Secret takeaways:

Dogecoin’s (DOGE) 7.5% rally from its regional lows listed below $0.18 seems cooling down, however traders think DOGE stays on track to “continue its uptrend” towards greater targets in 2025.

A number of information points recommend what should occur for Dogecoin to increase its possible to break out of combination in the coming days or weeks.

Dogecoin needs to break $0.20 resistance

Dogecoin’s bullish case depends upon its DOGE/USD set turning the resistance in between $0.20 and $0.22 into assistance.

” DOGE is presently combining near $0.19 after a substantial pullback,” crypto expert HODL Gentleman stated in a current post on X, including:

” A clear break above $0.20 is required to signify a pattern turnaround. Watch on that level!”

This level lines up with the 200-day easy moving average (SMA), as displayed in the chart below.

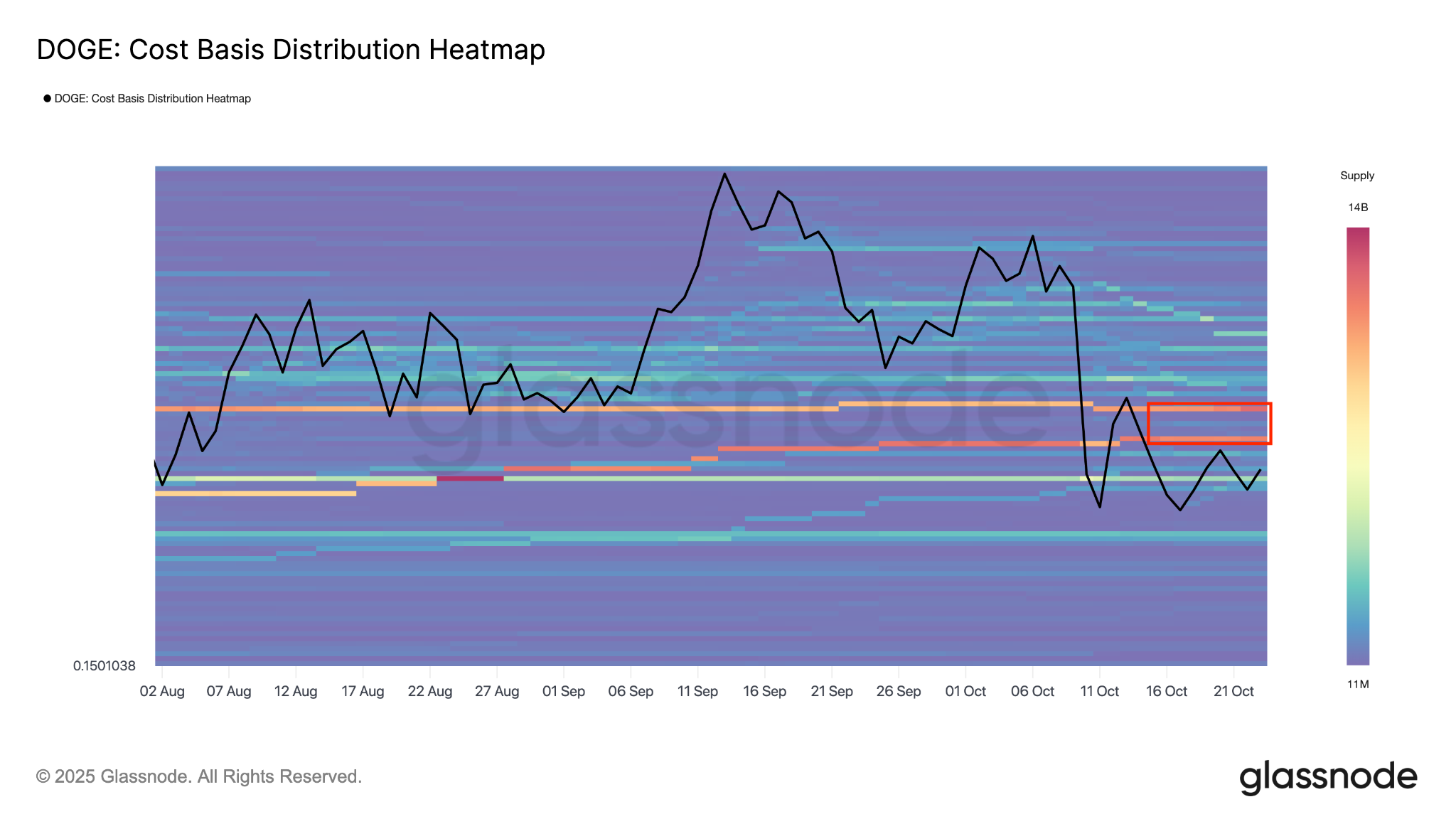

The Glassnode circulation heatmap shows that a substantial cluster of supply is focused in the $0.20-$ 0.21 location, where almost 24.9 billion DOGE were just recently gotten, highlighting the significance of this level.

Another location of resistance is the $0.23-$ 0.24 variety, enhanced by the 100-day and 50-day SMAs, respectively.

Related: Dogecoin’s Home of Doge bets on Italian soccer underdog

As Cointelegraph reported, if the 20-day EMA, presently at $0.22, is broken, it will recommend that offering pressure is reducing. If this occurs, DOGE cost might reach the 50-day SMA ($ 0.23) and later on to the stiff overhead resistance at $0.29.

DOGE needs to confirm in proportion triangle breakout

Information from Cointelegraph Markets Pro and TradingView reveals DOGE trading inside a balanced triangle in the four-hour amount of time, as displayed in the chart below.

The cost requires to close above the upper trendline of the triangle at $0.20 to validate a bullish breakout, with a determined target of $0.246.

Such a relocation would bring the overall gains to 25% from the existing level.

” Dogecoin continues its uptrend after breaking out of a falling wedge” on the four-hour chart, stated expert Trader Tardigrade in a Friday post on X.

The determined target of the falling wedge is $0.216, representing a 6.5% short-term cost boost.

Fellow expert Bitcoinsensus made a more enthusiastic analysis, stating that “Doge might see rates as high as $5-$ 7” if it follows a comparable market structure to that seen in previous cycles.

$DOGE MONTHLY MACRO CYCLES

Could 7$ be next in this cycle?

Taking a look at previous cost history on #Dogecoin, it has actually constantly followed the exact same market structure, completing with an enormous relocation at the end of the cycle.

If we were to duplicate the exact same playbook, Doge might see … pic.twitter.com/eWlrPhKHvV

— Bitcoinsensus (@Bitcoinsensus) October 16, 2025

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.