Secret takeaways:

-

Bitcoin choices and futures information recommend traders are neutral regardless of a 7% drop from the peak.

-

Stablecoin need in China stays constant, revealing limited worry in crypto markets.

Bitcoin (BTC) dropped 4% in between Thursday and Friday, falling listed below $115,000 for the very first time in 2 weeks. The correction accompanied the month-to-month derivatives expiration, which erased $390 million worth of futures agreements, comparable to 14% of open interest.

To figure out if this occasion transformed traders’ longer-term expectations, it is necessary to analyze Bitcoin futures and choices indications.

Under regular conditions, month-to-month Bitcoin futures trade at a 5% to 10% annualized premium over area markets to make up for the longer settlement duration. The existing 7% premium falls within that neutral variety and is close to Monday’s 8% level. Initially glimpse, the information recommends no shift in financier belief, regardless of Bitcoin’s $4,700 cost drop.

Bitcoin reached a record high of $123,181 on July 14, however the last time futures information signified bullish momentum remained in early February. That timing lines up with the United States enforcing import tariffs and the frustration over the United States Federal Reserve keeping rates of interest, regardless of January’s reasonably calm Customer Rate Index (CPI) reading of 3% year-over-year.

To verify whether the neutral position in Bitcoin futures precisely shows financier belief, one need to evaluate the BTC choices alter. When traders prepare for a correction, put (sell) choices tend to command a premium over call (buy) choices, driving the 25% delta alter above 6%.

On Friday, Bitcoin’s 25% delta alter rose to 10%, an uncommon tension level last seen almost 4 months back. Nevertheless, the raised worry was short-term, as the alter rapidly gone back to a well balanced 1% level. This signals that whales and market makers are pricing comparable dangers for both upward and down cost relocations.

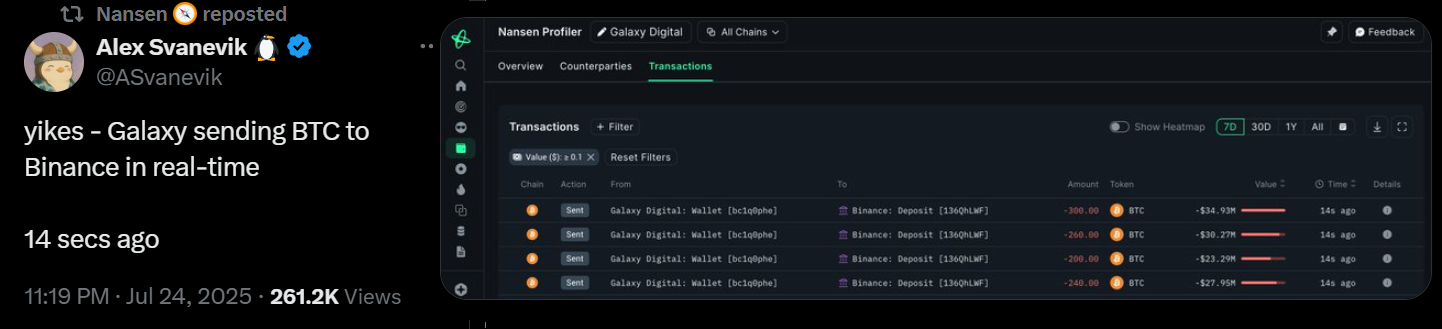

Bitcoin traders carefully observe 80K BTC wallet transfers

Bitcoin derivatives recommend that traders are not especially excited to purchase near $116,000, however they likewise have actually not stressed after the 7% drop from the all-time high. That is rather comforting provided the issues surrounding the entity that unloaded a part of its 80,000 BTC balance at Galaxy Digital, according to Nansen CEO Alex Svanevik.

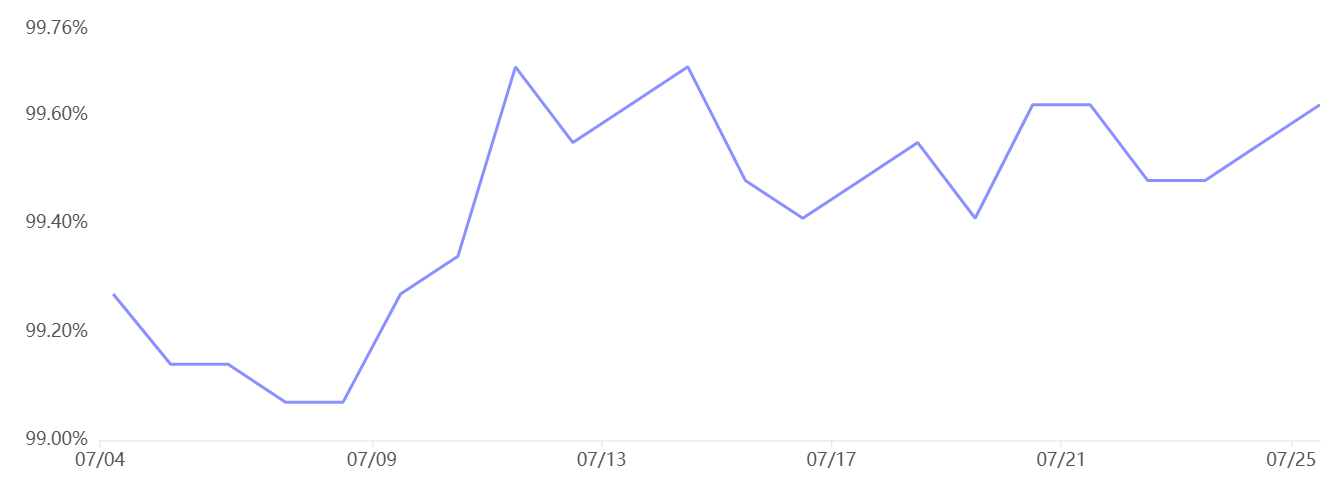

Stablecoin need in China offers extra insight. Strong retail activity normally drives stablecoins to trade at a 2% or greater premium to the main United States dollar rate. Alternatively, a discount rate higher than 0.5% frequently signifies market worry, as traders leave crypto positions.

Related: 35 business now hold a minimum of 1,000 Bitcoin as business adoption booms

Presently, Tether (USDT) is trading at a modest 0.5% discount rate in China. This suggests that Bitcoin’s current cost dip has not substantially impacted cryptocurrency need in the area. Even with Bitcoin reaching a brand-new all-time high, stablecoin inflows and outflows have actually stayed mostly the same over the previous 2 weeks.

In general, Bitcoin traders appear more worried about the prospective escalation of worldwide trade stress or a United States financial recession, both of which might activate more comprehensive threat hostility and weigh on Bitcoin. Still, the existing absence of interest in Bitcoin derivatives does not show any crucial concerns within the crypto markets, which is useful for the $115,000 resistance level.

This post is for basic info functions and is not planned to be and need to not be taken as legal or financial investment guidance. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.