Secret takeaways:

-

Bitcoin prospers when yields increase on financial obligation and inflation worries, however has a hard time when reserve banks tighten up strongly.

-

Today’s bond market tension looks inflation- and debt-driven, recommending BTC might follow gold’s record run with higher-beta gains.

Long-lasting federal government bond yields are ripping throughout the United States, Europe, Japan and the UK, even as reserve banks slash policy rates.

The 30-year United States Treasury is back near 5%, France’s long bond trades above 4% for the very first time considering that 2011, and UK gilts are checking 27-year highs. Japan’s 30-year yield has actually reached record levels, triggering experts to call it the “collapse of worldwide G7 bond markets.”

However what occurs to Bitcoin amidst this worrying macroeconomic outlook? Let’s analyze.

How Bitcoin responded throughout previous yield spikes

History reveals that Bitcoin’s response to increasing federal government bond yields depends upon why yields are climbing up. In some cases it rallies like “digital gold,” other times it has a hard time like a danger property.

Take the 2013 taper temper tantrum.

When the Federal Reserve hinted it would slow its money-printing program, the United States 10-year yield shot towards 3%. Financiers grew nervous about inflation and financial obligation, a belief that lined up with Bitcoin’s cost surge from under $100 to over $1,000.

A comparable story played out in early 2021.

Yields climbed up as market value in greater inflation throughout the post-COVID healing. Bitcoin relocated action with gold, rising to around $65,000 by April.

Nevertheless, in 2018, the result was the opposite.

Yields increased above 3% not due to the fact that of inflation or financial obligation worries, however due to the fact that the Fed was treking strongly. Genuine returns on bonds looked appealing, and Bitcoin plunged by about 85% throughout the exact same duration.

It reveals that Bitcoin acts like a hedging property with more upside when yields increase due to inflation, deficits or excess financial obligation supply. Bitcoin typically has a hard time when yields increase due to the fact that reserve banks are tightening up into development.

Are increasing bond yields bullish for Bitcoin this time?

Bitcoin has actually increased by 4.2% in the previous 3 days, relocating lockstep with a rise in long-lasting Treasury financial obligation in the United States and other G7 countries.

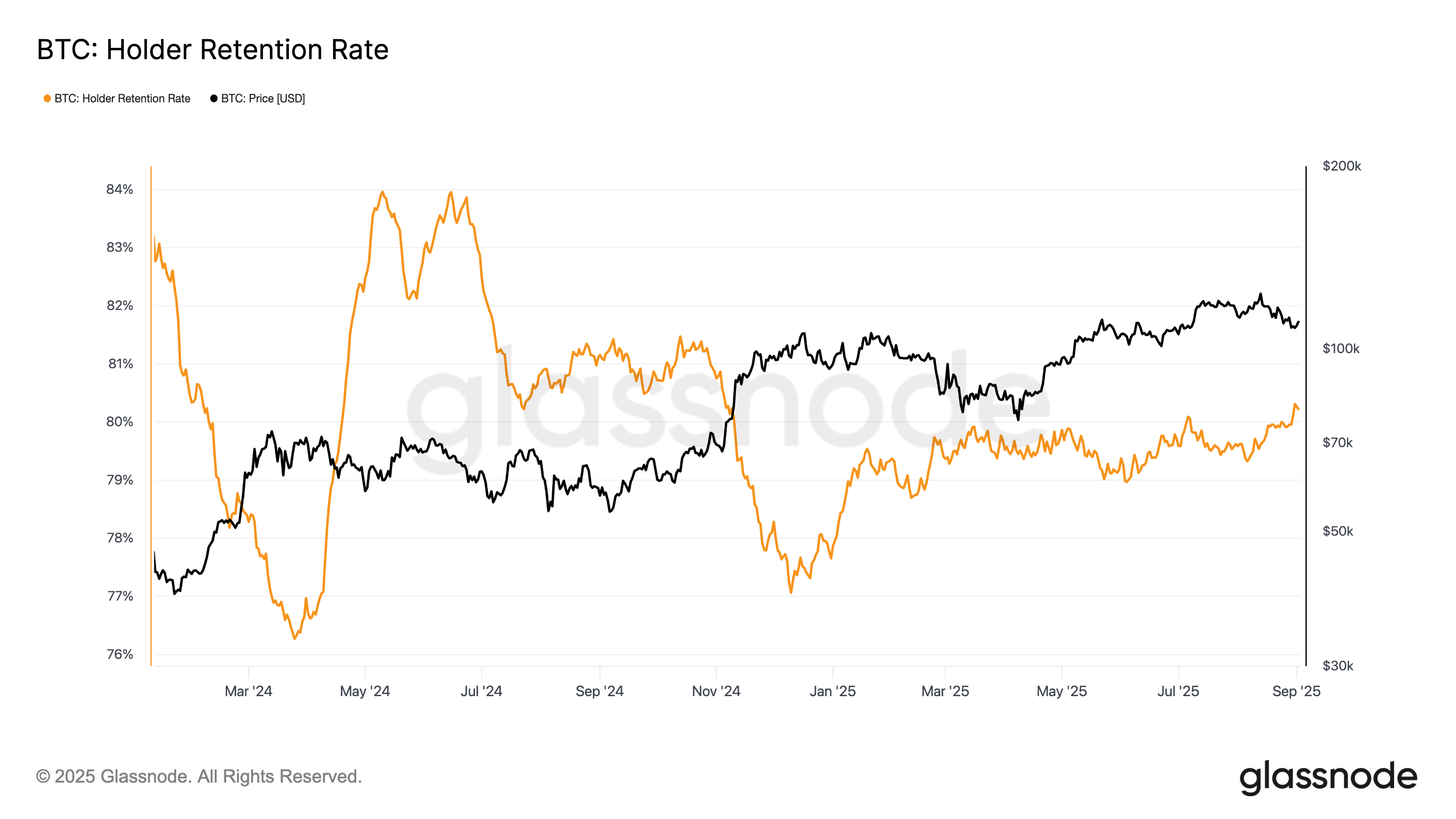

At the exact same time, its holder retention rate is climbing up, revealing that more traders are picking to keep BTC as a hedge rather of selling.

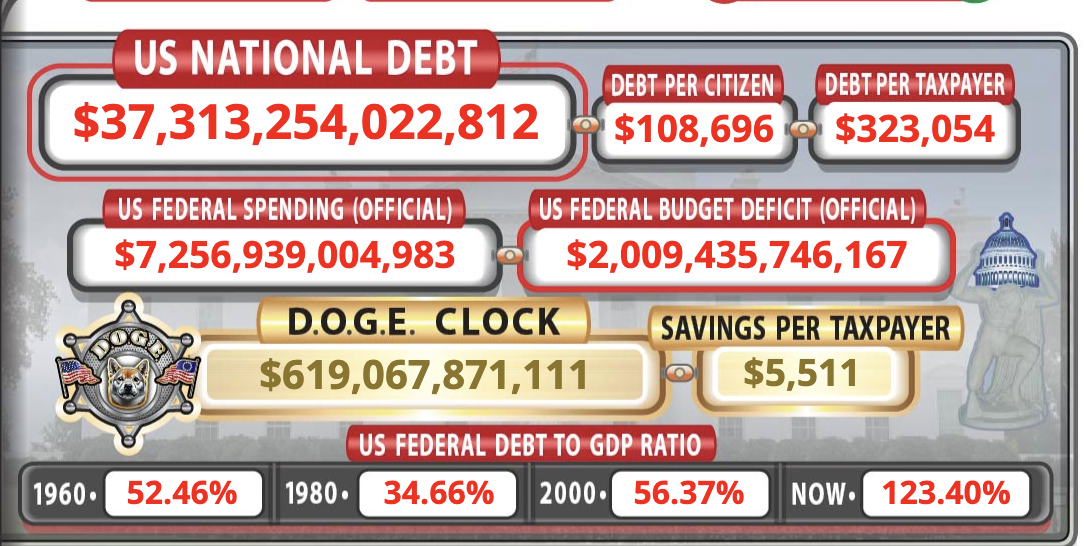

The background is tough to disregard. United States federal government financial obligation leapt from $36.2 trillion in July to $37.3 trillion by September, up by over $1 trillion in simply 2 months.

Throughout the Atlantic, Europe and the UK are dealing with comparable loaning waves.

The outcome has actually been record-sized bond auctions that just clear at greater yields. This is an indication that need for federal government bonds is damaging. UK’s 30-year bond yield, for example, reached its greatest level considering that 1998 on Wednesday.

Gold has actually currently verified the shift in financier habits, far from relying on federal government bonds and towards tough possessions.

The metal’s rise to tape-record highs above $3,500 today reveals that markets are actively hedging versus runaway financial obligation and inflation.

Historically, Bitcoin take advantage of such capital rotations a little later than gold. Once it does, it moves much faster and even more than the rare-earth element, functioning as the higher-beta sanctuary from financial and financial excess.

Related: Winklevoss, Nakamoto-backed Treasury launches with 1,000 BTC

” The reserve banks are losing control of the long end of the curve,” kept in mind Mark Moss, chief of Bitcoin Strategist at UK-based DeFi company Satsuma Innovation, including:

” Appears Like YCC (yield curve control) pertaining to a bond market near you quickly. Going long Bitcoin is such an apparent relocation.”

Lots of experts see Bitcoin reaching a record high of $150,000-200,000 by 2026.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.