Secret takeaways:

-

Ethereum runs the risk of a 25% drop towards $1,600 after stopping working to break above a multi-year technical resistance.

-

A whale moved over $237 million in ETH to exchanges, lining up with increasing ETH inflows into Binance over 5 straight days.

-

Wallet information recommends big ETH holders are rearranging or unloading, contributing to bearish pressure.

Ethereum’s native token, Ether (ETH), is revealing indications of vulnerability after breaking listed below a crucial multi-year assistance level, simply as a significant whale seems disposing numerous countless dollars worth of ETH.

Technical breakdown puts $1,600 ETH target in play

On the two-week chart, Ether has actually slipped listed below the lower trendline of an in proportion triangle that had actually held company given that mid-2022.

In March, the 200-period rapid moving average (200-period EMA; the blue wave) near $1,600 offered a momentary bounce, however the healing stalled after striking the 50-period EMA (the blue wave) around $2,545.

The 50-period EMA lines up with the triangle’s lower trendline, forming a resistance confluence that ETH bulls have actually consistently stopped working to conquer in current months, consisting of June.

Other indications of bearish pressure consist of Ethereum’s relative strength index (RSI), which stays listed below a multi-year coming down trendline.

Regardless of current rate rebounds, the RSI has actually stopped working to break above the trendline resistance, showing subsiding bullish momentum, strengthening the possibility of ongoing disadvantage.

ETH threats returning towards its 200-period EMA near $1,600 if this resistance confluence, marking a possible 25% slide from existing levels.

ETH whale wallets discard in the middle of stalled healing

Ethereum’s onchain information even more highlights the threat of ETH rate decreases in the coming weeks.

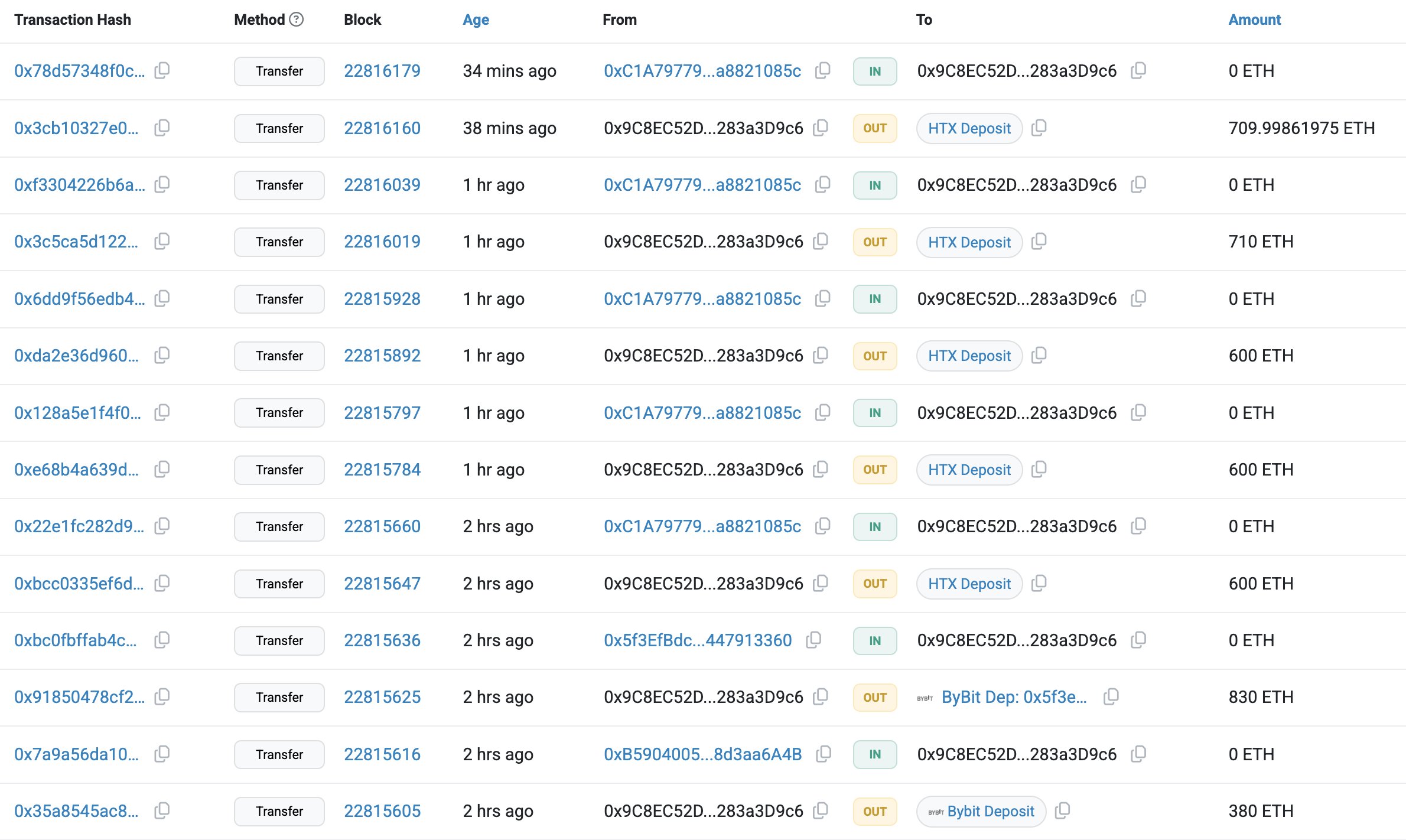

Previously in June, 2 Ethereum wallets, 0x14e4 and 0x26Bb, unstaked and withdrew 95,920 ETH (~$ 237 million), according to Etherscan.

Of that, 62,289 ETH (~$ 154 million) has actually currently been transferred to exchanges consisting of HTX, Bybit, and OKX in the previous 20 days. The staying 33,631 ETH (~$ 83 million) still beings in the whale’s address, possibly all set to be offered.

Information resource Lookonchain thinks about that the wallets are managed by a single “enormous whale” entity.

Binance sees ETH inflows for 5 days directly

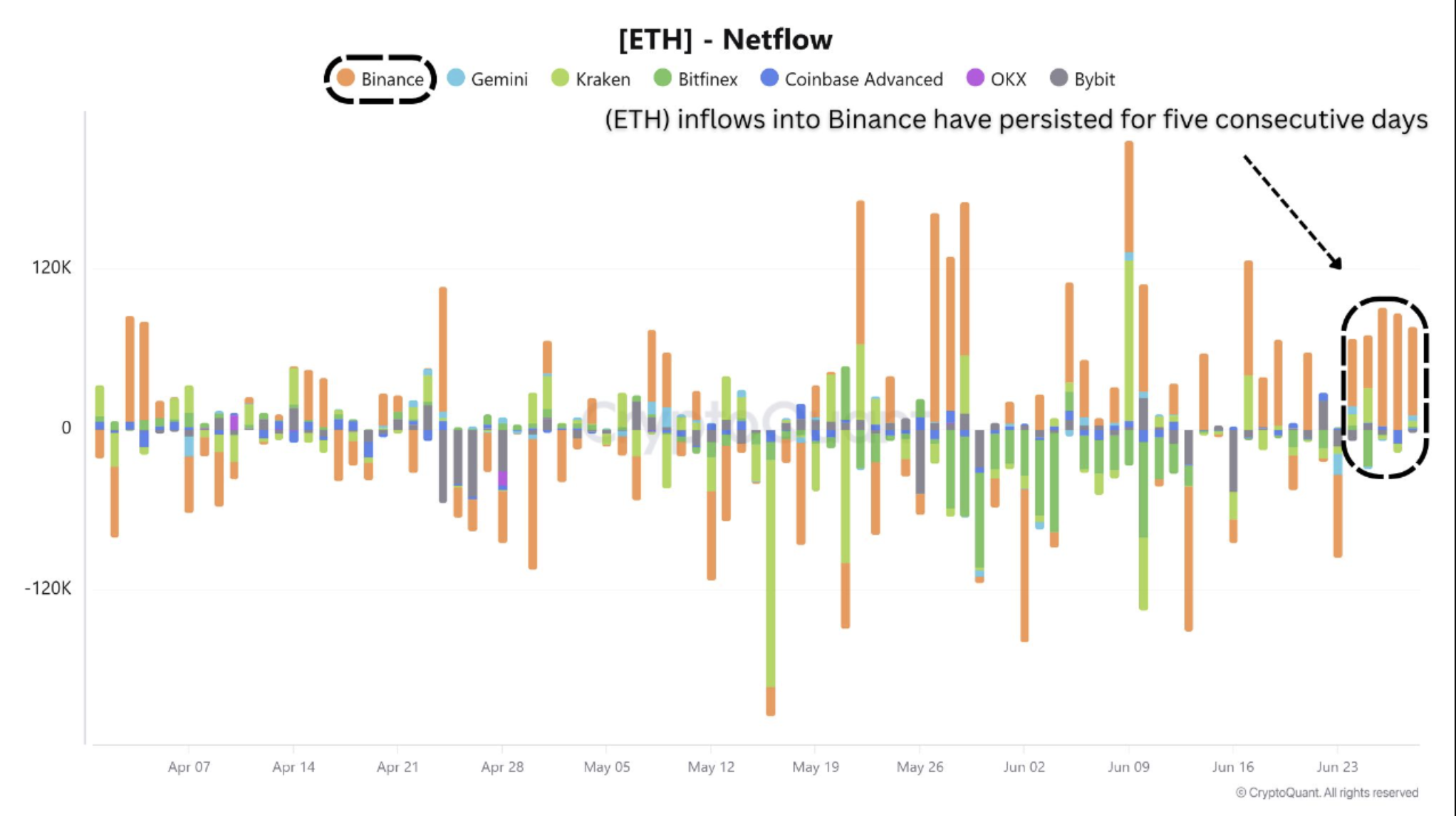

The whale’s big ETH transfers to exchanges line up with a current CryptoQuant report.

It reveals Ethereum inflows into Binance, the world’s biggest crypto exchange by volume, have actually continued for 5 successive days.

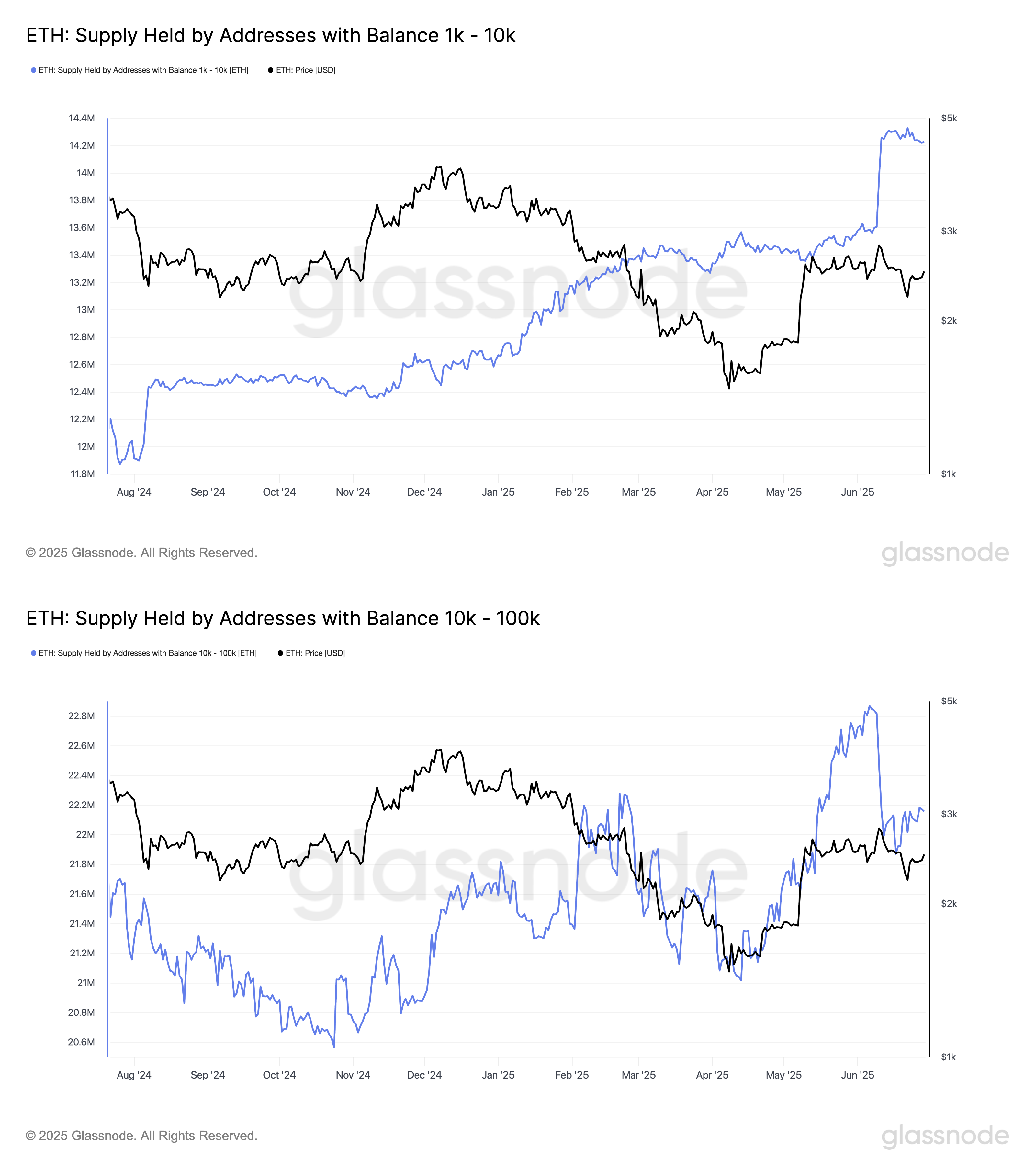

Glassnode information exposes even more bearish undercurrents.

The ETH supply held by addresses with 10,000– 100,000 ETH has actually decreased greatly given that mid-May, while the 1,000– 10,000 ETH friend has actually seen a parallel increase.

This suggests that big holders are either separating their wallets into smaller sized pieces or dispersing ETH to brand-new, perhaps unloading, addresses, therefore raising the cryptocurrency’s disadvantage predisposition.

Ethereum expert: Rally to $4,000 “a matter of time”

Ether’s bearish outlook contrasts with a more comprehensive benefit belief throughout the marketplace.

Related: Ethereum set for rally as it holds above essential $2.4 K rate: Expert

Expert Agela keeps in mind that Ether’s breakout above its weekly RSI resistance, as gone over above, is just a “matter of time.”

” This’ll be the driver for rate gratitude,” he composed, including:

” Because Q1 2024, ETH weekly RSI has actually made lower lows, and this is why ETH hasn’t had the ability to recover $4,000.”

Other experts even more forecast that the Ether rate will rally towards $10,000 due to helpful technical indications and consistent capital streams into ETH-focused mutual fund.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.