Secret takeaways:

-

Bitcoin rebounds from a 5.5% drop after the most recent escalation in the Israel-Iran dispute, duplicating a pattern seen in October 2024.

-

Experts highlight a bullish fractal including liquidity grabs, recommending BTC might quickly break towards brand-new highs.

-

Macro tailwinds and whale build-up support a prospective rally to $150,000 or more in 2025.

Bitcoin (BTC) is flashing indications of bullish rejection, brushing off current selling pressure triggered by the restored dispute in between Israel and Iran. This setup is noticeably comparable to one that preceded an 80% rally in late 2024.

Bitcoin bulls protect 2024-era trendline

On Friday, BTC rebounded from a low near $102,800 after moving 5.5% in reaction to Israel’s airstrikes on Iranian targets. The cryptocurrency recuperated a part of its losses later, reaching over $105,500.

The bounce lines up with an effective retest of Bitcoin’s 50-day easy moving average (50-day SMA; the red wave), a technical level that has actually traditionally served as reputable assistance.

This rate structure carefully mirrors Bitcoin’s efficiency in October 2024, when it fell 8.8% after Iran introduced a rocket barrage on Israel.

That decrease likewise discovered assistance at the 50-day SMA, with BTC bottoming simply around $60,500. What followed was a sharp turnaround: Bitcoin rose over 80% by December, topping around $108,365.

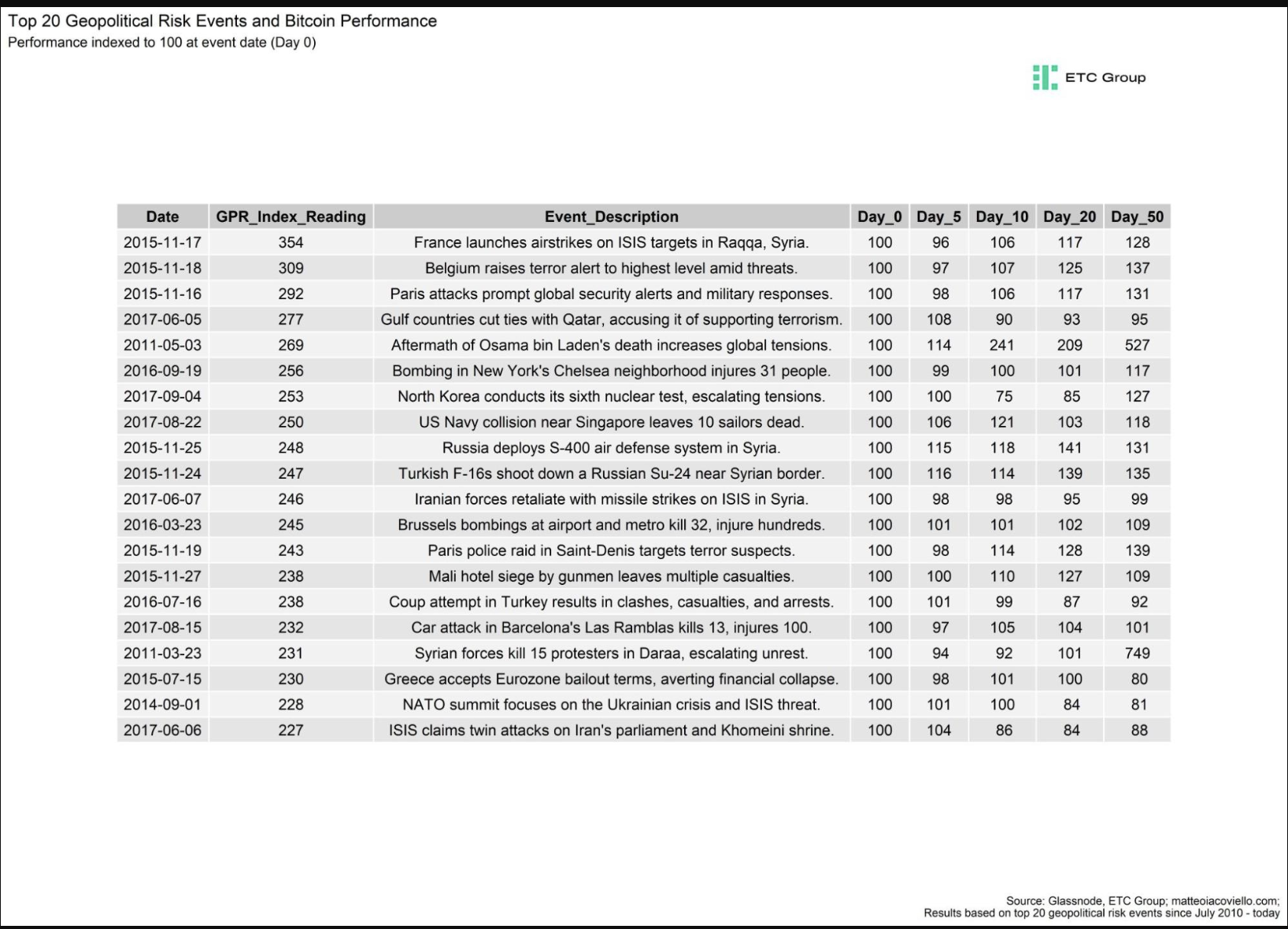

A research study by Andre Dragosch, head of research study at Bitwise’s ETP arm and so on Group, reveals that while Bitcoin typically sees a short-term rate decrease throughout durations of geopolitical stress or dispute, it regularly rebounds.

Usually, BTC recuperates within 50 days and, most of the times, exceeds its pre-event rate levels, highlighting the possession’s strength in the face of worldwide unpredictability.

The existing pullback might show to be another quick time out in Bitcoin’s more comprehensive uptrend, particularly in the wake of current favorable updates.

That consists of the increasing chances of Federal Reserve rate of interest cuts and alleviating US-China trade stress.

Onchain information verifies restored whale build-up, recommending that big financiers purchase into rate weak point.

Bitcoin establishing for ‘liquidity grab’ rate surge

Market expert Merlijn The Trader indicates a different fractal unfolding, one driven by “liquidity grabs” by traders.

His side-by-side chart contrast reveals indications of BTC breaking above a coming down trendline and “variety high” resistance, simply as it did ahead of its rise past $100,000 after the Israel-Iran dispute in late 2024.

” Very same structure. Very same trap. Very same breakout,” the expert composed, including:

” In 2024, $BTC blew up after the liquidity grab. In 2025, it’s establishing once again.”

Numerous experts see Bitcoin’s rate rallying to tape highs in 2025, with year-end forecasts varying from $150,000 to over $200,000.

Related: Nobody will offer their Bitcoin once it taps $130K: Bitwise CEO

One doubtful analysis, however, sees BTC’s uptrend having actually been tired near its existing record high of $112,000.

This short article does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.