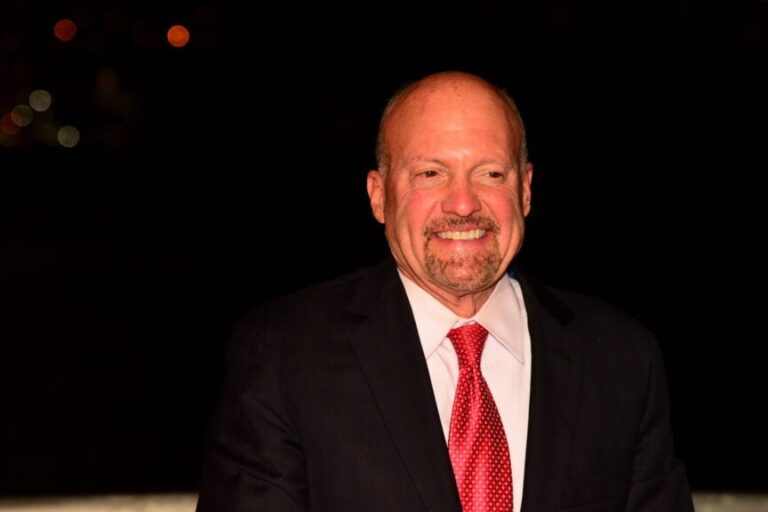

Prominent television host Jim Cramer is stirring chatter on X with another buzzworthy “meme stock” acronym, targeted at a brand-new group of retail-favorite stocks that are levitating.

Have a look at the present rate of PLTR stock here.

What Took Place: On Monday, in a post on X, Cramer composed, “A brand-new acronym for the meme stocks that simply will not stop!!! PARC!,” describing Palantir Technologies Inc. PLTR, AppLovin Corp. APP, Robinhood Markets Inc. HOOD, and Coinbase Global Inc. COIN

All 4 business are noteworthy for their social media-fueled momentum, high levels of retail involvement, and volatility, which has actually made them the “meme stock” name.

Palantir supplies AI and information analytics applications for federal governments and industrial applications, and has actually seen strong momentum in the last few years. AppLovin, on the other hand, is a mobile marketing platform and a video game publisher that has actually seen a sharp rally considering that mid-last year.

Trading platform Robinhood was at the center of the retail trading boom throughout 2020-21, and continues to stay popular amongst young financiers and traders. Coinbase, the biggest U.S.-based crypto exchange, is likewise being sustained by restored retail threat cravings for digital properties.

| Stock/ ETF | Year-To-Date | 5-Year |

| Palantir Technologies Inc. PLTR | +98.36% | +1,521.20% |

| AppLovin Corp. APP | +4.13% | +483.44% |

| Robinhood Markets Inc. HOOD | +153.45% | +184.38% |

| Coinbase Global Inc. COIN | +53.19% | +15.21% |

| Ark Development ETF ARKK | +29.46% | -8.70% |

Previously in the day, Cramer asked his fans on X to select in between PARC and CARP for the brand-new acronym, before leaning towards PARC on CNBC’s Mad Cash.

Cramer’s brand-new acronym, nevertheless, drew combined responses online. When he requested for recommendations from his fans, a number of users recommended “CRAP” over “PARC” or “CARP,” pointing out the high assessments of these business.

Why It Matters: This isn’t the very first time Cramer has actually packaged market favorites into memorable acronyms. In the past, he promoted the term “FANG” for Facebook, Amazon, Netflix and Google, which ultimately progressed into “FAANG” to consist of Apple.

Throughout the years, this acronym has actually triggered a number of ETFs that intend to supply financiers with direct exposure to the group, and the term has actually considering that ended up being associated with “huge tech.”

Early this month, Cramer divided the FAANG to simply “M-N-Ms,” describing Microsoft, Nvidia and Meta Platforms, which have actually substantially outshined their “Splendid 7” equivalents throughout the year.

Palantir leads the charge amongst its PARC peers with a market cap of $351 billion, and according to Benzinga’s Edge Stock Rankings, it has strong momentum, with a beneficial rate pattern in the brief, medium and long terms. Click on this link to see how it compares to Applovin, which ranks a far-off second.

Image courtesy: katz/ Shutterstock.com