US-listed area Bitcoin exchange-traded funds (ETFs) started the traditionally bullish month of October with their second-best week of inflows given that launch, indicating restored financier optimism.

Area Bitcoin (BTC) ETFs tape-recorded $3.24 billion worth of cumulative net favorable inflows over the previous week, almost matching their record of $3.38 billion in the week ending Nov. 22, 2024, according to information from SoSoValue.

The figure marks a sharp rebound from the previous week’s $902 million in outflows. Experts associated the turn-around to growing expectations of another United States rates of interest cut, which has actually enhanced belief towards danger possessions.

Growing expectations of another United States rates of interest cut set off a “shift in belief,” drawing in restored financier need for Bitcoin ETFs, “bringing four-week inflows to almost $4 billion,” Iliya Kalchev, dispatch expert at digital possession platform Nexo, informed Cointelegraph. “At present run-rates, Q4 circulations might retire over 100,000 BTC from flow– more than double brand-new issuance.”

” ETF absorption is speeding up while long-lasting holder circulation relieves, assisting BTC construct a more powerful base,” near crucial technical assistance levels, he included.

Related: Wall Street’s next crypto play might be IPO-ready crypto companies, not altcoins

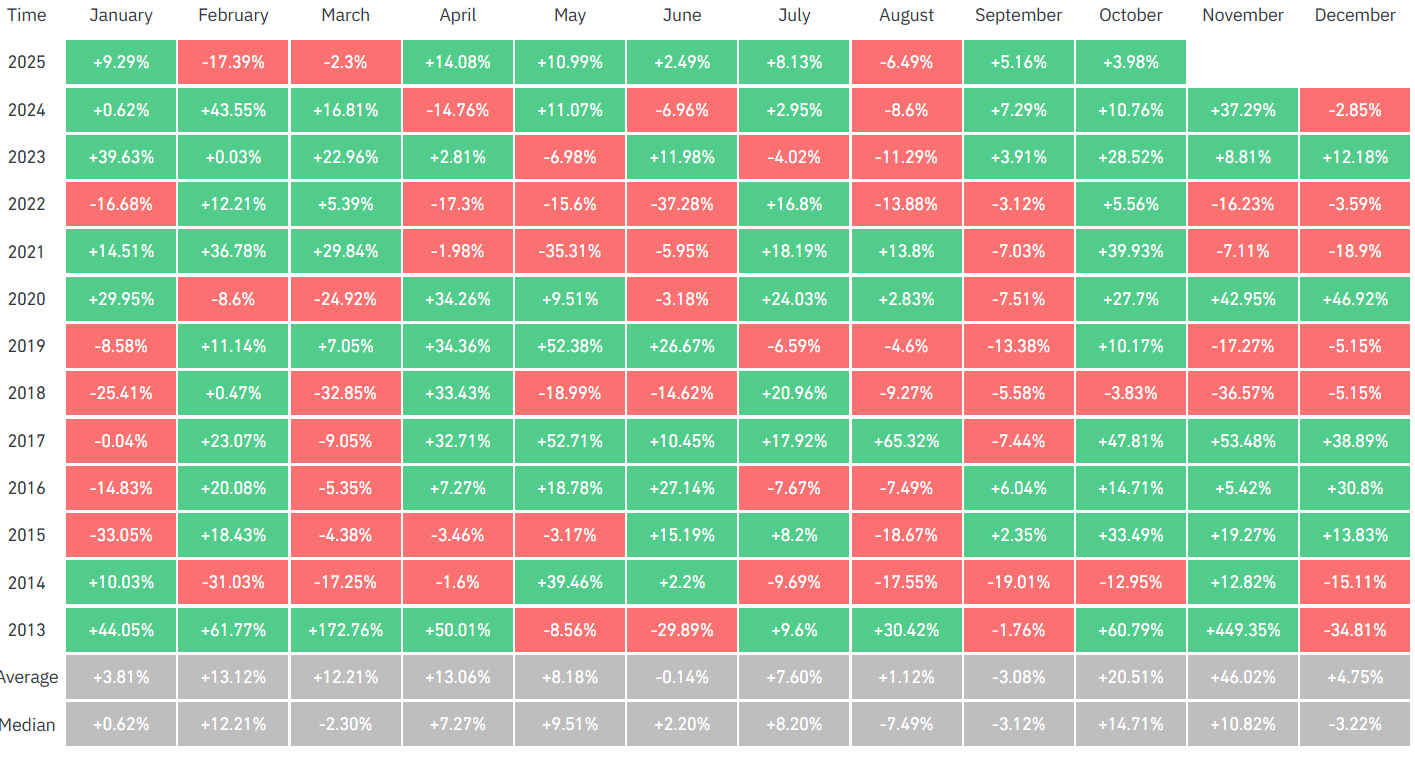

Continued ETF inflows might supply substantial tailwinds for Bitcoin in October, which is the second-best month for Bitcoin in regards to typical historic returns, typically described as “Uptober” by crypto financiers.

Today’s $3.2 billion briefly pressed Bitcoin’s rate above $123,996 on Friday, marking an over six-week high last seen on Aug. 14 for the world’s very first cryptocurrency, TradingView information programs.

Bitcoin’s breakout above $120,000 might welcome a “really fast relocation” above the $150,000 all-time high before completion of 2025, Capriole Investments creator Charles Edwards, informed Cointelegraph throughout an interview at Token2049 in Singapore.

Related: Bitcoin rallies with DeFi as Zcash tops weekly efficiency: Financing Redefined

Uptober raises expert hopes of brand-new Bitcoin highs

Bitcoin ETFs now act as the “clearest belief barometer” for the cryptocurrency market, showing a possible breakout for October, Kalchev stated.

” Uptober is revealing clear indications of an early-Q4 breakout in the crypto market, powered by ETF inflows, seasonal strength, and dovish macro conditions.”

Nevertheless, Bitcoin’s momentum will depend upon numerous crucial occasions next week, consisting of United States Federal Reserve Chair Jerome Powell’s upcoming speech, along with the release of the minutes from the Federal Free Market Committee (FOMC) conference.

Financiers are likewise eagerly anticipating the postponed United States tasks report, however its publication date depends upon the length of the present United States federal government shutdown, the very first such circumstances given that 2018.

On the other hand, financiers are anticipating a strong month for Bitcoin’s momentum, as October is the second-best month in regards to Bitcoin’s historic efficiency.

BTC balanced month-to-month returns of around 20% in October, 46% in November and around 4% in December, according to CoinGlass information.

Publication: Hayes pointers ‘up just’ for crypto, ETH staking exit line issues: Hodler’s Digest, Sept. 14– 20