Secret takeaways:

-

Institutional financier inflows are altering Bitcoin’s character, minimizing its volatility and increasing ease of access for daily financiers.

-

Area Bitcoin ETFs now hold over $138 billion in possessions, with RIAs, hedge funds, and pensions driving a growing share.

-

Lower volatility enhances Bitcoin’s possibilities of operating as a legal tender, not simply digital gold.

Bitcoin (BTC) has actually come a long method from a grassroots financial experiment to a growing monetary property. It took some time for Wall Street to unlock to an independent disruptor, now that Bitcoin has actually shown its remaining power, organizations aren’t averting. The approval of United States area Bitcoin ETFs in January 2024 marked a clear tipping point. No longer restricted to crypto-native platforms, Bitcoin can now be held through brokerages, pension funds, and even insurance coverage items.

This growing wave of institutional adoption is doing more than increasing Bitcoin rate– it slow in our economies. Lower volatility, more powerful facilities, and much easier gain access to are enabling Bitcoin to progress from an underground cost savings tool into a practical shop of worth, and ultimately, a functional legal tender.

Huge cash brings stability

Institutional capital acts in a different way from retail. While specific financiers frequently respond mentally– offering into dips or stacking in throughout rallies– big organizations tend to show longer time horizons. This habits has actually started to support Bitcoin’s market cycles.

Area ETF streams expose the shift. Because their launch in early 2024, United States Bitcoin ETFs have actually regularly signed up net inflows throughout rate corrections, with funds like BlackRock’s IBIT taking in capital while retail belief turned careful. That stated, February– March 2025 was an exception: political unpredictability and tariff worries drove extensive outflows throughout property classes, Bitcoin consisted of. However in general, organizations are most likely to typical into dips than panic-sell.

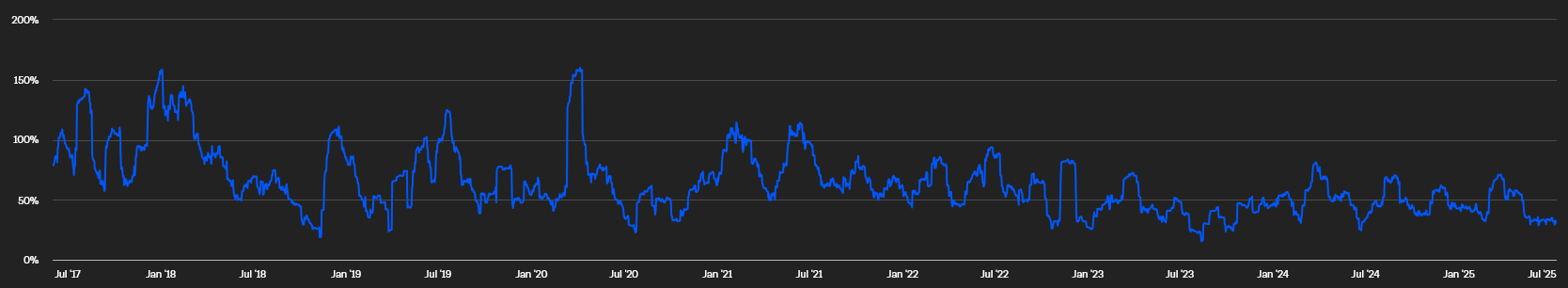

Volatility information verifies the pattern: Bitcoin’s 30-day rolling volatility has actually dropped considerably over the 2023– 2026 cycle, most likely helped by the supporting result of area BTC ETFs. While the 2019– 2022 cycle saw duplicated spikes above 100%, peaking as high as 158%, the existing cycle has actually been considerably calmer. Because early 2024, volatility has actually hovered around 50% and just recently dropped to simply 35%, a level similar to the S&P 500 (22%) and gold (16%).

Lower volatility does not simply relieve financier nerves– it enhances Bitcoin’s practicality as a legal tender. Merchants, payment processors, and users all gain from foreseeable prices. While onchain information still reveals that the majority of Bitcoin activity is driven by storage and speculation, a more steady rate might motivate more comprehensive transactional usage.

Will huge cash speed up Bitcoin adoption?

Institutionalization is likewise speeding up adoption by making Bitcoin more available to the general public. Retail and business financiers who can’t or will not self-custody BTC can now acquire direct exposure through familiar TradFi financial investment items.

In 18 months, United States area Bitcoin ETFs have actually collected over $143 billion in possessions under management (AUM). While much of this AUM is held by retail financiers, institutional involvement is growing quickly through financial investment advisors, hedge funds, pensions, and other expert property supervisors. As these entities start providing Bitcoin direct exposure to their customers and investors, adoption spreads.

Ric Edelman, co-founder of Edelman Financial Engines– a $293 billion RIA (signed up financial investment advisor) ranked No. 1 in the United States by Barron’s– just recently made waves with his upgraded crypto allowance assistance. In what Bloomberg’s Eric Balchunas called “the most crucial full-throated recommendation of crypto from the TradFi world because Larry Fink,” Edelman recommended conservative financiers to hold a minimum of 10% in crypto, moderate 25%, and aggressive financiers as much as 40%. His thinking was basic:

” Owning crypto is no longer a speculative position; stopping working to do so is.”

With financial investment advisors presently handling over $146 trillion in AUM, according to the SEC, the capacity for Bitcoin need is huge. Even a 10% “moderate” allowance would represent $14.6 trillion in possible inflows– a 330% boost over Bitcoin’s existing market cap of $3.4 trillion. A much more conservative 1% shift would still inject over $1.4 trillion– sufficient to structurally reprice the marketplace.

Related: SEC acknowledges Trump’s Reality Social Bitcoin and Ethereum ETF

Pension funds, which jointly handle $34 trillion, are likewise gradually relocating. Pension funds in the US states of Wisconsin and Indiana have actually currently revealed direct financial investments in area ETFs. These relocations are substantial: as soon as Bitcoin ends up being a checkbox in a retirement portfolio, the mental and procedural barriers to entry collapse.

Bitcoin’s institutionalization isn’t simply a story of Wall Street buy-in. It’s a shift in Bitcoin’s function– from speculative rebel to an alternative monetary system.

Obviously, this advancement includes compromises. Concentration, custodial danger, and sneaking regulative impact might jeopardize the extremely self-reliance that provided Bitcoin its worth in the very first location. The very same forces sustaining adoption might ultimately check the limits of Bitcoin’s decentralization.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.