Secret takeaways:

Bitcoin (BTC) climbed up towards $105,000 on June 6 after plunging to its least expensive level in 4 weeks the previous day.

Traders questioned whether the sharp decrease had actually been collaborated, particularly following reports that United States President Trump and Chinese President Xi Jinping had actually resumed conversations over import tariffs.

The factors behind Bitcoin’s abrupt drop on June 5 may never ever be completely clarified. Still, a number of contributing aspects emerged, consisting of worries of a possible financial recession, continued unpredictability surrounding the United States Strategic Bitcoin Reserves, and speculation that custodians may be taking part in re-hypothecation practices.

If these issues stand, a fast go back to the $110,000 level appears not likely.

Hyperliquid whale and Elon Musk’s influence on Bitcoin

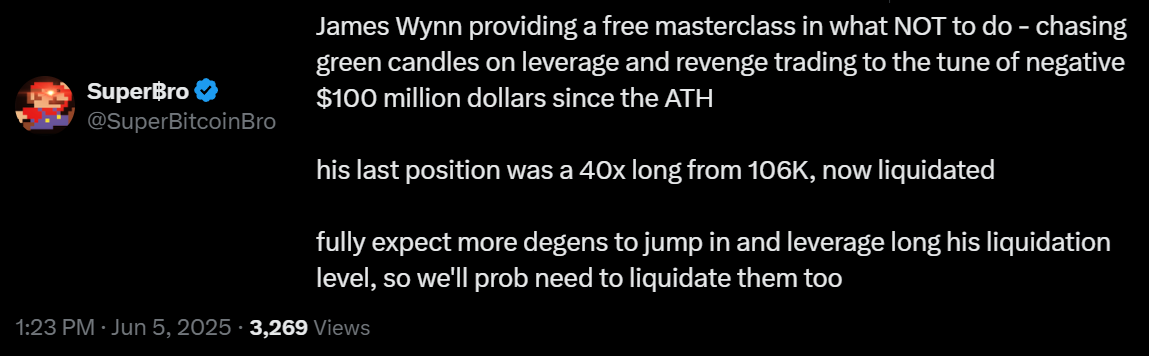

According to some experts, consisting of X user SuperBitcoinBro, the drop to $100,430 on June 5 was generally activated by extreme bullish utilize from “degenerate” traders. These leveraged bets followed the liquidation of a big position held by the so-called Hyperliquid whale near $104,000.

This trader, understood by the pseudonym “James Wynn,” supposedly sustained losses going beyond $100 million within a week.

SuperBitcoinBro kept in mind that traders anticipating an instant rebound in Bitcoin’s rate were blindsided, as skilled market individuals had actually currently prepared for the taking place purchasing pressure. This maneuver, frequently described as a “bull trap,” flourishes on overconfidence from purchasers, particularly after an unanticipated rate dip.

While the general public fight in between Elon Musk and United States President Donald Trump has actually drawn significant attention, connecting the disagreement straight to Bitcoin’s decrease is tough. The S&P 500 shut down simply 0.55% on June 5, a modest relocation that does not recommend prevalent market distress.

Financial economic downturn dangers and speculation on Bitcoin custody

Bitcoin traders stay worried that a looming worldwide financial downturn might lead financiers to end up being more risk-averse. Information from the United States Department of Labor revealed that weekly joblessness claims increased to their greatest level in 8 months throughout the last complete week of Might.

In Addition, United States Federal Reserve Guv Adriana Kugler mentioned that tariffs posture “drawback dangers to work and output development.”

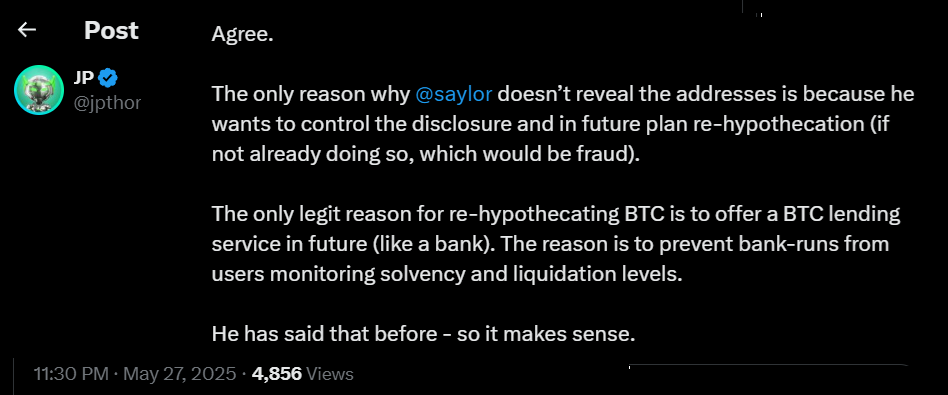

Financier belief was additional shaken by dissatisfaction with Michael Saylor and his company Technique after they decreased to reveal their onchain Bitcoin addresses.

This absence of openness triggered restored speculation that some custodians may be taking part in re-hypothecation, utilizing the very same Bitcoin security several times to protect various monetary dedications.

We simply upgraded our #Bitcoin– backed loan contract to make it clear:

Your #Bitcoin is never ever rehypothecated on@Strike

Never Ever has actually been, never ever will be. pic.twitter.com/dZqsIuBZao

— Jack Mallers (@jackmallers) June 4, 2025

There is no proof of misdeed amongst significant custodians such as Coinbase Custody or Fidelity Digital Assets, both of which undergo routine audits. Most likely, financiers are looking for factors behind Bitcoin’s rate weak point in spite of ongoing inflows from institutional purchasers like Technique, GameStop, Metaplanet, Semler Scientific, and Méliuz.

Related: The secret map whales utilize to liquidate you (Find out how to read it)

Financier disappointment has actually grown as 3 months have actually passed given that the statement of the United States Strategic Bitcoin Reserves, without any significant advancements given that.

Likewise, although there have actually been incremental regulative modifications enabling banks to use digital possession custody, area exchange-traded fund (ETF) items still do not have essential functions such as in-kind redemptions and staking systems.

Basically, the very same issues that activated Bitcoin’s drop to a low of $100,430 on June 5 stay unsettled. Traders continue to stress over a possible financial recession, the possibility of custodians taking part in re-hypothecation of Bitcoin, and the continuous absence of clearness concerning the function and application of the United States Strategic Bitcoin Reserves.

This post is for basic info functions and is not planned to be and ought to not be taken as legal or financial investment suggestions. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.