Secret takeaways:

-

Bitcoin leads its long-lasting “power law” curve, traditionally resulting in blissful cost highs in previous cycles.

-

A falling dollar and prepared for Federal Reserve rate of interest cuts might set off a more comprehensive risk-on rally, with Bitcoin as a significant recipient.

-

Area Bitcoin ETFs have actually caught 70% of gold’s inflows in 2025.

Bitcoin (BTC) has actually rallied by 10% in July, reaching brand-new highs at $118,600, and this might be simply the start of a parabolic rally according to confidential Bitcoin expert apsk32. The expert stated that Bitcoin might be worth as much as $258,000 if history repeats itself.

According to apsk32, Bitcoin’s cost action has actually followed a long-lasting power curve trendline, a mathematical design showing BTC’s rapid development in time. It determines cost discrepancy from this trendline, not simply in dollar terms, however in systems of time, a method referred to as Power Law Time Contours.

The expert discussed that Bitcoin is somewhat more than 2 years ahead of its power curve, suggesting if the cost remained flat, it would take control of 2 years for the long-lasting trendline to converge it once again. Apsk32 stated,

” We’re presently above 79% of the historic information utilizing this metric. The leading 20% is what I call “severe greed.” These are the blow-off tops that occur every 4 years.”

The “severe greed” zone covers from $112,000 to $258,000, a zone seen throughout Bitcoin’s blissful peaks in 2013, 2017, and 2021. The expert indicated that “if the four-year pattern continues,” Bitcoin might be in between $200,000 and $300,000 by Christmas, before the bullish momentum starts to fade at the start of 2026.

Also, Satraj Bambra, CEO of continuous trading platform Bed rails, informed Cointelegraph that a number of macroeconomic forces might drive Bitcoin substantially greater in 2025. Bambra indicated a broadening Federal Reserve balance sheet and a pivot towards lower rate of interest, possibly under brand-new Fed management reacting to the financial drag from increasing tariffs, as essential drivers. Together, these shifts might spark a broad-based rally in risk-on possessions, with Bitcoin poised to benefit.

Bambra pointed out the United States Dollar Index (DXY) dropping listed below 100 as a vital early signal of this macro pivot, recommending that a wave of rate cuts and fresh stimulus might quickly follow. Versus this background, the CEO stated,

” I see Bitcoin going parabolic in the area of $300K– 500K driven by 2 essential forces.”

Related: Is the crypto market going into a brand-new supercycle? Here are 5 methods to understand

Bitcoin ETF reaches gold as risk-on rally develops

Area Bitcoin exchange-traded funds (ETFs) are picking up speed on gold, recording 70% of its year-to-date net inflows, according to Ecoinometrics. This strong rebound from a sluggish 2025 start signals growing institutional interest and self-confidence in Bitcoin as a genuine shop of worth.

Bitcoin stays a risk-on possession, with a moderate connection to the Nasdaq 100 over the previous 12 months, constant with its five-year average. Its low connection with gold and bonds highlights its distinct portfolio function.

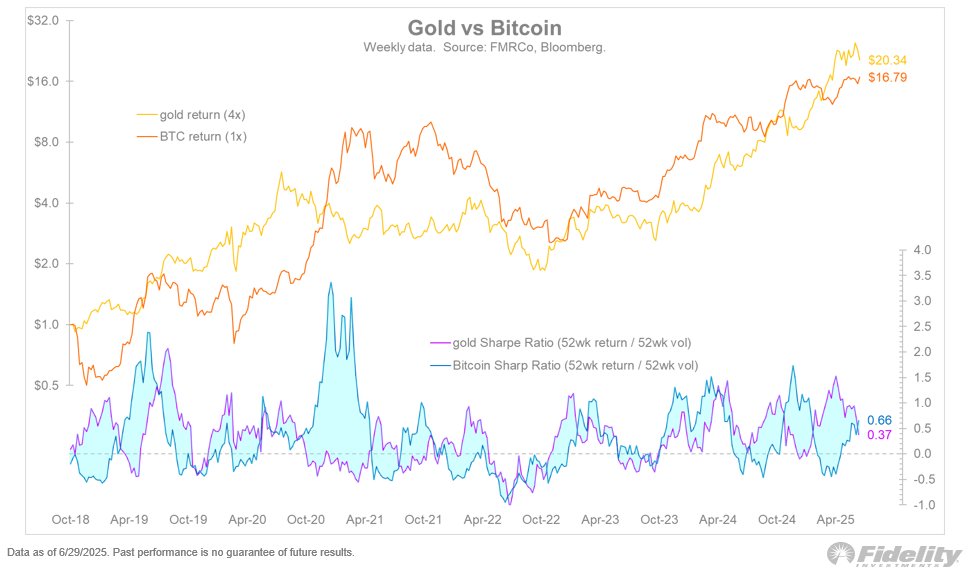

Echoing that belief, Fidelity’s Director of International Macro, Jurrien Timmer, just recently said that the baton has actually swung back to Bitcoin. According to Timmer, the narrowing space in Sharpe ratios in between Bitcoin and gold indicate BTC providing remarkable risk-adjusted returns. The Sharpe ratio assesses just how much excess return a possession provides for the level of threat taken, comparing its efficiency to a safe criteria changed for volatility.

The chart below, based upon weekly information from 2018 through July 2025, highlights how Bitcoin’s returns (1x) have actually been surrounding gold’s (4x). In relative efficiency terms, gold stands at $20.34, while Bitcoin has actually reached $16.95.

Related: Bitcoin $120K expectations intensify to ETH, BUZZ, UNI and SEI

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.