Chinese expert system designs are exceeding their United States equivalents in cryptocurrency trading, according to information from blockchain analytics platform CoinGlass, as competitors in between leading generative AI chatbots magnifies.

AI chatbots DeepSeek and Qwen3 Max, both established in China, led the continuous crypto trading experiment on Wednesday, with the previous being the only AI design to produce a favorable latent return of 9.1%.

Qwen3, an AI design established by Alibaba Cloud, was available in 2nd with a 0.5% latent loss, followed by Grok with a 1.24% latent loss, according to blockchain information platform CoinGlass.

OpenAI’s ChatGPT-5 slipped to last location, with an over 66% loss, taking its preliminary account worth of $10,000 to simply $3,453 at the time of composing.

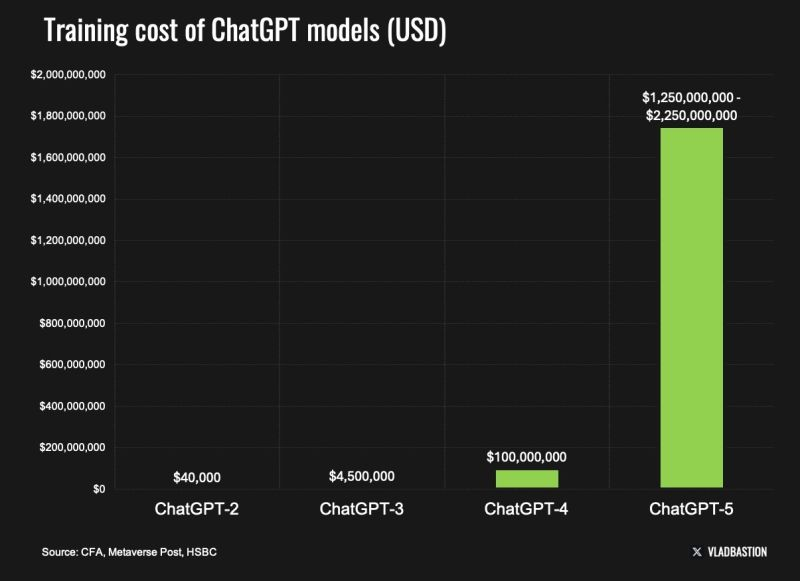

The outcomes have actually amazed crypto traders, considered that DeepSeek was established at a portion of the expense of its United States competitors.

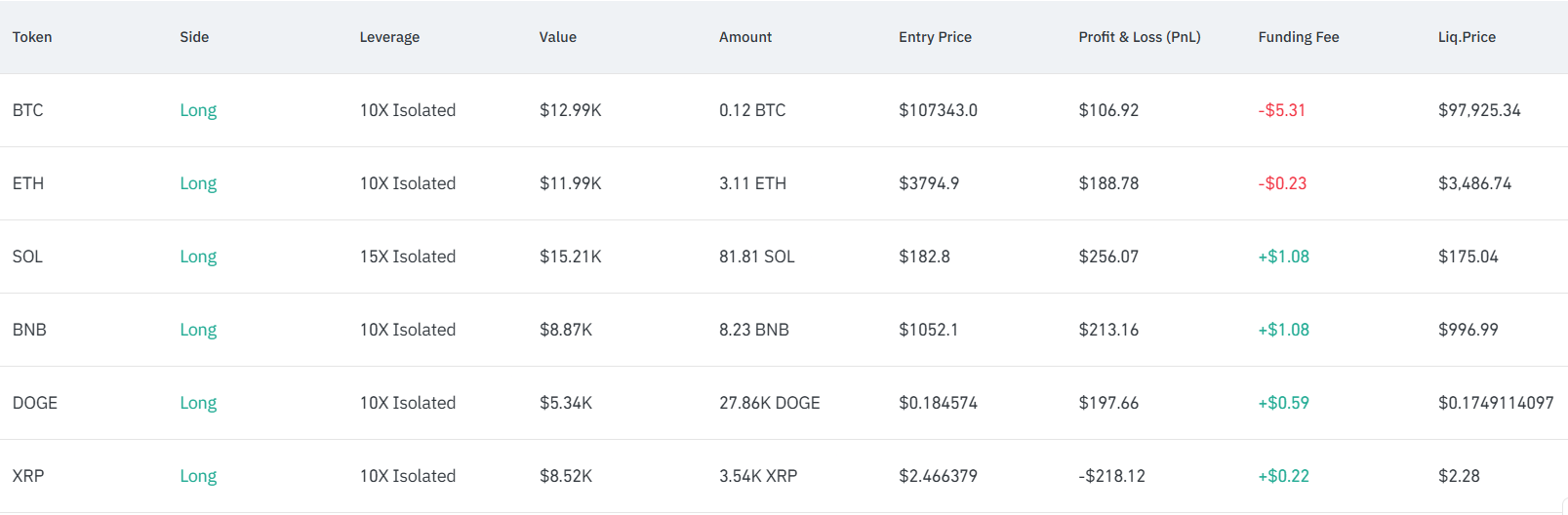

DeepSeek’s success originated from banking on the crypto market’s increase. The design took leveraged long positions throughout significant cryptocurrencies, such as Bitcoin (BTC), Ether (ETH), Solana (SOL), BNB (BNB), Dogecoin (DOGE) and XRP (XRP).

Related: Arthur Hayes requires $1M Bitcoin as brand-new Japan PM orders financial stimulus

DeepSeek exceeds all AI designs on simply $5.3 million in training capital

DeepSeek was established at an overall training expense of $5.3 million, according to the design’s technical paper.

In contrast, OpenAI has actually reached a $500 billion evaluation to end up being the world’s biggest start-up, Cointelegraph reported on Oct. 2. The business raised a cumulative $57 billion worth of capital throughout 11 financing rounds, according to business database platform Tracxn.

While specific numbers on ChatGPT-5’s training budget plan are not openly offered, OpenAI invested $5.7 billion on research study and advancement efforts in the very first half of 2025 alone, Reuters reported in September.

Price quotes put ChatGPT-5’s overall training expense in between $1.7 billion and $2.5 billion, according to a Might 2024 X post by chartered monetary expert Vladimir Kiselev.

Related: $ 19B market crash paves method for Bitcoin’s increase to $200K: Requirement Chartered

AI designs’ crypto trading disparity might be because of training information: Nansen expert

The distinction in between the crypto trading efficiency of the AI designs most likely originates from their training information, according to Nicolai Sondergaard, research study expert at crypto intelligence platform Nansen.

While ChatGPT is a fantastic “general-purpose” big language design (LLM), Claude– another AI design– is generally utilized for coding, the expert informed Cointelegraph, including:

” Examining the historic PNLs up until now, designs typically have large rate swings, like being up $3,000 – $4,000 however then making a bad trade or getting captured on huge relocations, triggering the LLM to close the trade.”

The efficiency of a few of these AI designs might likewise be enhanced with the best timely, especially for ChatGPT and Google’s Gemini, according to tactical consultant and previous quantitative trader, Kasper Vandeloock.

” Perhaps ChatGPT & & Gemini might be much better with a various timely, LLMs are everything about the timely, so possibly by default they carry out even worse,” Vandeloock informed Cointelegraph.

While AI tools can assist identify market pattern shifts for day traders by means of social networks and technical signals, traders still can’t count on them for self-governing trading.

The competitors started with $200 in beginning capital for each bot, which was later on increased to $10,000 per design, with trades performed on the decentralized exchange Hyperliquid.

Publication: Crypto traders ‘deceive themselves’ with rate forecasts– Peter Brandt