BlackRock’s area Bitcoin exchange-traded fund has actually produced almost $245 million in costs over the previous year, making it now the most lucrative ETF for the company by a broad margin.

The iShares Bitcoin Trust ETF (IBIT) presently beats the iShares Russell 1000 Development ETF (IWF) and the iShares MSCI EAFE ETF (EFA) by $25 million in yearly earnings, BlackRock ETF expert Eric Balchunas published to X on Monday.

IBIT ended up being the most lucrative BlackRock ETF when it went beyond IWF and EFA around mid-July, as previous X posts from Balchunas reveal.

Every other BlackRock ETF in the leading 12 by cost earnings has actually been around more than a years, Balchunas kept in mind on Monday, while including that IBIT is now “a hair”– or $2.2 billion– far from reaching the $100 billion turning point in spite of releasing simply 22 months back.

BlackRock produces earnings from IBIT through management costs– presently 0.25% of its overall properties under management, with earnings increasing as financier need and Bitcoin’s (BTC) rate increase.

IBIT is the dominant area Bitcoin fund in the United States. Recently, the fund represented more than $1.8 billion of the $3.2 billion in overall inflows into United States area Bitcoin ETFs in its second-largest week on record. Bitcoin broke the $125,000 mark for the very first time over the weekend.

Increased need for area Bitcoin ETFs has actually likewise been driven by Washington’s warming mindset towards crypto under the Trump administration, which has actually guaranteed to make America the “crypto capital of the world.”

IBIT set to be fastest ever ETF to $100 billion

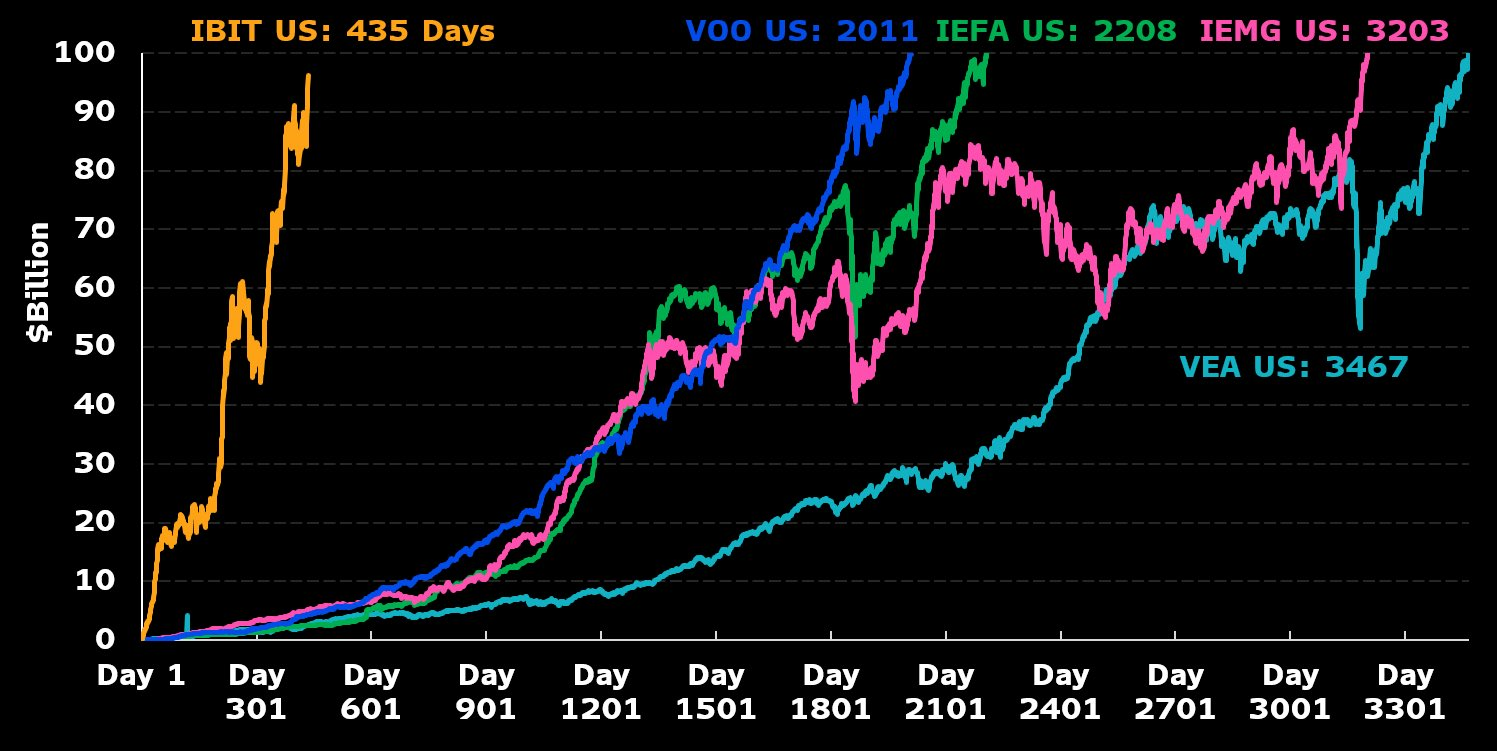

With $97.8 billion in net properties collected in simply 435 days, IBIT is on track to go beyond Lead’s S&P 500 index fund (VOO) and end up being the very first ETF to cross $100 billion, Balchunas kept in mind. VOO reached $100 billion in 2,011 days (around 5.5 years).

BlackRock is checking out a brand-new method to make earnings from Bitcoin

BlackRock submitted to sign up a Delaware trust business for its proposed Bitcoin Premium Earnings ETF late last month, signifying a push to widen its Bitcoin offerings.

BlackRock’s proposed item would offer covered call choices on Bitcoin futures, gathering premiums to create yield.

Related: Harvard endowment invests $116M into BlackRock Bitcoin ETF

The routine circulations would, nevertheless, trade away possible upside from purchasing IBIT, which mirrors Bitcoin’s rate motions.

Balchunas stated the relocation suggested that BlackRock would continue to propose items connected to Bitcoin and Ether (ETH) and not sign up with the altcoin ETF craze that other possession supervisors are looking for to provide– a minimum of in the meantime.

The United States Securities and Exchange Commission has actually stopped briefly evaluations on crypto ETF applications till the federal government resumes.

Publication: Astrology might make you a much better crypto trader: It has actually been predicted