The next wave of institutional adoption of cryptocurrencies is becoming developed fintech companies start developing their own blockchains.

Monetary services app Robinhood just recently revealed that it is developing its own layer-2 blockchain to support tokenized stocks and real-world properties, while Stripe followed with prepare for Pace, a payments-focused chain developed with Paradigm.

” That’s going to be the start of lots of others to come,” Annabelle Huang, co-founder of Altius Labs, informed Cointelegraph in an interview. “The fintechs in Asia, Latin America and other emerging markets that have actually checked out this for several years now are likewise preparing to make more relocations.”

Huang has actually endured the phases of crypto’s steady courtship with Wall Street. After beginning her profession trading forex and rates in New york city, she signed up with Amber Group in Hong Kong as its handling partner and assisted scale it into among Asia’s biggest crypto liquidity suppliers throughout the decentralized financing (DeFi) boom.

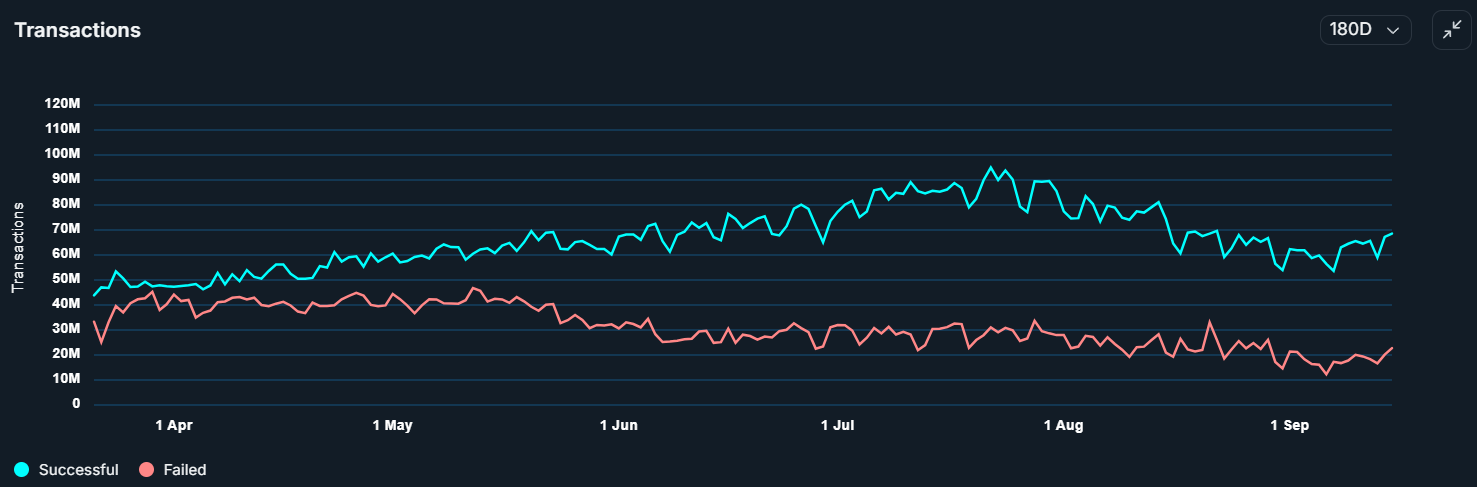

The new age of fintech-led blockchains deals with the very same efficiency problems that have actually dogged crypto given that its beginning. Wall Street companies sell split seconds, while blockchains still procedure deals in seconds or, at best, milliseconds. Huang called this the market’s “execution traffic jam” and argued it should be cleared before fintech-built chains can bring the weight of institutional capital.

Execution traffic jam in crypto’s course to institutional adoption

Given that leaving Amber Group, Huang has actually turned her focus to fixing the execution traffic jam. With Altius Labs, she is developing a modular execution layer developed to plug straight into existing blockchains, enhancing throughput without requiring tasks to reconstruct their whole stack.

” Our objective is to bring efficiency to any blockchain in a plug-and-play method,” Huang stated. “That method, a chain can update its block execution time and throughput without needing to revamp its whole architecture.”

She explained the method as bringing modularity deeper into the execution layer of the blockchain stack, which is a departure from the normal design of spinning up sidechains or brand-new layer twos. By concentrating on the execution engine itself, Huang argues that Web3 can close the space with Web2-level efficiency while protecting the dispersed nature of blockchains.

Related: Firedancer will accelerate Solana, however it will not reach complete capacity

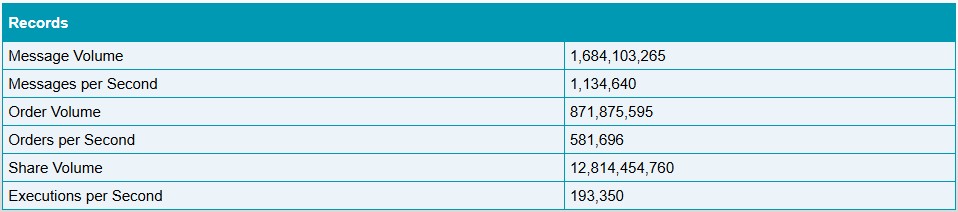

On June 27, 2025, Wall Street revealed simply how huge the efficiency space is in between modern-day blockchains and conventional financing facilities. Nasdaq’s closing auction for the yearly Russell index reconstitution– an occasion when index funds reshuffle their holdings– matched 2.5 billion shares in simply 0.871 seconds. The exchange’s INET system is marketed to manage more than 1 million order messages per 2nd with sub-40-microsecond latency.

By contrast, blockchains still run at a portion of that speed. Ethereum procedures about 15 deals per 2nd with block times of around 12 seconds. Solana– among the fastest significant networks– has an approximately 400-millisecond block time and manages numerous thousand deals per second in practice. Even at their finest, those figures do not satisfy the criteria organizations anticipate before moving significant trading activity onchain.

Blockchains have actually enhanced scaling, with Ethereum L2s unloading traffic to rollups. Solana’s next-generation validator customer, Firedancer, intends to narrow the space even more.

Huang declared that the market ought to not anticipate more “Ethereum killers” or general-purpose blockchains to emerge, including that users choose to combine around a couple of dominant platforms instead of spread throughout lots of brand-new chains.

” However within Ethereum, there was still the scalability problem, which’s why individuals began spinning up brand-new block areas by establishing sidechains. And after that L2s presented extra fragmentation and hard UI/UX since of it,” she stated.

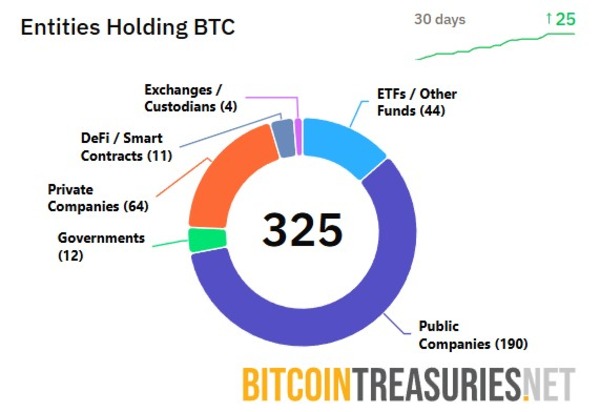

Institutional adoption in ETFs and treasuries

Though the next wave of institutional adoption requires enhancements on existing blockchain networks, Wall Street hasn’t awaited these technical upgrades before stacking into the digital gold rush. For lots of big financiers, direct exposure has actually come indirectly through exchange-traded funds (ETFs) or business treasuries. Bitcoin (BTC) funds have actually ended up being simple entry points, while business like Technique (previously MicroStrategy) have actually turned themselves into leveraged proxies for the possession.

The plan hasn’t worked for everybody. Throughout 2025, having a hard time companies acquired the “Bitcoin treasury” story as a desperate method to stimulate financier interest. Some briefly saw their stock rates rise, just to backtrack not long after. The weak financial resources of a few of these business have actually likewise raised issues about what may take place if they fail throughout undesirable market conditions.

Huang stated these pivots can be dangerous, particularly for retail financiers, since not all business Bitcoin methods are structured the very same method. She compared the stock spikes to token launches– a preliminary bid-up, followed by a go back to “reasonable worth.” Nevertheless, she argued that need for proxies like ETFs and treasury methods will continue to exist.

Related: Bitcoin treasury flops: These companies fumbled their BTC bets

” Before MicroStrategy, there was Grayscale. Everybody presumed that when a Bitcoin ETF was authorized, the Grayscale premium would vanish, therefore would the MicroStrategy trade. However if you look more detailed, financiers still choose MicroStrategy over an ETF for a couple of factors,” Huang stated.

” First, since Michael Saylor has actually been collecting for a longer duration, their typical expense basis is lower. Second, they have actually done numerous rounds of fundraising through convertible bonds, which presents utilize. That makes MicroStrategy successfully a somewhat levered play on Bitcoin at a lower expense basis,” she included.

Huang likewise stated that while ETF choices exist for Bitcoin and Ether (ETH), financiers who desire altcoin direct exposure frequently turn to financial obligation methods rather.

Fintech chains are forming the next phase of institutional adoption

Fintechs like Robinhood and Stripe are ending up being the next phase of institutional blockchain dedication. Instead of including crypto tickers to trading apps, they are now buying their own blockchains– an action towards embedding digital properties into their core facilities.

The facilities around them is moving too. Over the counter desks, when discreet on-ramps for hedge funds to purchase Bitcoin off-exchange, are now placing themselves as controlled liquidity suppliers.

In practice, that indicates using the compliance, settlement and reporting requirements that institutional customers anticipate, bringing crypto one action more detailed to Wall Street standards.

” What we’re seeing now– and I anticipate much more moving forward– is a pattern of organizations embracing stablecoins or perhaps developing their own blockchains for particular usage cases,” Huang stated.

These are discussions she was having with institutional gamers 4 years earlier at Amber Group. Now, “they’re lastly all set to act.”

Publication: Fulfill the Ethereum and Polkadot co-founder who wasn’t in Time Publication