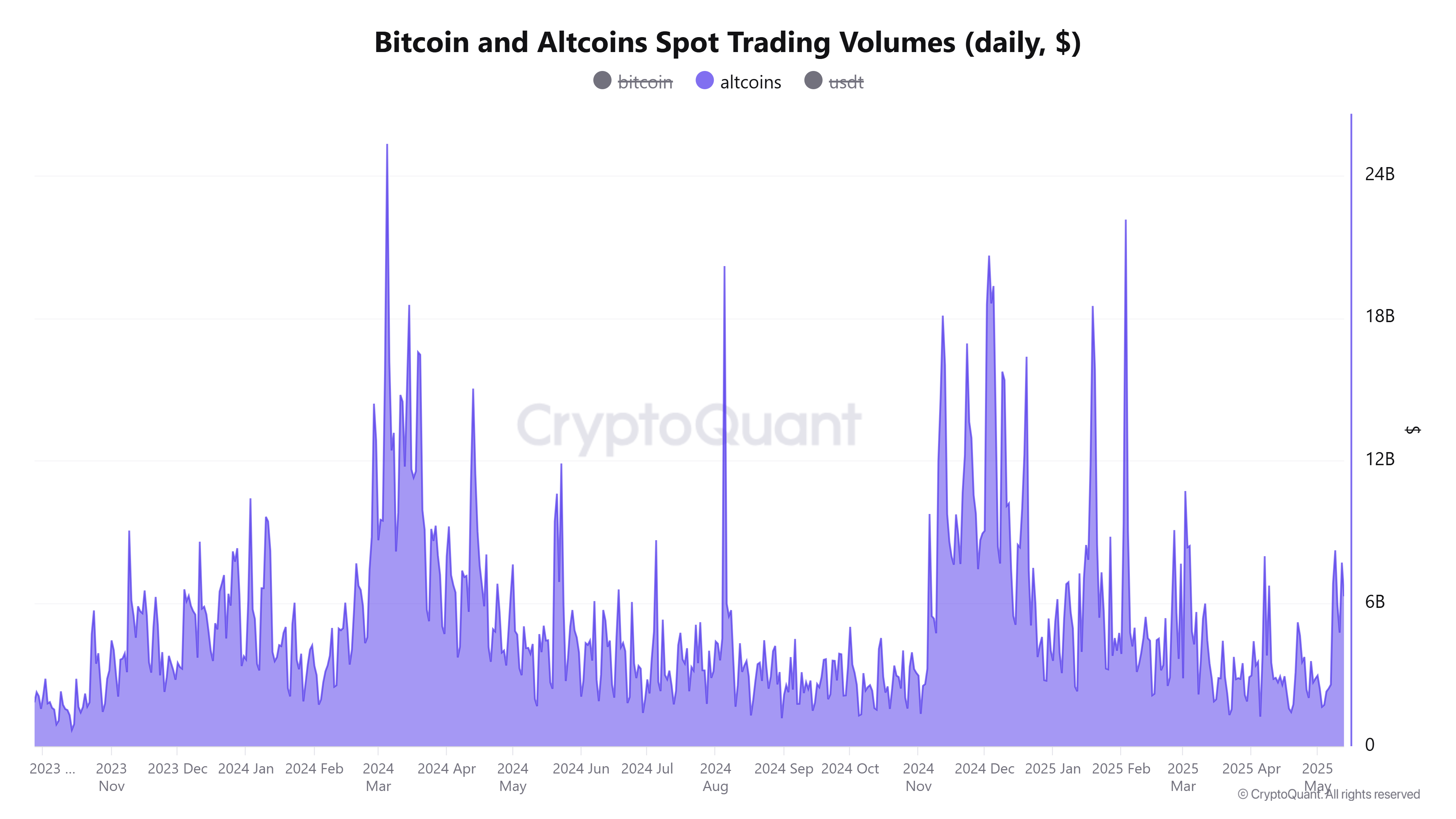

Altcoin area trading volume is still under $10 billion

Information from CryptoQuant suggests that altcoin area trading volumes stay suppressed, balancing $3-$ 5 billion/per day compared to $8-$ 12 billion/per day in Q4 2024, suggesting that altcoins remain in the early phases of a rally. In spite of these lower volumes, market observers see this as a precursor to substantial development, recommending that altcoins have yet to reach their peak momentum.

The Altcoin Season Index, presently at 24, even more supports this outlook by verifying that the marketplace remains in Bitcoin season, as kept in mind by Blockchaincenter.net. Historically, an index listed below 25 suggests Bitcoin supremacy, however this can be a favorable setup for altcoins. When the index climbs up above 30-40, altcoins frequently experience substantial pumps, driven by capital rotation from Bitcoin.

With trading volumes revealing early indications of healing and the Altcoin Season Index indicating a shift, financiers’ optimism for an altcoin rally is growing.

Related: Area Bitcoin ETF inflows fall, however BTC whale activity indicate booming market velocity

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.