Bottom line:

-

Bitcoin can reverse its most current depression to strike brand-new all-time highs in the next 4 months, based upon historic efficiency.

-

Research study states that the outlook for Bitcoin in between now and Christmas is “favorable yet less unpredictable.”

-

The existing dip might be “frontrunning” standard September BTC cost drawback.

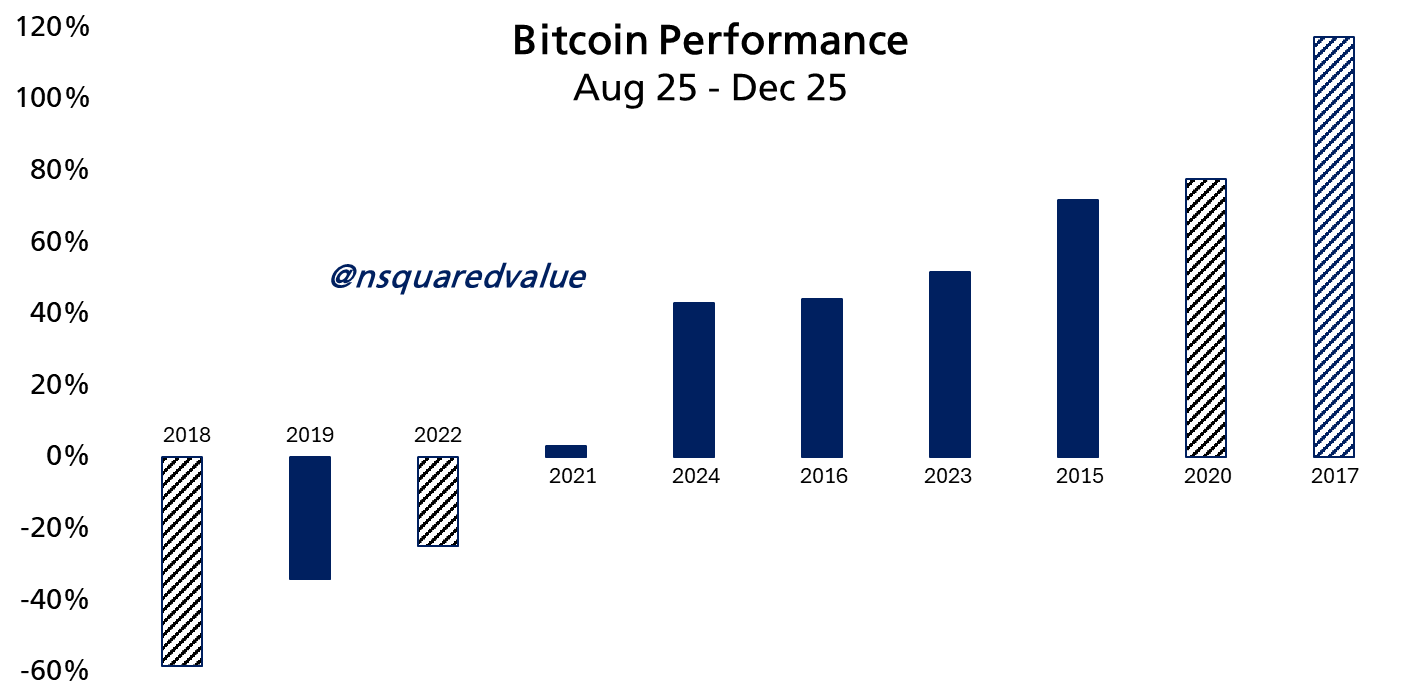

Bitcoin (BTC) deals with typical gains of 44% by Christmas as experts soft-pedal the effect of a much deeper BTC cost correction.

Research study from network economic expert Timothy Peterson, launched on X today, anticipates “favorable” efficiency for BTC/USD in Q4.

Bitcoin analysis has fun with $160,000 target

Bitcoin generally sees its weakest gains in September, a month that BTC/USD has actually never ever ended up more than 8% greater.

In Spite Of that, Peterson, who routinely compares efficiency over several booming market, stays positive.

” Precisely 4 Months Up Until Christmas. How does Bitcoin fare throughout this time? Up 70% of the time. Typical gain +44%,” he summed up.

That typical advantage would put Bitcoin at $160,000 by the recently of 2025, information from Cointelegraph Markets Pro and TradingView verifies.

Peterson acknowledges that such expectations are more a standard than a guideline, with different nonconformant years over Bitcoin’s life time.

” Nevertheless, I believe some years do not have market/economic conditions similar to 2025. I would omit 2018, 2022, 2020, and 2017 as uncharacteristic years,” he concluded.

” This alters the result to preferring favorable yet less unpredictable efficiency.”

Bitcoin “frontrunning” basic September blues

In Other Places, others are unfazed by the existing BTC cost weak point, which has actually seen the most affordable levels given that early July return today.

Related: Bitcoin Q2 dip resemblances ‘extraordinary’ as Coinbase Premium turns green

Popular trader Donny informed X fans that BTC/USD is “frontrunning” standard September drawback.

” The scale is various– however the result is the very same. Much greater,” he anticipated while comparing cost action to the 2017 booming market.

Donny included that he saw BTC/USD copying gold after a duration of lag– a timeless relationship that has actually continued to play out in the last few years.

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.