Bottom line:

-

Bitcoin futures purchase volume suggests that traders are ending up being progressively long-lasting bullish on BTC this month.

-

The $110,000 “space” in CME Group’s Bitcoin futures stays unfilled.

-

Bitcoin ETF choices experience a spike in appeal as IBIT open interest nears $40 billion.

Bitcoin (BTC) derivatives traders are turning “strongly long” as rate squeezes closer to all-time highs.

In a brand-new analysis launched on X Friday, J. A. Maartunn, a factor to the onchain analytics platform CryptoQuant, exposed a substantial shift in Bitcoin futures in October.

Bitcoin futures purchase volume rises in October

Bitcoin futures markets are going through a change in belief as October gets underway.

As Maartunn revealed, net buy volume has actually risen, and is now outmatching net sell volume by $1.8 billion.

” Futures purchasers are stepping up,” he commented along with a CryptoQuant chart of net taker volumes on the biggest crypto exchange, Binance.

The post was a reaction to observations by CryptoQuant CEO Ki Young Ju, who kept in mind that Bitcoin’s most current regional highs began the back of continual buy momentum amongst derivative-market whales.

” A clear indication of aggressive long positioning,” Maartunn included.

Simply days back, futures markets were striking the headings for the opposite factor.

A weekend “space” left in CME Group’s Bitcoin futures had actually ended up being a brand-new short-term BTC rate correction target for traders, lying simply above $110,000, per information from Cointelegraph Markets Pro and TradingView.

Regardless of spaces being filled within weeks or days in current months, sellers stopped working to start a deep adequate retracement today.

As Cointelegraph reported, strategies are afoot at CME to make Bitcoin futures trade all the time, getting rid of the “space” phenomenon.

Bloomberg expert: Bitcoin ETFs are “no joke”

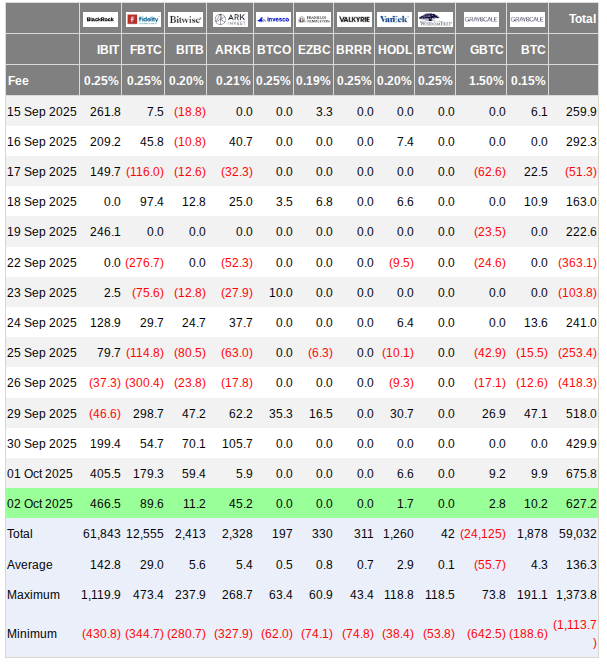

The United States area Bitcoin exchange-traded funds (ETFs), on the other hand, took in more than $600 million throughout Thursday’s Wall Street trading session.

Related: Bitcoin’s next stop might be $125K: Here’s why

With the week’s overall at $2.25 billion at the time of composing, ETF information continued to amaze.

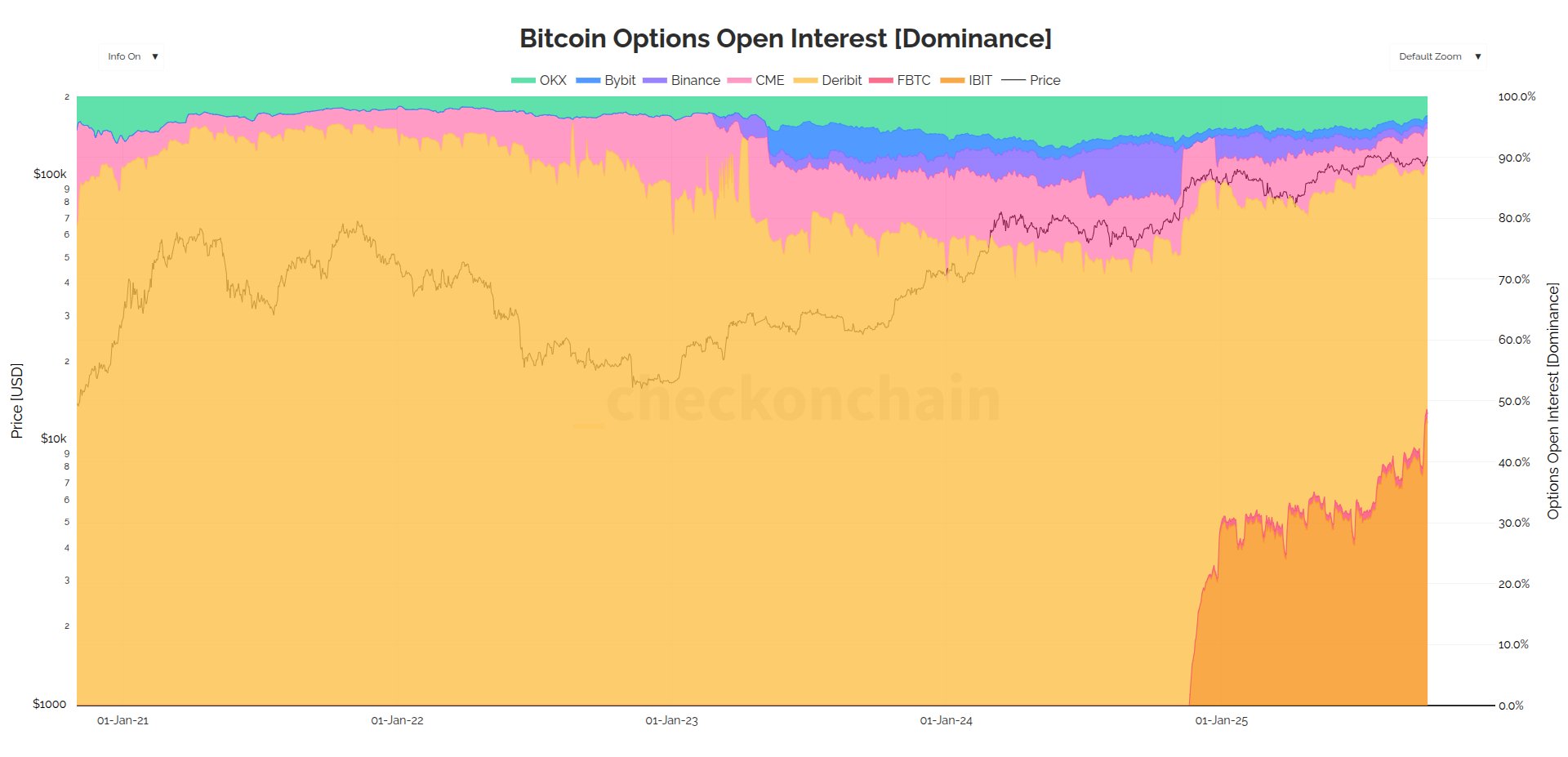

In an X post Friday, James Inspect, developer of onchain information resource Checkonchain, flagged rising development in choices on the biggest area ETF, BlackRock’s iShares Bitcoin Trust (IBIT).

” The development of IBIT choices is the least gone over, however a lot of substantial markets structure shift for Bitcoin considering that the ETFs themselves,” he argued.

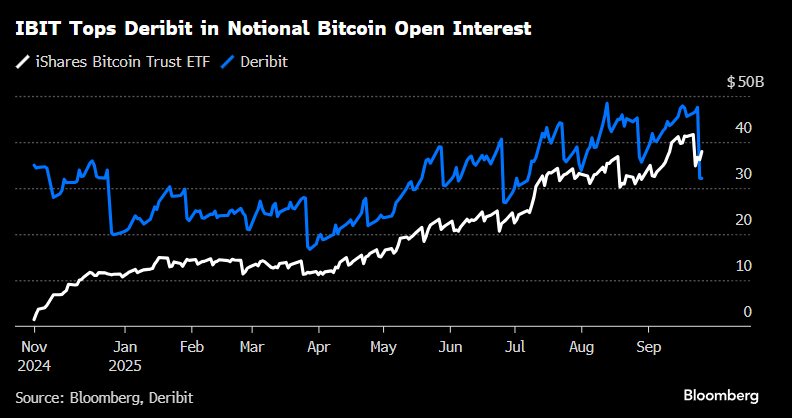

” Not just did IBIT exceed Deribit, however Alternatives are now bigger then futures by open interest.”

Eric Balchunas, a devoted ETF expert for Bloomberg, at first reported on IBIT exceeding Coinbase’s Deribit, with the previous’s open interest now at $38 billion.

” I informed y’ all ETFs are no joke. Fat crypto margins in difficulty,” he concluded.

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.