The finalizing of the GENIUS Act into law developed the initially thorough regulative structure for US-issued stablecoins. Fans argue it will boost trust, drive mainstream adoption and boost the dollar’s status as the worldwide reserve currency.

With stablecoins now acquiring traction in worldwide financing, the GENIUS Act might likewise show a benefit for the establishing world, draw in institutional interest and drive a renewal in decentralized financing (DeFi).

Nevertheless, issues stay over unsettled concerns, such as the guideline of foreign providers, doubts about the restriction on yield-bearing stablecoins and the prospective supremacy of business and standard financing gamers.

Market professionals surveyed by Cointelegraph concur that the GENIUS Act is a landmark occasion for the United States blockchain and stablecoin sector, if not the worldwide crypto market.

” Banks, fintechs and even big merchants– basically anybody with substantial customer or institutional circulation– will all be thinking about providing their own stablecoin,” Christian Catalini, creator of the MIT Cryptoeconomics Laboratory, informed Cointelegraph, including that a stablecoin technique will now be an important part of all payments and monetary services business.

GENIUS Act’s foreign stablecoin “loophole”

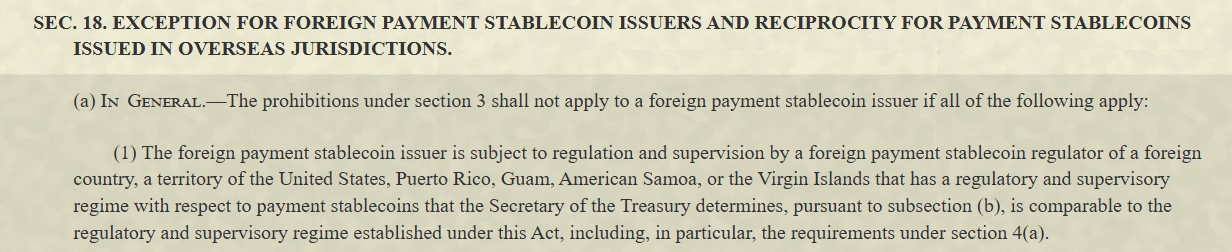

A significant weak point of the GENIUS Act is what the Atlantic Council calls the “Tether loophole.” The United States think tank argued in an article that the United States stablecoin law did not “sufficiently” manage offshore stablecoin providers.

The law intends to bring order to United States stablecoins by enforcing stringent guidelines on reserves, monetary disclosures and sanctions compliance. This might put regional providers at a competitive downside and possibly motivate brand-new providers to integrate in less-demanding jurisdictions offshore.

” The foreign provider loophole was not adequately repaired,” Timothy Massad, a research study fellow at the Kennedy School of Federal Government at Harvard University and previous chairman of the United States Product Futures Trading Commission, informed Cointelegraph. Massad is a co-author of the Atlantic Council blog site.

Related: Stablecoins include $4B, Bitcoin exchange reserves listed below 15%: July in charts

The GENIUS Act needs Tether and other foreign providers to fulfill requirements “equivalent” to those of United States providers, however what certifies as “equivalent” isn’t plainly specified, Massad included.

However Christopher Perkins, president of CoinFund, stated that controlled United States stablecoins offer end users self-confidence that their holdings are completely backed, leading the way for more business to start a business in the United States.

” I believe lots of financiers will select the onshore controlled variation of stablecoins since of the incremental self-confidence they provide.”

In a current media interview, Tether CEO Paolo Ardoino stated that the business’s “foreign stablecoin” USDt (USDT) will adhere to the GENIUS Act. It is likewise preparing to release a domestic stablecoin under the brand-new law.

Stablecoin issuance goes mainstream with GENIUS

The GENIUS Act opens doors for huge United States industrial banks like Bank of America to release their own stablecoins, while mega merchants like Walmart and Amazon are likewise apparently checking out stablecoin issuance.

The possibility of regulated business stablecoin providers raises concerns about how crypto-native stablecoins like Tether and USDC (USDC) will be impacted.

” Tether less so, as its lead offshore is significant,” Catalini stated. He included that the majority of the brand-new competitors will concentrate on the United States market, which provides “a more substantial obstacle for USDC.”

On The Other Hand, Keith Vander Leest, United States basic supervisor at London-based stablecoin facilities start-up BVNK, stated that brand-new gamers will not always flood the marketplace. Non-crypto native companies introducing stablecoins will most likely move meticulously, starting with small pilot programs to develop convenience and proficiency.

” It is most likely for banks to move quicker into providing than corporates,” Vander Leest informed Cointelegraph. Numerous will be “use-case particular” stablecoins. The variety of brand-new stablecoins that “reach scale” will be restricted, he stated.

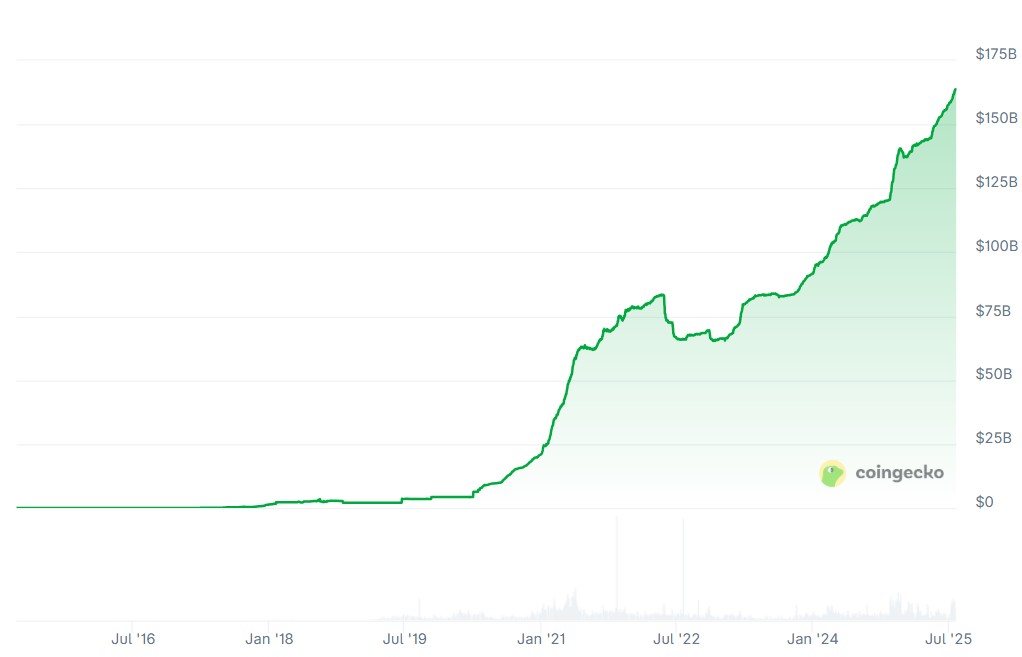

GENIUS and stablecoins increase United States financial obligation need

The White Home declares that the GENIUS Act will increase need for United States financial obligation and seal the dollar’s status as the world’s reserve currency. Treasury Secretary Scott Bessent stated that dollar-linked stablecoins might ultimately reach a minimum of $2 trillion in market capitalization, up from today’s market cap of about $267 billion.

Markus Hammer, a specialist and principal at HammerBlocks, stated that since US-issued stablecoins need to be 100% backed by United States dollars or their equivalents, they will naturally increase need for United States financial obligation.

Related: White Home crypto report a variety for Bitcoin supporters

” Emerging markets, in specific, might end up being substantial users of United States dollar stablecoins, as these deal more stability and performance compared to their typically vulnerable regional monetary systems,” he informed Cointelegraph.

However Hammer disagreed on the dollar’s restored supremacy, declaring that rely on US-based currencies is slowly deteriorating.

According to Massad, the act’s effect will depend upon whether stablecoins end up being a crucial ways of payment or stay a specific niche usage case. Business-to-business payments comprise the bulk of worldwide payments, and it’s unclear whether there will be substantial development in making use of stablecoins for that function, he stated.

GENIUS improves stablecoin energy

The GENIUS Act forbids stablecoin providers from paying “interest or yield” to people holding stablecoins. Could that put US-issued stablecoins at a competitive downside?

” Without yield, stablecoins are a diminishing possession,” Perkins stated. “And while lots of think that payments are the killer usage case for stablecoins, they likewise act as a crucial shop of worth in the establishing world. Holders will turn to DeFi to reconstitute yield.”

In time, it is possible that yield-bearing securities or tokens will end up being more available, continued Perkins. Till then, institutional financiers, who have a fiduciary responsibility to make interest on their holdings, might require to check out other methods to make interest. They might provide certified revenue-sharing contracts with providers to get yield direct exposure, for example.

It nearly appears counterproductive, however the elimination of yield on stablecoins might really be great news for Ethereum-based DeFi as the primary option for passive earnings generation.

Total, “the finalizing of the Act is a considerable turning point,” Massad stated. “Stablecoins are the most beneficial application of blockchain innovation to date, and even if they do not end up being a significant ways of payment, they will produce beneficial competitors into payments– we might see tokenized bank deposits quickly.”

Catalini of MIT Cryptoeconomics Laboratory called stablecoins “the very first tokenized possessions to begin its journey towards mainstream adoption.” He included that possessions such as bonds and securities will quickly follow.

The GENIUS Act sets a regulative structure for stablecoin issuance in the United States and signals mainstream adoption is underway. Regardless of issues over unsettled concerns such as the unclear language around foreign providers, market leaders see the law as a vital action for controlled dollar-backed tokens.

Publication: Ethereum’s roadmap to 10,000 TPS utilizing ZK tech: Dummies’ guide