Shares in Bitcoin miner IREN and treasury business Kindly MD have actually closed with losses on Tuesday after each revealed multimillion-dollar convertible note offers amidst a downturn in equity capital activity in the crypto sector.

Shares in IREN (IREN) completed Tuesday’s trading session with a gain of 6.81% however dropped 4.9% after the bell to trade at $58.66 following the business’s statement of an $875 million convertible senior note offering.

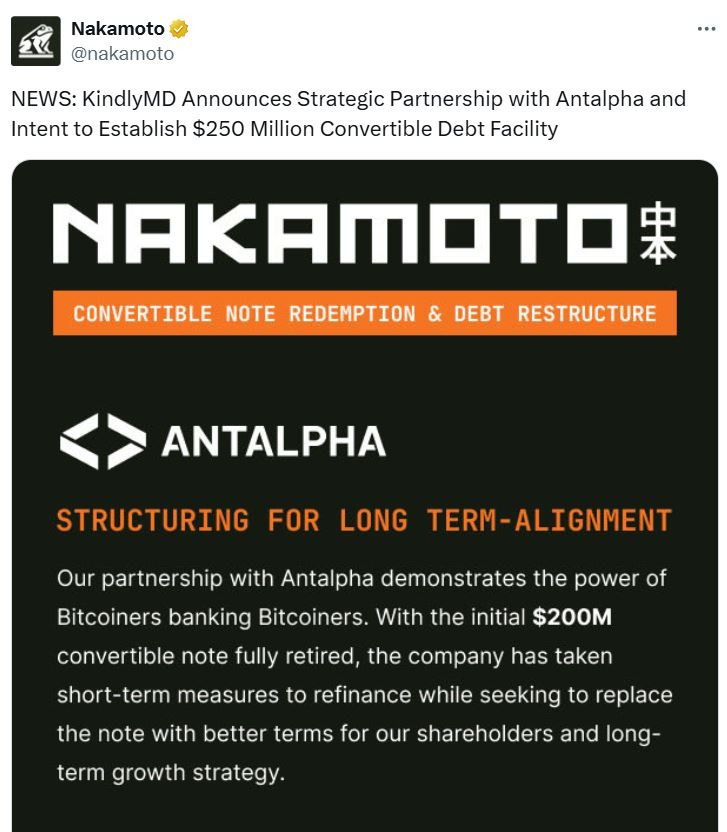

Health care business Kindly MD, which combined with David Bailey’s Bitcoin company Nakamoto, likewise stated on Tuesday that it chose into a $250 million 5-year convertible note handle fintech business Antalpha, which likewise apparently startled investors.

Kindly MD (NAKA) saw a 0.97% drop on the day and shed an extra 2.83% to trade at $0.99 in after-hours trading.

Digital possessions continue to draw in interest from institutional financiers, however Galaxy Research study’s newest equity capital report discovered there was a 59% decrease in financing and a 15% drop in offer count compared to the previous quarter.

IREN raising capital for business functions

IREN means to utilize a part of the earnings from the note offering for basic business functions and working capital.

The business likewise intends to money the expense of capped call deals, which are utilized to safeguard versus extreme brand-new share production when a business’s financial obligation is transformed into stock by positioning a rate cap limitation.

There are likewise an extra $125 countless notes available for preliminary buyers, which can all be transformed into shares of the business.

The business stated the call deals are anticipated to minimize the possible dilution to IREN’s normal shares upon any conversion of the notes.

Investors are frequently worried that convertible note offers will minimize the worth and power of the stock they currently own.

Nakamoto wishing to purchase more Bitcoin

Antalph and KindlyMDs have actually participated in a non-binding letter of intent for long-lasting funding in the hope of minimizing the “less dilution threat to its shareholders compared to basic convertible financial obligation,” the business stated.

The earnings have actually been flagged for usage in broadening Bitcoin (BTC) holdings in the KindlyMD Bitcoin Treasury, in addition to basic business functions.

Funds raised through the funding are likewise meant to change an existing $203 million Bitcoin-secured loan from 2 Prime Financing Limited.

Related: Crypto treasury share buybacks might signify a ‘reliability race’ is on

Antalpha likewise offering Bitcoin-backed loan

Pending the conclusion of the convertible financial obligation center, Antalpha will offer an interim Bitcoin-backed loan to KindlyMD.

Bailey stated the collaboration “represents the power of Bitcoin business backing Bitcoin business,” and intends to attend to “today’s funding requirements, however we are likewise laying the structure for future structures customized to the distinct requirements of Bitcoin treasury business.”

” This is the primary step in what we anticipate will be a long series of efforts to benefit our portfolio, our investors, and the Bitcoin community at big.”

Publication: How do the world’s significant religious beliefs see Bitcoin and cryptocurrency?