Secret takeaways:

-

XRP’s failure to hold $3 indicate an ongoing drawback danger to $2.40-$ 2.00.

-

Whales continue to offer XRP.

-

Decreasing daily active addresses signal minimized deal activity and liquidity.

XRP (XRP) rate flashes alerting indications listed below $3 as bearish technical patterns emerge on its everyday chart, accompanying selling by whales and decreasing network activity.

XRP rate charts mean more drawback

XRP rate has actually been forming a coming down triangle pattern on its everyday chart given that its rally to $3.66 multi-year highs, defined by a flat assistance level and a downward-sloping resistance line.

The current breakout above the triangle’s upper trendline was a fakeout as bulls had a hard time to keep the rate above $3, signifying an absence of strength.

Related: XRP reserves increased by 1.2 B in a day: Is it build-up or indications of a sell-off?

For that reason, failure to recover $3 quickly, where the 50-day SMA sits, might sink the XRP/USDT set to the next assistance at $2.70.

Even More down, the list below levels to view are the 200-day SMA at $2.50 and, later on, the drawback target of the triangle at around $2.06, down 31% from existing rate levels.

Additionally, XRP’s coming down triangle analysis is accompanied by a bear flag on the very same timespan, which cautions of a possible decrease to as low as $2.40, after the assistance at $3 was lost.

As Cointelegraph reported, if the rate recovers $3, purchasers will then attempt to resume the uptrend by pressing the XRP above the flag’s upper border at $3.20. If they do that, the XRP rate might rally to $3.40 and consequently to $3.66.

Whales unload XRP at $3

Onchain information reveals that big financiers scheduled earnings on the current rally to $3.10.

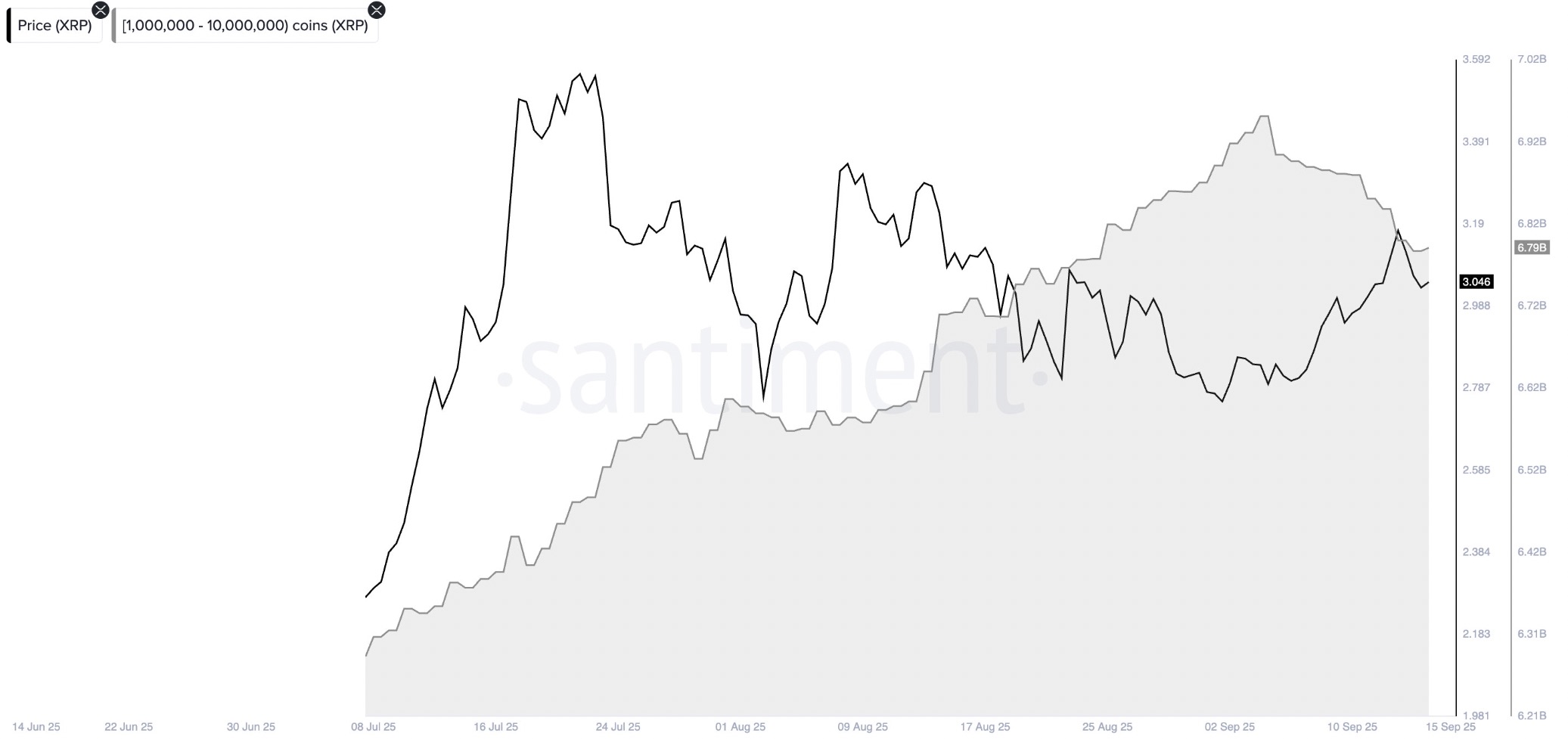

The Supply Circulation metric programs a sharp drop in the supply held by entities with a 1– 10 million balance. These addresses now own 6.79 billion XRP supply, marking a six-week low.

The chart listed below programs that these whales have actually unloaded over 160 million XRP tokens worth over $476 million at existing costs in the last 2 weeks.

This highlights that the huge financiers are most likely expecting lower costs in the future regardless of upcoming area ETF approvals and Fed rate cuts.

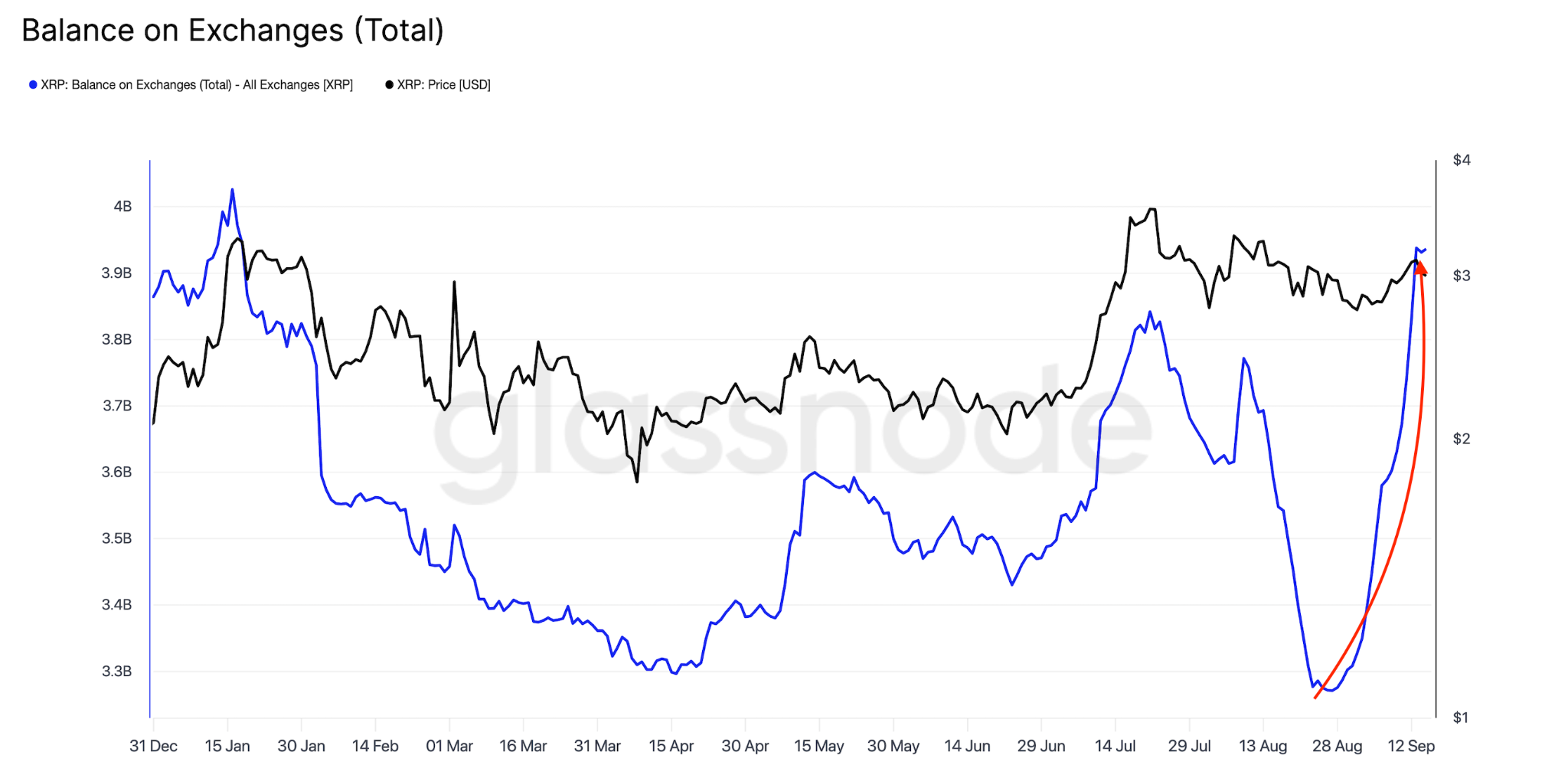

On the other hand, a substantial increase in XRP exchange reserves contributes to the headwinds, information from Glassnode exposes.

The chart listed below programs that the XRP balance on exchanges increased by 665 million tokens to 3.94 billion on Monday from 3.3 billion on Aug. 27, increasing the supply readily available for offering.

Decreasing XRP Journal network activity

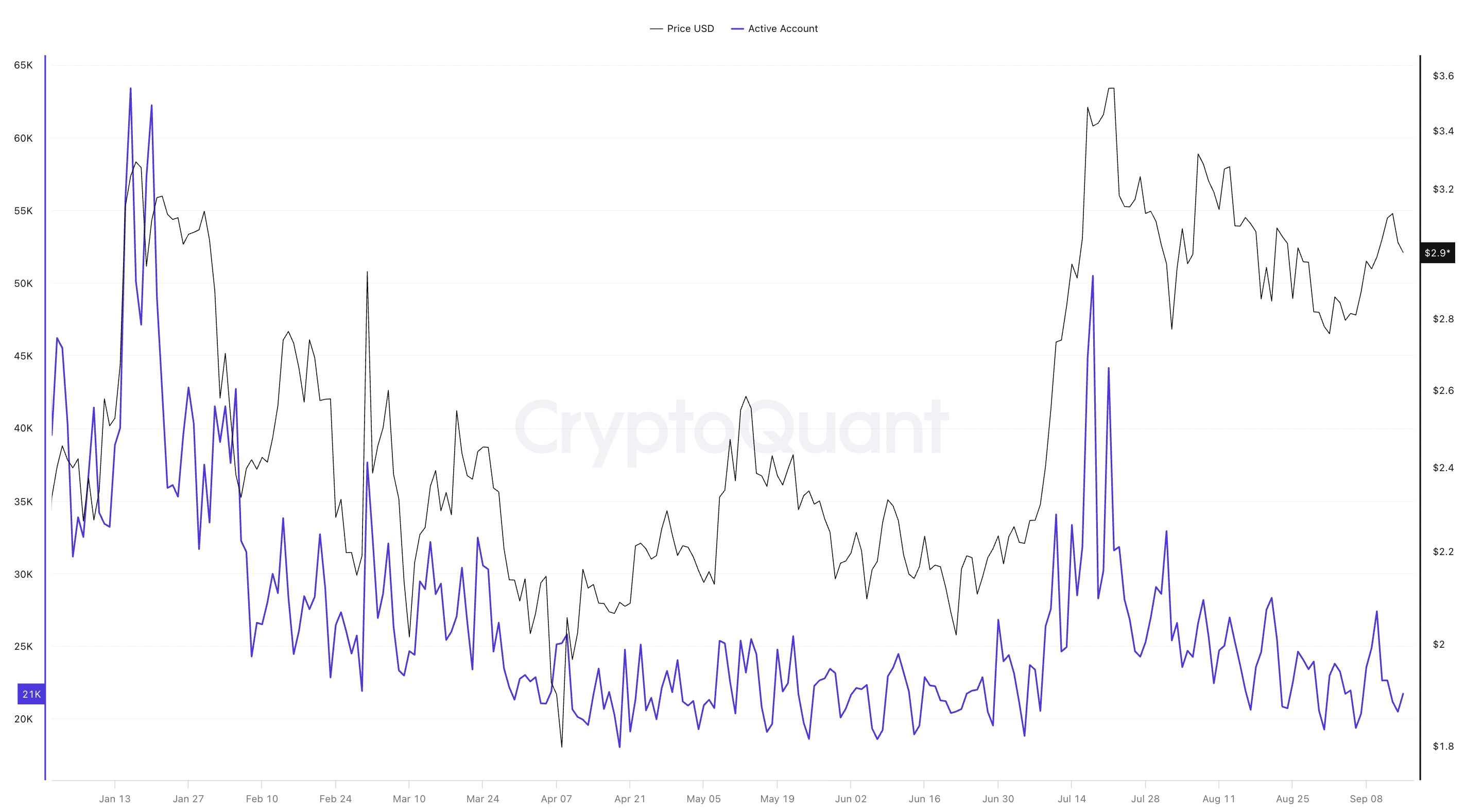

The XRP Journal has actually seen a substantial drop in network activity over the last 2 months. Onchain information from CryptoQuant reveals that the everyday active addresses (DAAs) are far listed below the July 18 peak of 50,482 DAAs.

With just around 21,000 daily active addresses at the time of composing, user deals have actually decreased substantially, perhaps signifying minimized interest or an uncertainty in XRP’s near-term outlook.

New addresses have actually likewise dropped from a 2025 high of 11,000 everyday to the existing count of 4,300 over the very same duration, recommending decreasing network adoption and user engagement.

Historically, decreases in network activity generally signal approaching rate stagnancy or drops, as lower deal volume lowers liquidity and purchasing momentum.

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.