Secret takeaways:

-

Possible Federal Reserve rate cuts into weak United States tasks information might sustain Bitcoin’s next rally.

-

BTC holds crucial assistance and eyes $129,000 after rebounding from its wedge pattern.

Bitcoin (BTC) dropped listed below $111,000, matching decreases in the United States stock exchange after the Bureau of Labor Data (BLS) slashed 911,000 tasks from payroll information, the steepest cut considering that 2009.

Could BTC sink even more as United States economic crisis threats grow? Let’s take a look at.

United States stock exchange history recommends BTC owners “will gain the benefits”

The BLS cut 880,000 tasks from the economic sector and 31,000 from the federal government in its March 2025 benchmark modification. Joblessness increased to 4.3%, while companies included just 22,000 tasks in August, versus 75,000 anticipated.

Core Personal Usage Expenses (PCE) inflation held at 2.9%, raising economic crisis threats. Unless the Federal Reserve steps in with looser financial policies.

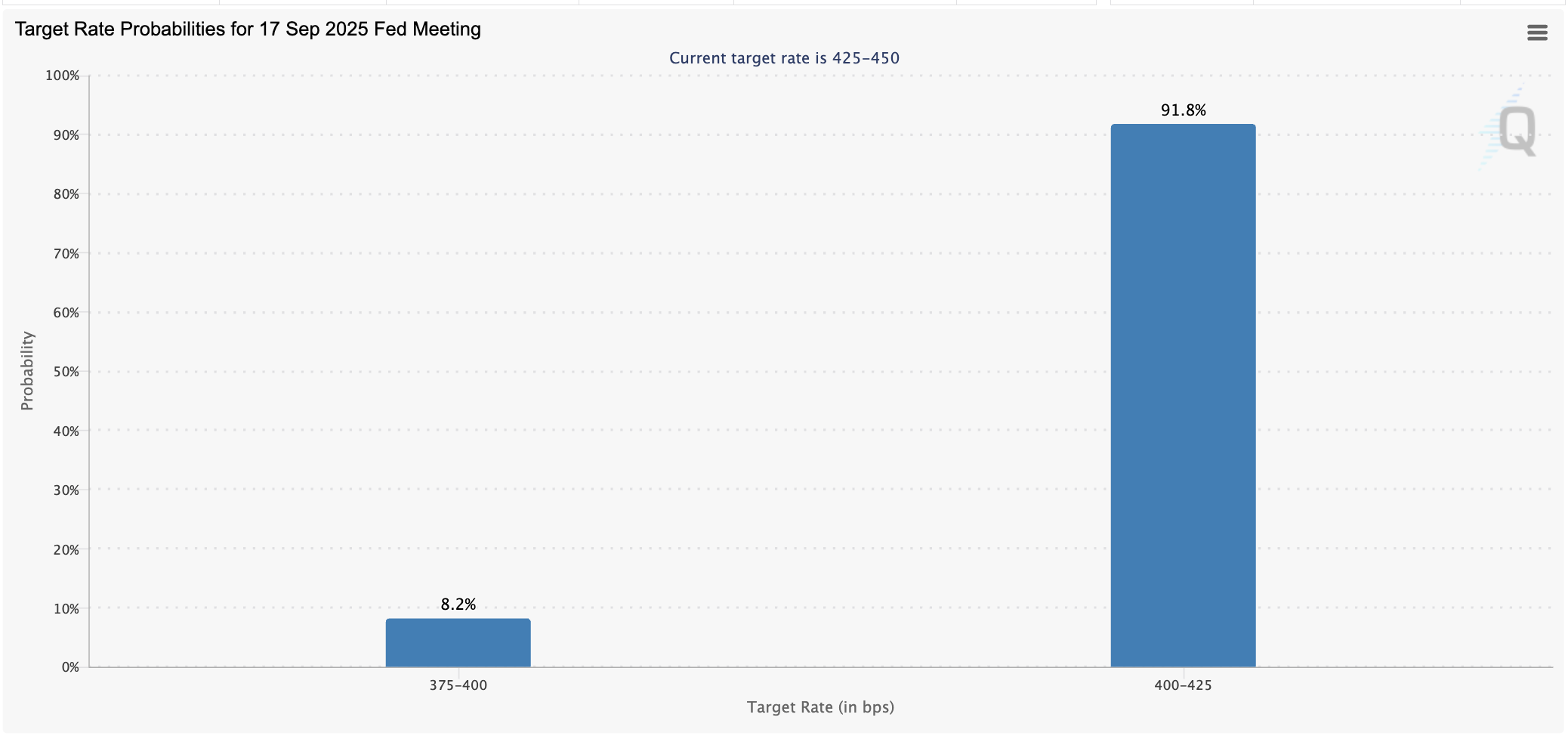

Bond traders are currently wagering that the reserve bank authorities will greenlight a 25 basis point rate cut in September, with chances climbing up towards 92% since Tuesday. 2 more rate cuts might follow by 2025’s end, CME information exposes.

” The Fed will be cutting rates into hot inflation due to the fact that the labor market is weak,” market analyst, The Kobeissi Letter, composed, including:

” Possession owners will gain the benefits.”

History reveals the exact same.

In the 1990– 1991 economic crisis, for example, the United States Federal Reserve slashed rates to 3% from 8.25% even as core PCE hovered around 4% and joblessness reached 6.8%.

Stocks at first fell by over 20% however rebounded more than 30% the list below year as more affordable Fed credit restored development.

In 2025, gold has actually risen 40% in the months leading up to the BLS modification, with the Kobeissei Letter keeping in mind that the metal traders have “priced-in [weaker job numbers] for months” currently.

Bitcoin has actually leapt 20.30% up until now in 2025 under comparable conditions, and might mirror gold’s cost rally if the history of their delayed connection is any indicator.

Related: Bitcoin taps $113K as analysis sees ‘go back to highs’ on Fed rate cut

Can Bitcoin increase to a brand-new record high?

Technically, Bitcoin looks primed to break above its record high of $124,500.

The cryptocurrency has actually rebounded from the increasing wedge’s lower trendline, recommending bulls are restoring control with an upside target near the 1.618 Fibonacci extension at $129,000, a possible 12% to 15% gain.

At the exact same time, Bitcoin continues to trade above its 20-week EMA (the red wave at around $108,500), strengthening the bullish outlook and verifying strong assistance underneath existing levels.

A definitive close above the $115,000–$ 116,000 resistance zone might bring the purchasers back, speeding up the rally towards brand-new all-time highs and marking the next leg of Bitcoin’s bull cycle.

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.