Secret takeaways:

-

Bitcoin’s long-lasting uptrend stays strong, however an expert cautions that the four-year cycle might restrict another upper hand.

-

Experts think Bitcoin might move greater past the existing all-time highs, with targets in between $130,000-$ 168,000.

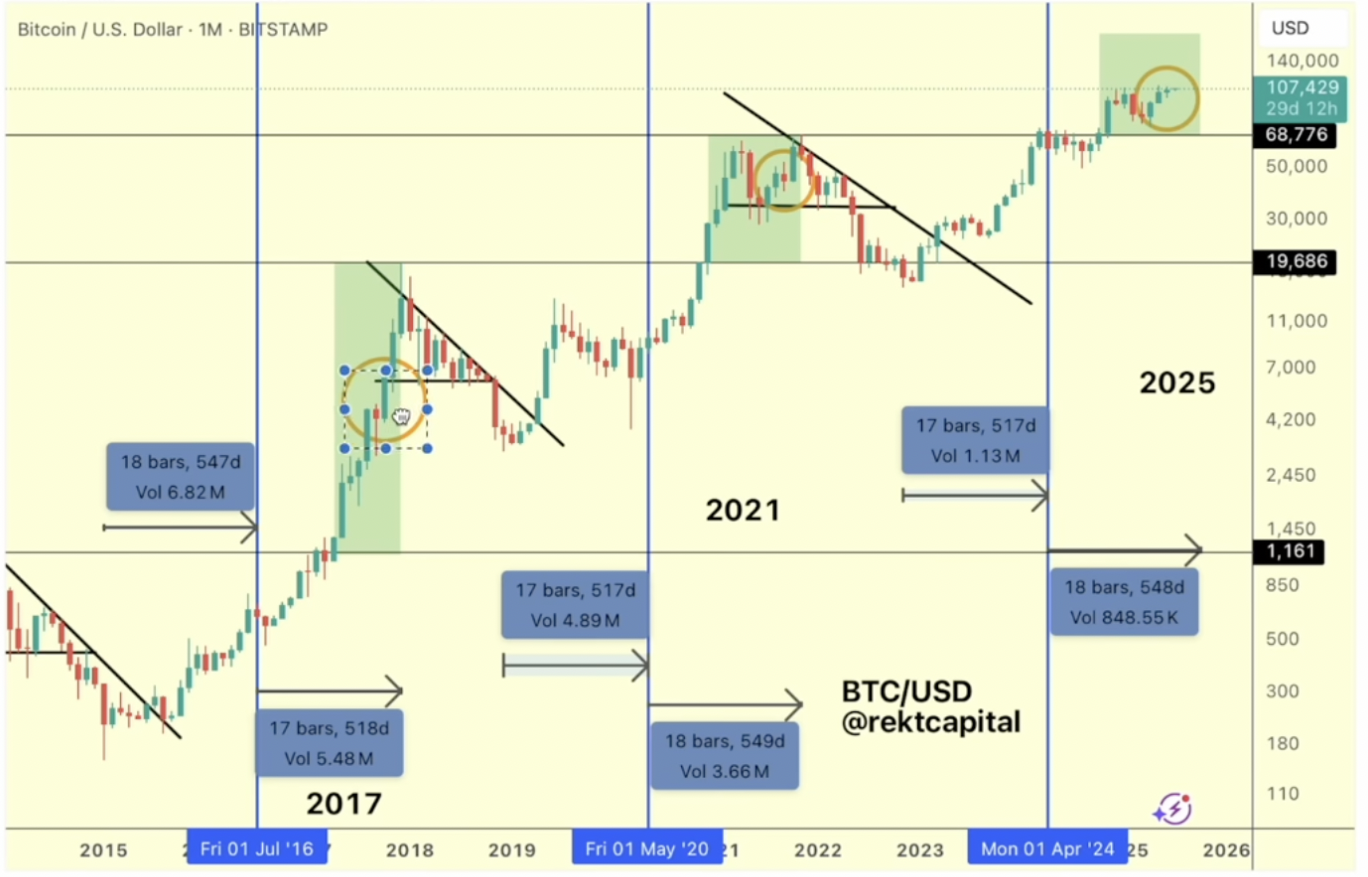

Bitcoin (BTC) may not have time to install another parabolic rally this cycle, based upon its four-year cycle design, a crypto expert cautions.

” Regardless of the short-term volatility, the long-lasting outlook is still really strong, structured uptrend, a Channel Up pattern that is now technically going for its next greater high,” stated popular expert TradingShot in a Tuesday post on TradingView, basing his analysis on Bitcoin’s technical signs.

Will Bitcoin see another parabolic rally?

TradingShot described that another significant rally might be restricted by Bitcoin’s position within a distinct long-lasting uptrend that has yet to produce the type of rallies seen in the previous cycles.

Given that bottoming in November 2022, he kept in mind that Bitcoin has actually traded within an upward channel that carefully lines up with a Fibonacci channel that has actually tracked BTC cost motions considering that 2013.

Related: Bitcoin gets ‘complimentary’ hints as DXY sets 21-year weak point record

” As you can see throughout the previous 2 cycles, whenever BTC got above that Buy Zone, it began a parabolic rally,” the expert composed.

For example, in the 2017 and 2021 cycles, such breakouts set off fast, rapid relocations into the upper Fibonacci bands, providing considerable gains.

TradingShot states that this cycle has not produced a comparable breakout, keeping in mind:

” Up until now, we have not had such a rally throughout the existing Cycle, and with time going out (presuming the 4-year Cycle design continues to hold), do you believe we will get one this time around?”

Popular crypto expert Rekt Capital likewise explained that Bitcoin might just have a couple of months of cost growth left in the cycle, specifically if it follows the exact same historic pattern from 2020.

Rekt described that the cost will likely peak in October, which is 550 days after the Bitcoin halving in April 2024. He included:

” That’s currently 2 to 3 months possibly that we have actually left in this booming market.”

As Cointelegraph reported, the Bitcoin regular monthly outflow/inflow ratio recommends that the $100,000 mental level might be the brand-new bottom variety before BTC goes through another parabolic leg in the 2nd half of 2025.

Bitcoin is trading at $109,760, simply 2% listed below its $111,970 all-time high at the time of composing, according to information from Cointelegraph Markets Pro and TradingView.

Bitcoin traders concur BTC cost upside not over

Bitcoin keeps screening resistance at $110,000 however has actually stopped working to break above it so far, casting doubts about its capability to continue its uptrend. Regardless of this, a number of traders think BTC still has space for more growth in 2025.

” Bitcoin has actually turned the top of the previous bull flag into an assistance!” TradingShot stated in another BTC cost analysis.

This is a “strong bullish signal together with the cost holding above the 50-day basic moving average (SMA),” presently at $106,750, the expert described, including:

” Technically, the break-out from this bull flag targets the 2.0 Fibonacci extension, which presently sits at $168,500.”

” Bitcoin broke the bullish flag, retested it, and now presses greater,” fellow expert Jelle observed a comparable technical breakout, including:

” Clear $110,000 and $130,000 is the next target.”

Bitcoin cost is “still well above the 50-week MA, and it’s likewise holding strong above the previous all-time high,” stated popular crypto expert Mags, including:

” It appears like we’re simply combining before the next upper hand.”

Besides traders, numerous onchain metrics and signs reveal that Bitcoin is not displaying patterns related to previous tops.

These consist of Bollinger Bands, high BTC supply in long-lasting holder hands, lessening BTC supply on exchanges, MVRV ratio, and consistent institutional need from area Bitcoin ETFs and business treasuries.

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.