Secret takeaways:

-

Experts see a 70% possibility that Bitcoin strikes fresh highs within 2 weeks.

-

Area ETF inflows and bullish futures premiums strengthen the upside outlook.

-

Internal liquidity near $114,000-$ 113,000 might stimulate a short pullback before a breakout.

Bitcoin (BTC) is setting the phase for a prospective rally, with experts indicating a 70% possibility that the cryptocurrency might press towards fresh all-time highs within the next 2 weeks. According to Bitcoin scientist Axel Adler Jr., market conditions are presently well balanced and primed for a relocation higher.

Adler Jr. highlights that the Short-Term Holder (STH) MVRV Z-Scores for both 155-day and 365-day mates are hovering near no, suggesting that the marketplace is neither overheated nor oversold. With BTC trading simply above the STH recognized cost, the setup recommends a one-to-two-week debt consolidation stage might precede a breakout. “Uptober inbound,” Adler Jr. kept in mind, indicating seasonal tailwinds.

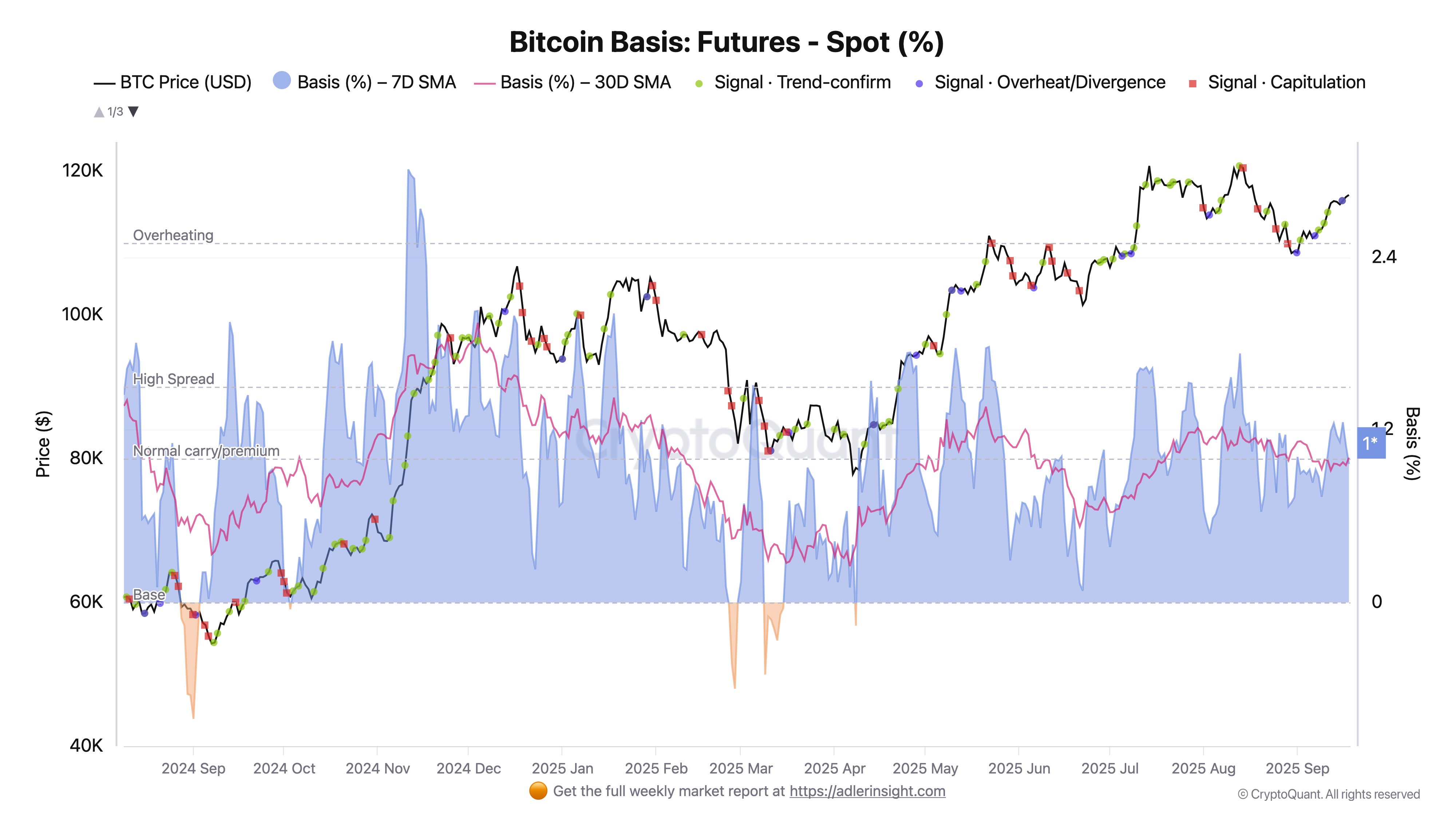

Derivatives information even more strengthens the useful outlook. Bitcoin futures are trading at a constant premium to area, with the seven-day basis running above the 30-day, a structure usually related to bullish patterns. Nevertheless, Adler Jr. warned that small getting too hot signals appeared ahead of the current FOMC occasion, where expense basis increased on light volume, recommending some late-stage positioning.

Still, the base case stays slanted towards strength. “There’s a 70% possibility the next 2 weeks will see a step-by-step uptrend or sideways debt consolidation,” Adler Jr. discussed.

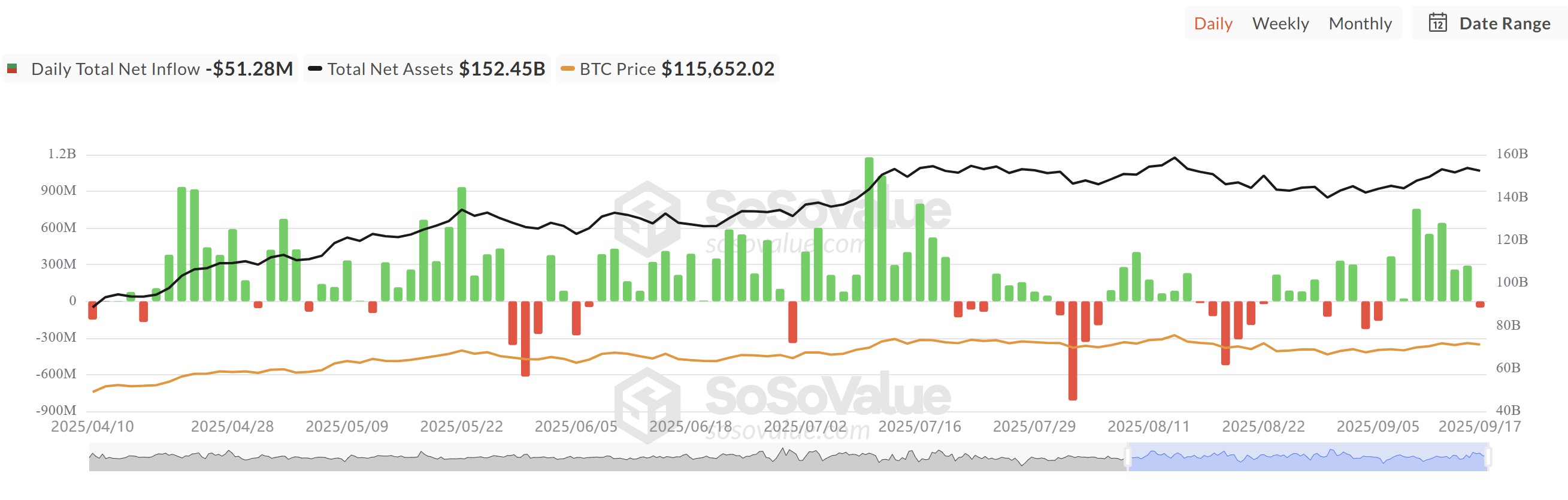

On the other hand, institutional need stays a company anchor as United States area Bitcoin ETFs have actually brought in $2.8 billion in net inflows because Sept. 9, pressing activity decisively into favorable area. With inflows supporting BTC cost and technical indications lining up, traders are bracing for what might be a specifying stretch in Bitcoin’s next bullish leg.

Related: Bitcoin to check all-time high ‘rapidly’ if bulls recover $118K: Trader

Does Bitcoin stop briefly for a dip, or break straight towards $124,000?

Bitcoin has actually rallied 8.5% this month, reaching $117,800 from $107,000 ahead of the Federal Reserve’s rates of interest choice. The consistent increase has actually left pockets of internal liquidity, recommending the possibility of a short-term pullback before extension. September’s seasonality, traditionally leaning bearish, includes weight to this situation.

That being stated, Bitcoin’s more comprehensive habits in 2025 has actually mostly defied expectations for retracements. For much of the year, the possession has actually avoided over internal liquidity levels, rather moving in between external liquidity zones, i.e., swing low and high on greater amount of time charts over numerous weeks. An equivalent relocation took place in July, when BTC bypassed liquidity near $105,000 and rapidly rose to brand-new highs after verifying an everyday break of structure (BOS).

A comparable setup seems forming now. If Bitcoin protects an everyday close above $117,500, it would validate another BOS and dramatically minimize the chances of a dip listed below $114,000. Such an advancement would likewise line up with expert Axel Adler Jr.’s forecast of brand-new all-time highs within the next 2 weeks.

While a narrow window stays for a retest of order obstructs near $114,000–$ 113,000, enhancing macroeconomic conditions and speeding up ETF inflows recommend purchasers might action in earlier, restricting disadvantage chances. The balance in between structural liquidity spaces and bullish momentum might choose whether Bitcoin stops briefly or breaks straight towards $124,000.

Related: Knocking Bitcoin’s absence of yield reveals your ‘Western monetary benefit’

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.