Secret takeaways:

-

Inactive whale purchases $28M in ETH as cost drops 13%, indicating build-up.

-

Whales, BitMine, and ETFs include billions in ETH, strengthening bullish need.

-

” V-shaped” healing pattern emerges, with experts considering $7.5 K–$ 20K targets.

An Ethereum whale wallet has actually resurfaced after 4 years of silence, scooping up $28 million worth of Ether (ETH) in a relocation that has actually stirred bullish chatter throughout the marketplace.

Abundant Ethereum addresses are purchasing the dip

On Tuesday, the entity withdrew 6,334 ETH (worth around $28.08 million) from Kraken in the previous hour, according to onchain information mentioned by expert CryptoGoos. The very same address last connected with the exchange in 2021.

Ether has actually dropped more than 13% because Sunday, slipping from above $5,000 to around $4,315, a decrease the whale appears to have actually dealt with as a purchasing chance.

The transfer is notable since whale outflows from exchanges are normally viewed as a bullish signal, recommending build-up and long-lasting holding, instead of impending sell pressure.

Other whale wallets have actually made bigger ETH purchases.

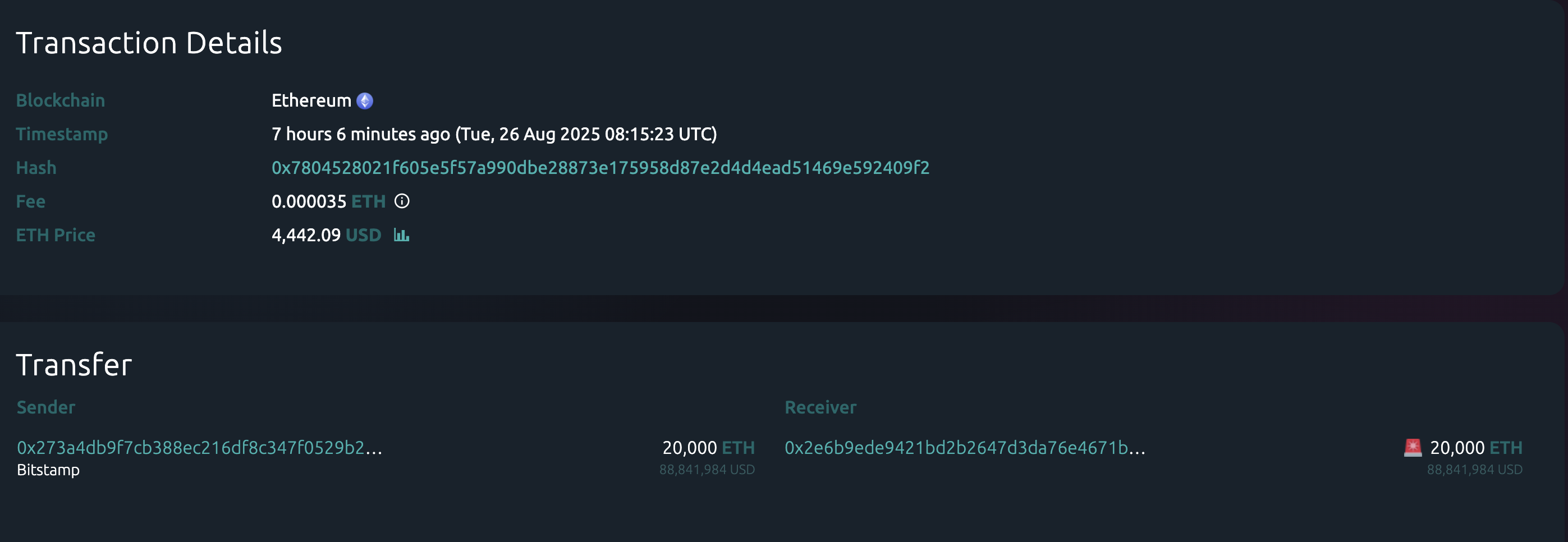

On Tuesday, crypto exchange Bitstamp sent out 20,000 ETH to an unidentified wallet, according to Whale Alert information. That shows an exchange-to-self-custody circulation normally connected with build-up.

Furthermore, according to information resource Arkham Intelligence, a single whale purchased and staked around $2.55 billion in ETH through Hyperliquid on Monday.

These relocations accompany BitMine’s ongoing push into Ethereum. Over the previous week, the company included $252 million in Ether, which has actually pressed its overall holdings to 797,704 ETH (valued at approximately $3.7 billion).

Related: Tom Lee calls Ether bottom ‘in next couple of hours’ as BitMine purchases 4,871 ETH

BitMine has an extra $200 million in reserves for more Ethereum purchases.

Area Ethereum ETFs have actually brought in more than $1 billion in inflows because Aug. 21, according to Farside Investors information, hence nearly removing $925.70 million in outflows experienced 4 days prior.

The consistent capital contributes to whale and business purchasing, strengthening the view that ETH’s dip is being dealt with as an entry point instead of a breakdown.

Ethereum in “V-shaped” healing: Expert

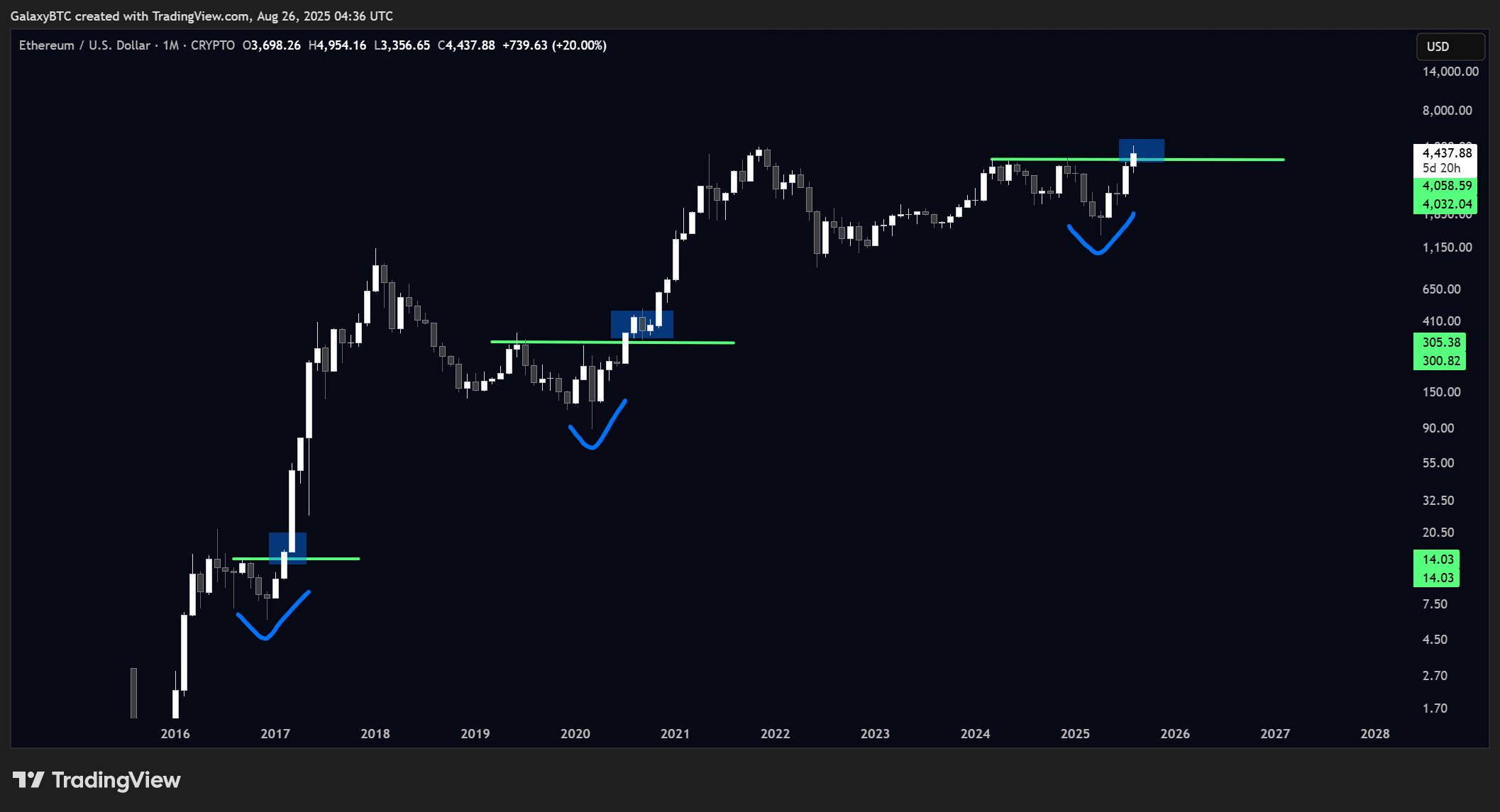

Ether’s continuous rebound from summer season lows near $3,350 to above $4,000 resistance is forming a “V-shaped” healing, echoing previous cycle bottoms that preceded significant bull runs, according to expert GalaxyBTC.

In late 2020, ETH took a comparable “V,” increasing to more than $4,000 a year after plunging to approximately $100 throughout the March pandemic crash. A smaller sized variation of this situation unfolded in late 2022 when ETH recuperated above $2,000 in early 2023 from under $1,200.

Ethereum’s technical setups recommend ETH’s cost might climb up towards $10,000-20,000 in the coming months. Geoffrey Kendrick, head of digital possessions at Requirement Chartered, expects it to strike $7,500 by the year’s end.

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.