International group shifts and increasing wealth might power cryptocurrency adoption and possession need well into the next century.

Need for worldwide possessions, consisting of cryptocurrencies, is anticipated to be driven by an aging worldwide population and increased efficiency worldwide, leading to an older population with more capital to invest.

This dynamic will drive possession need up until the year 2100, according to the United States Federal Reserve Bank of Kansas City. “For possession need, population aging implies that the upward pattern from current years will continue,” a research study report released on Aug. 25 stated.

” Utilizing group forecasts to extend our historic analysis, we forecast that aging will raise possession need by an extra 200% of GDP in between 2024 and 2100.”

The report included that this dynamic might “suggest an ongoing decrease in genuine rate of interest,” increasing need for alternative financial investments such as Bitcoin (BTC).

Related: Crypto trader turns $3K into $2M after CZ post sends out memecoin skyrocketing

Financiers will value Bitcoin like gold in next 75 years

While cryptocurrencies are still thought about dangerous possessions, growing regulative clearness might lead the aging population to worth Bitcoin (BTC) as much as gold over the next 75 years, according to Gracy Chen, CEO of cryptocurrency exchange Bitget.

About one-third, or 34% of worldwide cryptocurrency holders were aged in between 24 to 35 since December 2024, according to a report by crypto payment business Triple-A.

While crypto stays an unpredictable possession class, growing regulative clearness and institutional items like ETFs might make Bitcoin more appealing to older financiers, Chen informed Cointelegraph.

” The maturity of crypto policies being dealt with at the minute can play a great function in sustaining future needs for the possession class.”

Chen included that crypto’s growing “federal government support” and tested function as a shop of worth will see the aging population “progress to worth Bitcoin as much as they have actually pertained to worth gold within a 75-year space.”

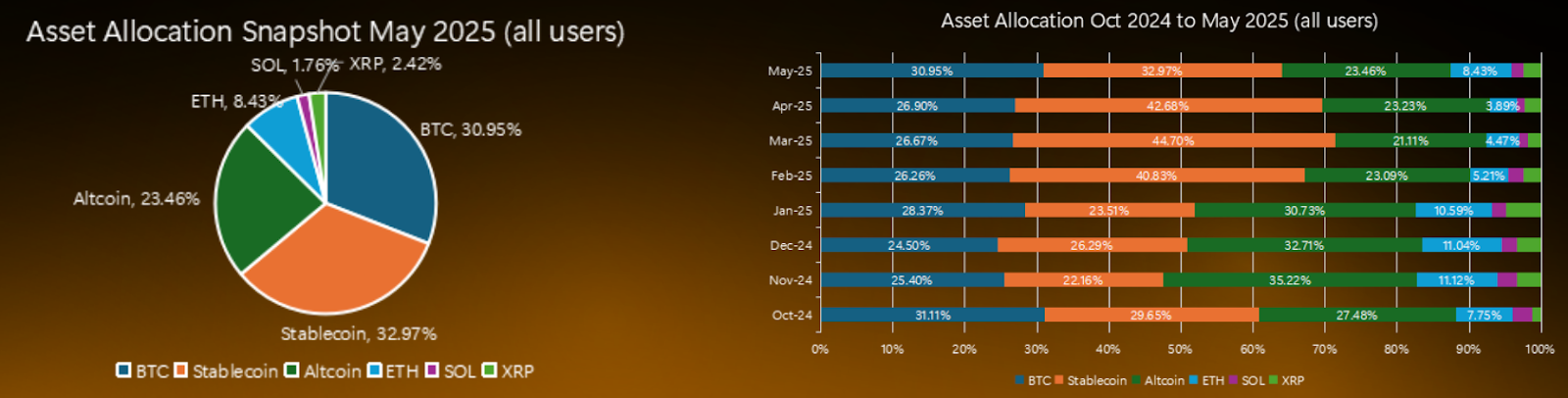

Bitcoin represented one-third, or 30.95%, of overall possessions in financier portfolios since May, up from 25.4% in November 2024.

Related: Bitcoin ETFs start ‘Uptober’ with $3.2 B in second-best week on record

Increasing wealth fuels crypto diversity

Experts at cryptocurrency exchange Bitfinex stated that increasing worldwide wealth will likely equate into higher danger cravings and diversity into emerging possession classes such as crypto.

” Increasing individual wealth increases diversity into more recent possessions, as danger cravings establishes,” the experts informed Cointelegraph. “We see greater wealth levels feeding through into increased need for crypto, while financiers with longer financial investment horizons are most likely to be open up to buying Bitcoin.”

They included that more youthful, more tech-savvy financiers “will look more positively at altcoins and more recent crypto tasks, offered their higher understanding of innovation and danger tolerance.”

Publication: Bitcoin is ‘amusing web cash’ throughout a crisis: Tezos co-founder