Cryptocurrency financial investment items held stable amidst last Friday’s huge flash crash, tape-recording strong inflows over the previous week.

Crypto exchange-traded items (ETPs) tape-recorded $3.17 billion in inflows recently regardless of the marketplace correction brought on by fresh China tariff risks from United States President Donald Trump, CoinShares reported on Monday.

” Friday saw little response with a paltry $159 million outflows,” CoinShares head of research study James Butterfill composed, highlighting crypto funds’ durability to the marketplace panic after the Friday sell-off and $20 billion liquidations.

In addition to robust weekly inflows, crypto funds reached a brand-new turning point by going beyond overall inflows tape-recorded in 2015, reaching $48.7 billion year-to-date.

Trading volumes struck brand-new highs amidst Friday’s bloodbath

CoinShares likewise reported a brand-new all-time high in weekly trading volumes for crypto funds, which rose to $53 billion, consisting of $15.3 billion on Friday alone.

Still, overall properties under management (AUM) toppled in the previous week, decreasing from $254 billion tape-recorded in the previous week to $242 billion.

Bitcoin (BTC) funds led inflows at $2.7 billion over the week, bringing YTD inflows to a brand-new high of $30.2 billion, still about 30% below in 2015’s overall of $41.7 billion.

” Volumes on Friday’s rate correction were the greatest on record at $10.4 billion for the day, while circulations on Friday were just $0.39 million,” CoinShares’ Butterfill kept in mind.

Ether funds struck with the biggest outflows

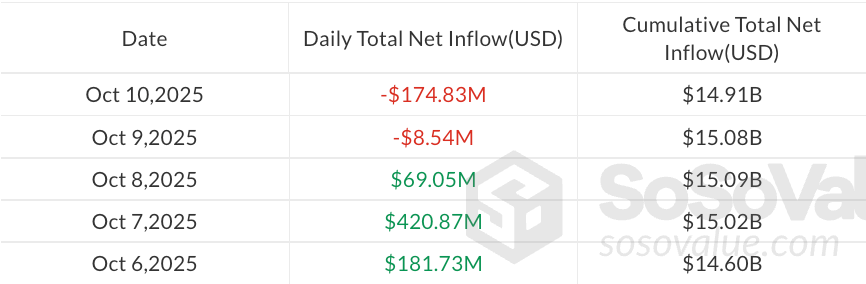

Although Ether (ETH) financial investment items tape-recorded $338 million in net inflows recently, they likewise experienced the biggest single-day outflow amongst significant crypto properties on Friday, amounting to $172 million.

Butterfill recommended that financiers saw Ether funds as the “most susceptible” throughout the marketplace correction.

On the other hand, altcoin financial investment items saw a significant downturn. Solana (SOL) funds drew in $93.3 million, and XRP (XRP) items drew $61.6 million, both down dramatically from the previous week’s $706.5 million and $219 million, respectively.

Related: Luxembourg sovereign wealth fund dips into Bitcoin ETFs with 1% stake

Butterfill pointed out that the downturn in SOL and XRP inflows came regardless of the growing buzz around upcoming SOL and XRP ETF launches in the United States.

As the United States enters its 3rd week of shutdown, a minimum of 16 crypto ETFs wait for approval ought to the shutdown continue into November.

According to ETF expert and NovaDius Wealth Management president Nate Geraci, the market is set for a “flood” of area crypto ETFs once the federal government shutdown ends.

Publication: ‘ Debasement trade’ will pump Bitcoin, Ethereum DATs will win: Hodler’s Digest, Oct. 5– 11