Secret takeaways:

-

Bitcoin futures open interest fell $2 billion in 5 days, signifying careful futures traders.

-

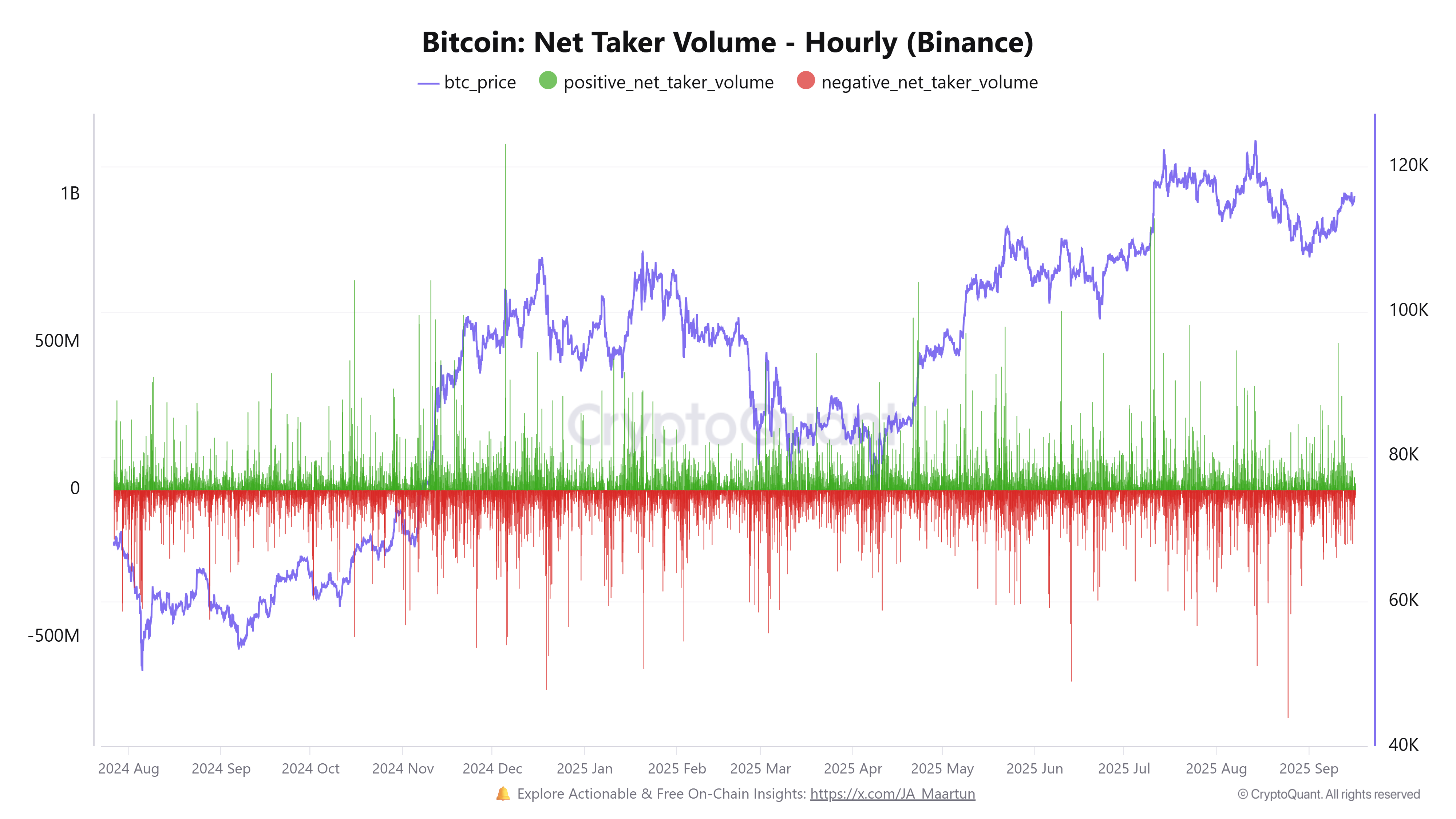

Binance taker volume averages cycle lows as the marketplace waits on Fed’s rate of interest choice.

-

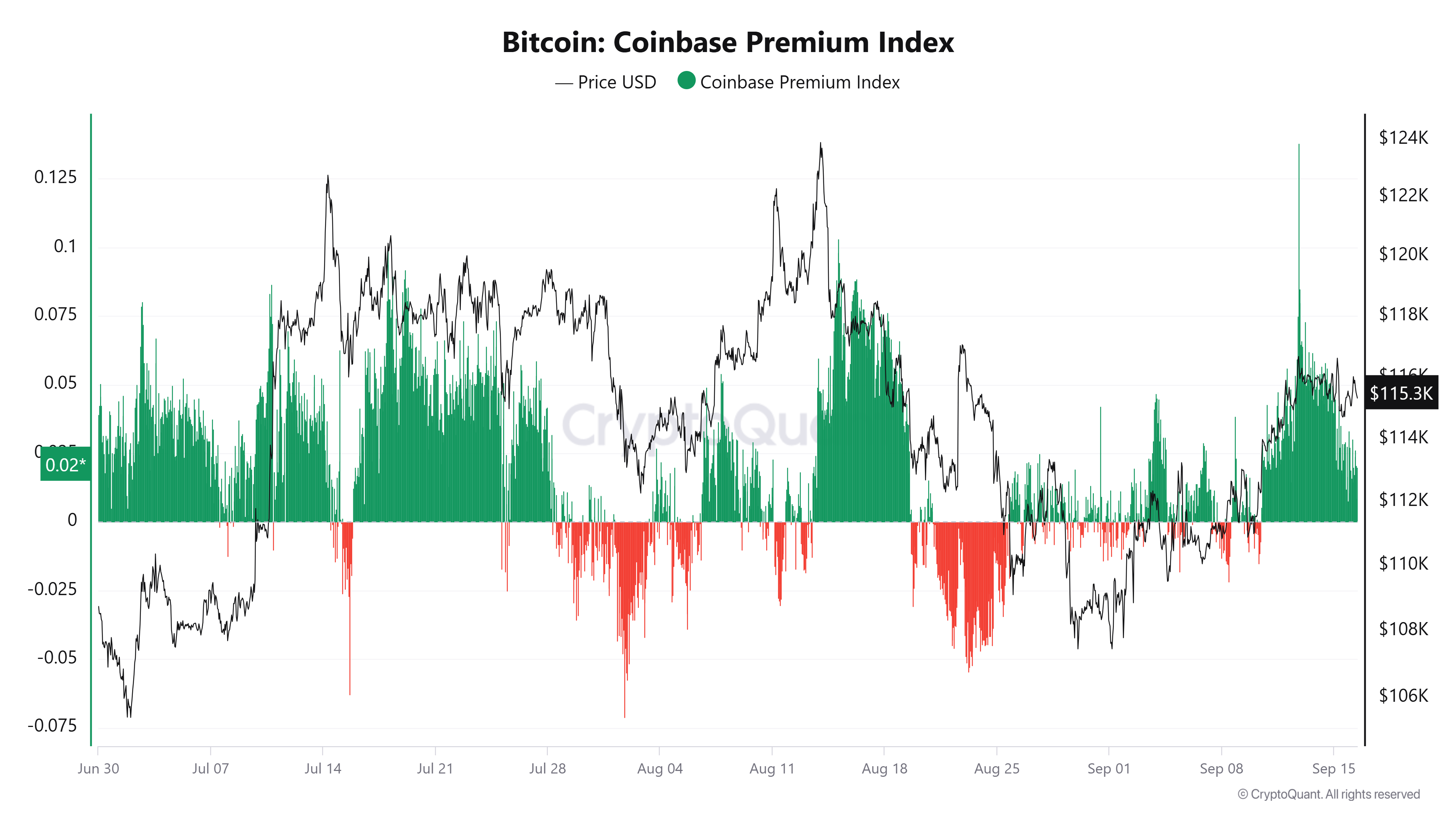

The Coinbase premium recommends stable United States need protecting $115,000.

Bitcoin (BTC) traders seem downsizing direct exposure ahead of the United States Federal Reserve’s policy choice today, with onchain and derivatives information revealing a noteworthy decrease in utilize along with indications of stable purchasing need around the $115,000 mark.

Bitcoin open interest has actually slipped by $2 billion given that last Friday, dropping listed below $40 billion from $42 billion. The decrease follows Bitcoin briefly peaked near $116,700 on Monday. Along with this, aggregate futures volume has actually been minimal, recommending an absence of aggressive placing in either instructions as futures traders stay careful.

The financing rate, a step of the expense of holding positions in continuous futures, is likewise on a down trajectory. Significantly, the London session on Tuesday saw the sharpest per hour financing spike given that August 14, a relocation that at that time accompanied a regional top.

According to crypto expert Maartunn, per hour net taker volume on Binance has actually fallen listed below $50 million, well listed below the normal $150 million average. Such suppressed activity indicate a sidelined market, with individuals awaiting clearness from the Fed before fresh capital positions.

Related: Bitcoin deals with resistance at $118K, however ETFs might press BTC cost greater

Coinbase premium signals strong need at $115,000

While derivatives traders go back, area need on Coinbase is informing a various story. The Coinbase premium, the cost distinction in between Bitcoin on Coinbase and other exchanges, has actually been gradually increasing given that last Tuesday. This pattern shows robust United States financier need, with the existing purchasing cluster the greatest given that early August. The circulations recommend that purchasers are actively protecting the $115,000 level.

More comprehensive belief indications likewise show this balance in between care and peaceful self-confidence. The Bitcoin Bull Rating, which tracks shifts in market momentum, has actually rebounded to a “neutral” 50 from a “bearish” reading of 20 over the previous 4 days. This recommends that offering pressure is relieving, with the marketplace getting in a more well balanced stage ahead of the Fed statement.

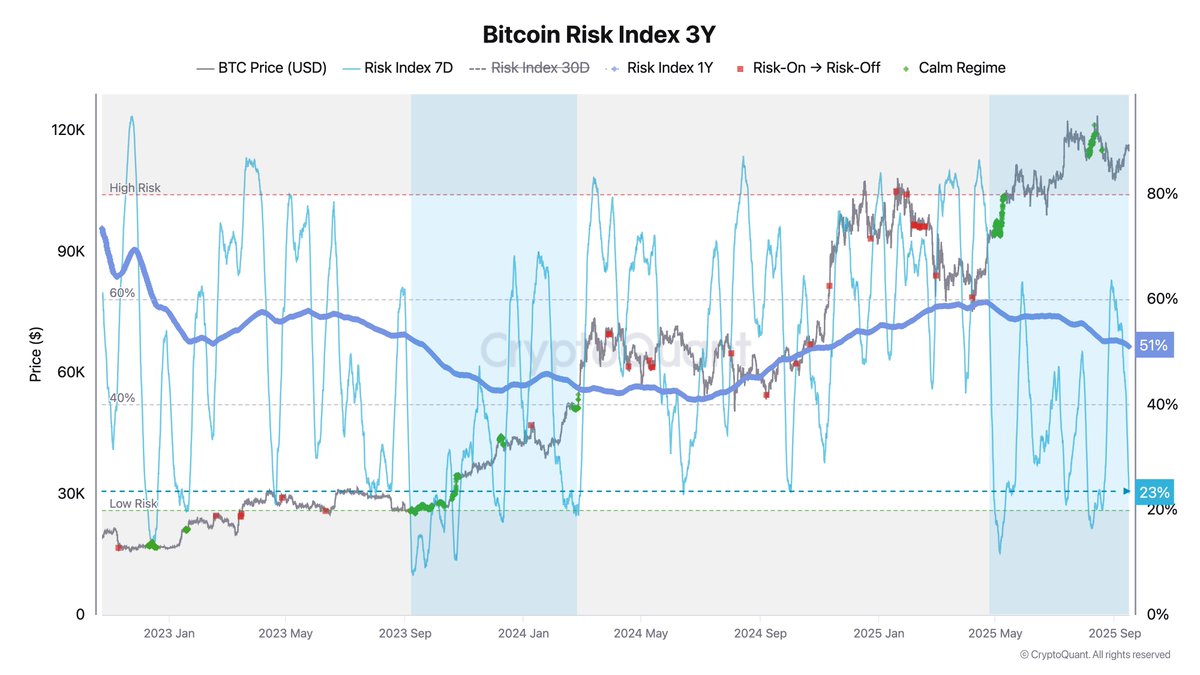

On The Other Hand, the Bitcoin Danger Index, tracked by expert Axel Adler Jr., sits at 23%, near cycle lows. The metric assesses the relative risk of sharp pullbacks compared to the previous 3 years.

Adler notes that low readings represent “calmer environments” with a lowered probability of quick liquidations. A comparable setup last took place in between September and December 2023, when Bitcoin traded gradually before getting in a brand-new uptrend.

Related: Bitcoin cost drop to $113K may be the last huge discount rate before brand-new highs: Here’s why

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.