Bottom line:

-

Bitcoin recuperates from a journey listed below $103,000 with markets on edge over the Israel-Iran dispute.

-

Oil takes the program on the day, however analysis is far from consentaneous on the outlook.

-

BTC cost forecasts see the rebound continuing, getting rid of the possibility of more losses.

Bitcoin (BTC) bounced previous $105,000 around the June 13 Wall Street open as markets waited for hints from the Israel-Iran dispute.

Oil might yet see “last flush” after day of gains

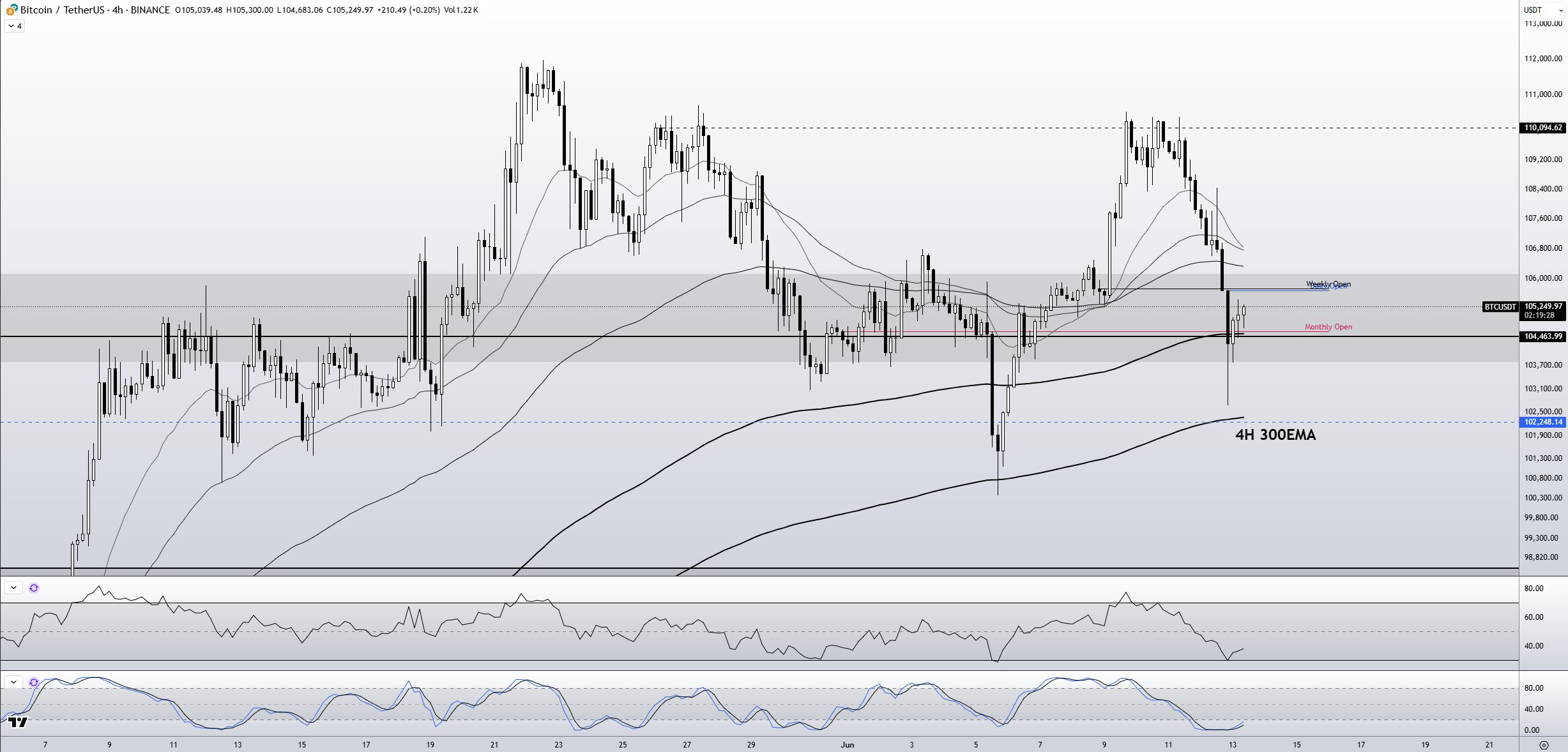

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD staging a modest rebound after dipping to $102,816 on Bitstamp.

Geopolitical stress had actually triggered breeze losses throughout crypto and stocks overnight, while oil skyrocketed and gold struck two-month highs.

Both the S&P 500 and Nasdaq Composite Index were down around 1% on the day at the time of composing.

Responding, crypto analysts had actually blended viewpoints over how a resurgent oil cost may affect Bitcoin and altcoins moving forward.

” Oil up. Gold up. Bitcoin down,” crypto business owner Anthony Pompliano composed in part of a preliminary reaction on X.

Pompliano remembered earlier episodes in the Middle East stress while anticipating that BTC would ultimately benefit.

” Bitcoin wound up outshining the other 2 over the very first two days because circumstance. Will be intriguing to see what takes place here,” he concluded.

Popular analytics resource Bitcoin Macro saw oil’s gains as possibly being brief.

” Oil may have considerable relocation down after this. Up until now it looks clear that they aren’t and will not be targeting Iran’s oil centers,” part of its own X product mentioned.

” The premium may vaporize, and technically oil may have its last flush down previously increasing.”

In October in 2015, Arthur Hayes, previous CEO of crypto exchange BitMEX, argued that a total change in the Middle East would sustain both oil and BTC cost action.

” Bitcoin is saved energy in digital kind. For that reason, if energy rates increase, Bitcoin will deserve more in regards to fiat currency,” he stated at the time.

Bitcoin cost checks out “double bottom level”

Amongst traders, short-term viewpoints on BTC/USD stayed positive.

Related: Bitcoin cost Bollinger Bands ‘failure’ dangers end of uptrend at $112K

Popular trader CrypNuevo kept in mind that the cost had actually gone back to the 50-day rapid moving average (EMA), a pattern line working as assistance considering that late April.

” I believe we benefit more advantage as long as we handle to hold the $100k mental assistance level,” he informed X fans.

Fellow trader Crypto Caesar anticipated that Bitcoin would “recuperate quickly,” calling the over night lows a “double bottom level.”

” Great bounce so far & & absence of follow through lower,” trader Alter advanced the subject.

” Anticipating still some care in markets today & & over weekend for crypto concerning Iran & & Israel. Likely to see tight connection to worldwide markets too.”

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.