UPS (NYSE: UPS) stock has actually been moving for more than 1,300 days, and under the lens of the Adhishthana Concepts, the outlook stays far from motivating. Here’s a breakdown of where the stock bases on its weekly cycle and what lies ahead.

UPS and the Guna Triads

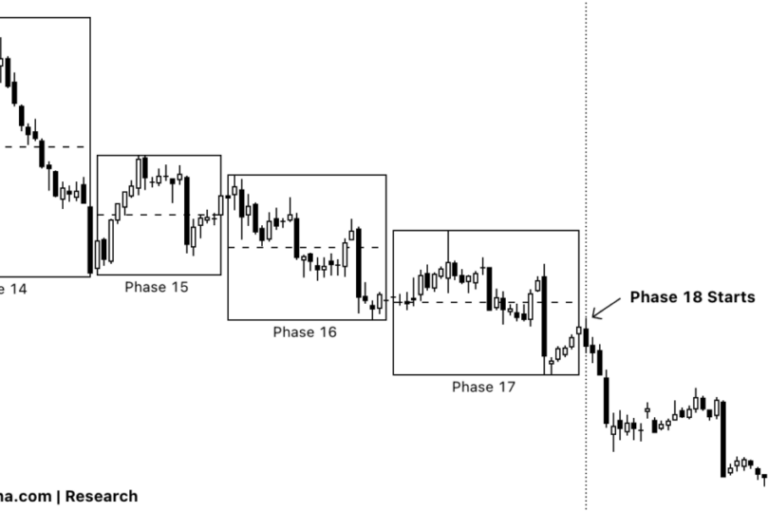

In the Adhishthana structure, Phases 14, 15, and 16 together form the Guna Triads. These stages choose whether a stock will reach Nirvana in Stage 18, the peak of its cycle.

For a Nirvana relocate to emerge, the triads need to show Satoguna, a tidy, sustainable bullish rally. Without it, no Nirvana can emerge.

As I laid out in Adhishthana: The Concepts That Govern Wealth, Time & & Catastrophe:

” Without obvious Satoguna in any of the triads, no Nirvana can emerge in Stage 18.”

UPS entered its triads in April 2023. Throughout the whole structure, the stock stopped working to reveal any significant bullishness. This dismiss the possibility of a Nirvana relocation in Stage 18. Rather, weak point controls.

The stock formally went into Stage 18 on the weekly chart in March 2025, and the effect is currently noticeable. Ever since, UPS is down ~ 32% and continues to move. With Stage 18 lasting till August 2026, this sluggishness is anticipated to continue.

Financier Outlook

With weak triads and no Satoguna, UPS is set to slog through Stage 18 under bearish pressure. Financiers need to remain careful. Those thinking about a buy might wish to look the other method, as the cycle recommends no significant healing remains in sight.

For alternatives traders, nevertheless, this weak structure provides chances. Bearish or range-bound credit spreads might gain from UPS’s most likely trajectory.

Likewise Check Out: Banco Macro Stock Under Pressure As Outlook Dims

Benzinga Disclaimer: This post is from an unsettled external factor. It does not represent Benzinga’s reporting and has actually not been modified for material or precision.